By now, all sophisticated investors have heard of the CBOE Volatility Index, or VIX, the so-called fear index. It is derived from measuring the implied volatility that is priced into options on the S&P 500 Index. That pricing changes from moment to moment as traders reflect upon the relative likelihood of a sudden change in the magnitude of the stock market’s fluctuations. And because traders worry more about that factor when the stock market is in a decline, the VIX has a pretty reliable inverse correlation to price movements. You can think of it as being like the price of homeowners insurance going up on the day after a hurricane.

The advent of ETFs means that there is an ETF out there for almost anything you can think of, including the VIX. The most commonly known VIX futures fund is VXX, the Barclays iPath SP500 VIX Short-Term Futures ETN. And while it might be a useful trading vehicle for someone looking to trade extremely short-term moves, it is a horrible idea for investors.

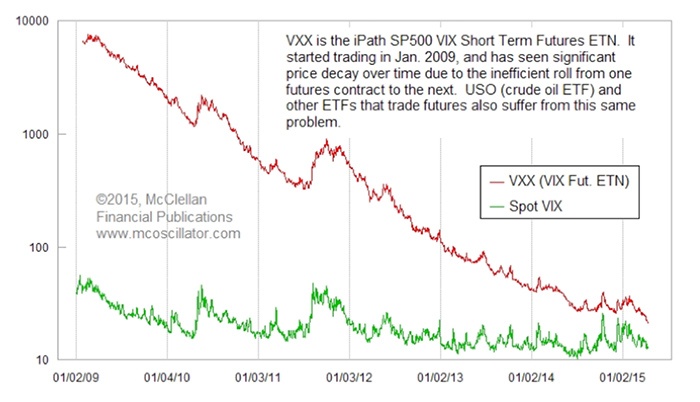

The share price history of VXX has a terribly negative bias, and it has ever since it debuted back in 2009. A recent value for VXX’s share price was $22.30—a huge dip from its March 2, 2009, closing high of $7,449, when we adjust for three separate 1-for-4 reverse splits.

This persistent negative bias has to do with the nature of the VIX futures contracts that VXX invests in. Since there is no physical product to own, as with gold or silver bullion ETFs, the sponsors of VXX have to invest in VIX futures. Most of the time those futures contracts have a steep “contango” to their pricing, meaning that the price is higher the farther into the future you go for a contract’s expiration.

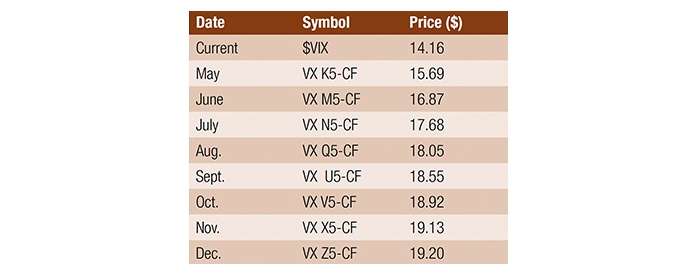

Source: Quote LLC, 2015

The table shows the closing prices for VIX futures as of April 17, 2015, extending out through the December 2015 contract (the furthest one currently open). You can see that all of the contracts are priced higher than the spot VIX Index, and the further out you go, the greater the premium.

As of this writing, VXX currently has its holdings divided between the May (K5) and June (M5) 2015 VIX futures contracts. As the May contract nears expiration, the folks at iPath will have to replace it with the July contract (N5), and presumably at a higher price. That price premium will then decay back down toward where the spot VIX is as the contract nears expiration. So VXX shareholders are continuously being victimized by the “roll” to later-expiration-month contracts, with the ETN buying higher and then selling lower and repeating. That explains why the VXX’s long-term “performance” has been so awful.

However, this does not mean VXX cannot be used for very short trading periods, when a rising VIX pushes up the prices of its futures contracts, and where the effect of the roll to the later contracts is not an important factor. But for investors with a longer time horizon, owning VXX can be a hedge against a portfolio ever making any money.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Recent Posts: