While many of the headlines for the U.S. auto industry this year were focused on the innovative story of Tesla and its ambitious growth goals, the automaker remains a minor player in terms of unit sales—at least for now.

The rest of the U.S. market experienced a somewhat lackluster 2019—though better than some earlier estimates—according to a preliminary look at the year’s total sales.

The Wall Street Journal wrote on Jan. 3,

“The multiyear boom in U.S. auto sales showed signs of easing in 2019 with major car companies reporting softer results and industry executives predicting the slowdown would continue in 2020.

“Auto makers reported year-end U.S. sales Friday. Analysts expect the car industry to post a decrease of 1% to 2% in U.S. auto sales for the year, once final numbers are compiled, to around 17 million vehicle sales, defying earlier predictions of a sharper decline.”

Investors.com reported,

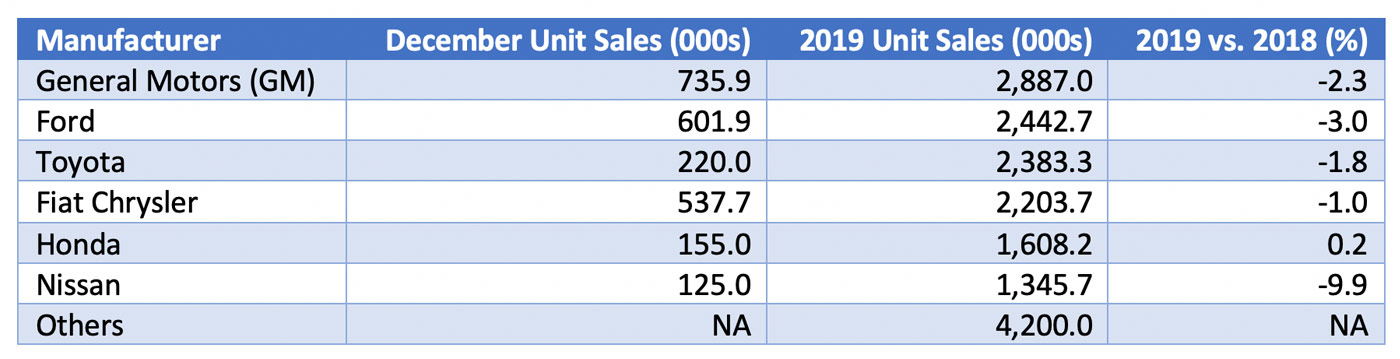

Source: Investors.com, Wall Street Journal, Autodata Corp., Edmunds, Cox

The Wall Street Journal offered several observations on the auto market for 2019, paraphrased here:

- A strong U.S. economy, low gas prices, attractive interest rates, and many new SUV options led to relatively stable sales and overall more expensive average vehicle prices in 2019.

- Overall, U.S. industry sales have been hovering at an annual rate of 17 million units since setting a record of 17.6 million in 2016. This came following steady increases from a low of 10.4 million units in 2009.

- The average price of a new vehicle hit $33,656 in 2019, up 4% from 2018.

- According to J.D. Power, purchasing incentives rose to 11% of sticker prices, the highest percentage level since 2008.

- Automakers continue to make significant investments in new technologies, especially electric vehicles, and continue to form new partnerships and alliances.

Related to new technologies, Tesla surprised many with a strong end to 2019.

Says Investors.com,

“Tesla delivered a record 112,000 vehicles globally during Q4, handily beating Wall Street estimates and reaching a lofty sales goal of CEO Elon Musk. Musk had expected to deliver 360,000-400,000 vehicles in all of 2019 and would have needed to hit 104,500 in Q4 to reach the low end of that range. The analyst consensus had called for more than 106,000 deliveries in the quarter. Tesla stock hit an all-time high Friday (1/3/2020).”

For 2020 and beyond, the outlook for U.S. auto sales is mixed. Many analysts are predicting a decline to an annual rate of 16.4–16.8 million units, says The Wall Street Journal.

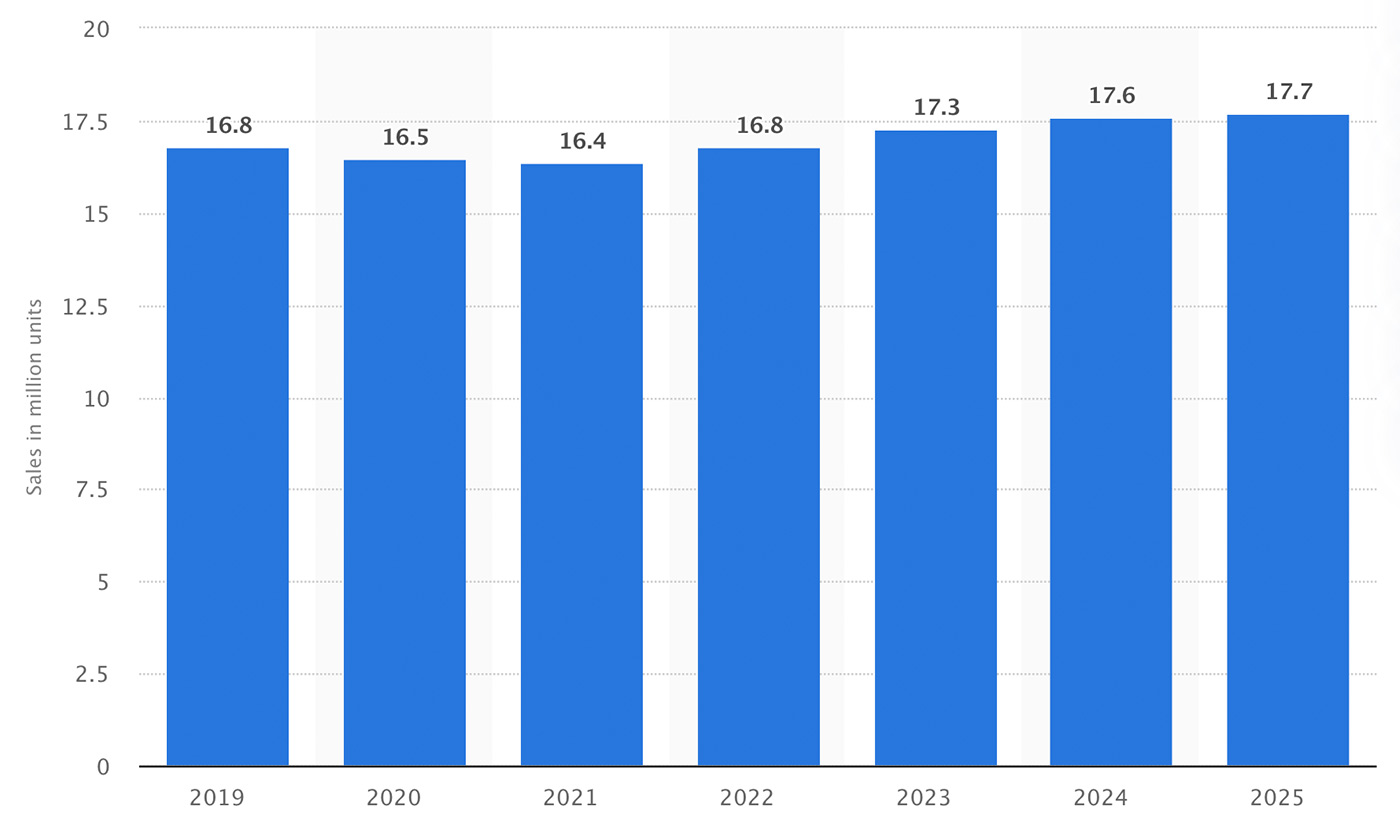

Research firm Statista sees the trend for sub-17 million units extending until 2023.

Source: Statista based on industry data.

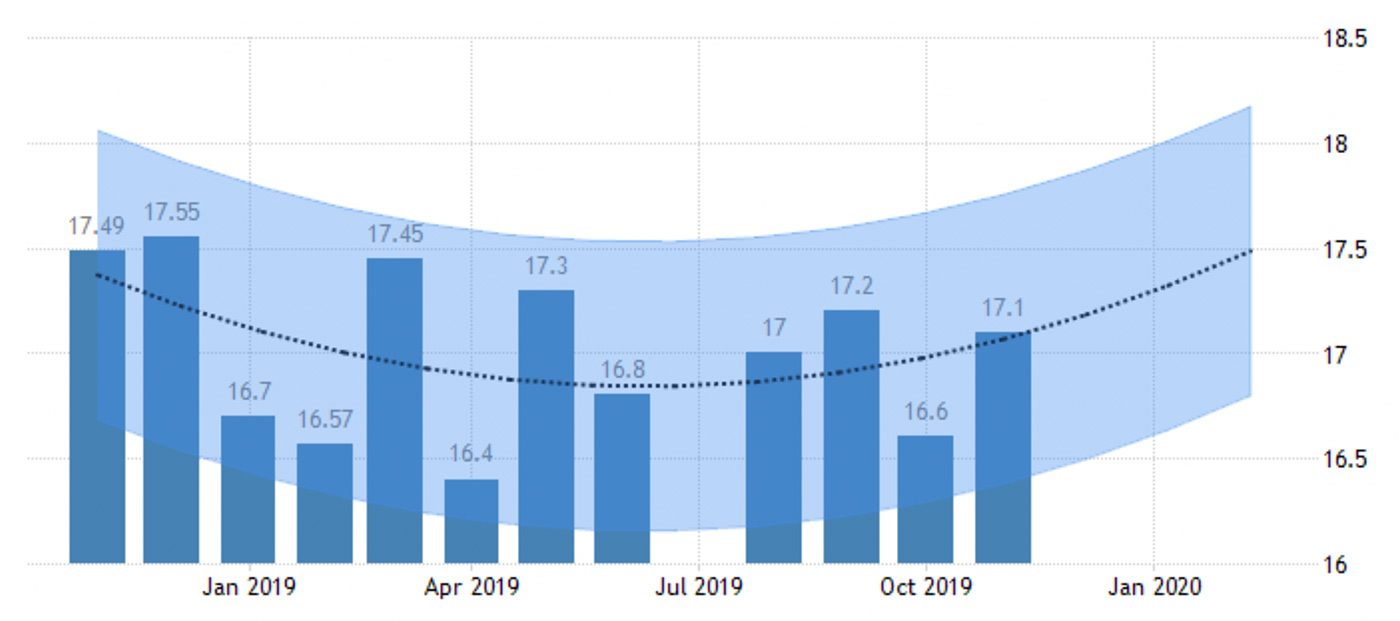

However, according to econometric models from Trading Economics, total U.S. light vehicle sales are trending toward reaching 17.3 units in 2020.

Source: Trading Economics, Autodata Corp.