Lowest “bearish” investor-sentiment reading since 1986

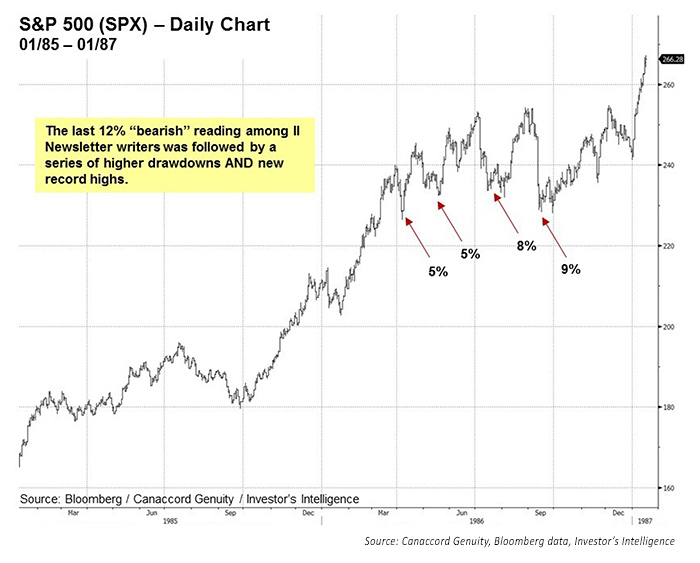

The Investors Intelligence report last week showed the percentage of bearish newsletter writers dropped from 13.5% the previous week to 12.7%. Extremes in investor sentiment are important because the one thing that does not change is human nature. As a result, we looked back at what happened to the market following the last “bearish” reading of just 12% in April 1986. That historically low reading was likely a result of a 33% six-month rally from September 1985 to March 1986, which was immediately followed by several sharp corrections, and subsequent immediate new highs from April 1986 to September 1986 (Figure 1). The final pullback was a four-day 9% drawdown from a record high in September 1986 before a 45% rally into the August 1987 peak.

FIGURE 1: SPX FOLLOWING LAST 12% “BEARISH” INVESTOR-SENTIMENT READING IN 1986

Click Image to Enlarge

Historically low investor sentiment this cycle “rhymes” with 1986

In the current cycle, there have been only three prior periods when the bearish percentage dropped below 14%. The first two instances, in 2014, came shortly before the SPX saw a brief pullback of 5%–7%, with a more pronounced 14% pullback into early 2016. Similar to such sentiment extremes in 1986, all of the low bearish extremes of this cycle proved temporary and were quickly followed by record highs.

Summary: Continued bullish outlook

Despite the possibility of near-term volatility, Canaccord Genuity’s core thesis keeps us focused on our 2018 S&P 500 (SPX) target of 3,100, which we expect might be conservative. In our view, the market has not adjusted expectations up enough to reflect the current tailwinds for economic and EPS growth, especially given the recent tax legislation. These tailwinds also include (1) a global synchronized recovery, (2) accelerating domestic activity, (3) capital spending plans improving, (4) real household median incomes jumping with strong employment, and (5) the demographic-driven push to higher homeownership. Our overweight sectors remain Financials, Info Tech, and Industrials, while underweighting defensive areas such as Consumer Staples, Utilities, and Telecom.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com