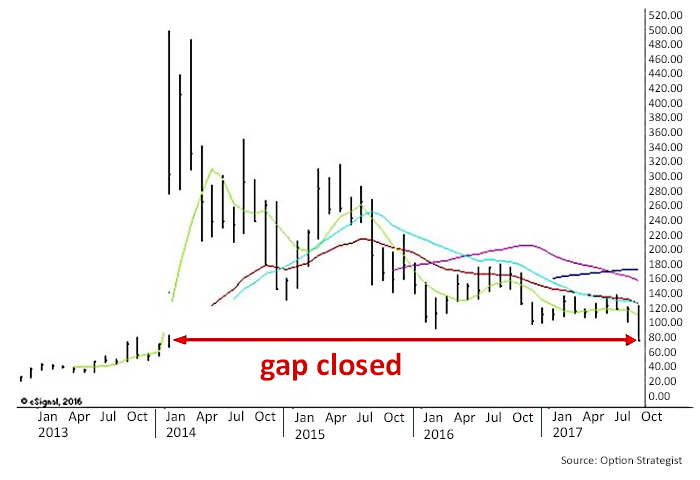

FIGURE 1: 5-YEAR PRICE TREND FOR INTERCEPT PHARMACEUTICALS (ICPT)

Now it has fallen so far that it has closed the gap from January 2014 when the stock spurted from $76 to $305 in one day! The next day it traded up to nearly $500.

I have no way of knowing how many investors held on for the entire ride, but I’m betting there were quite a few. On that day almost four years ago, there was probably zero expectation that the stock could trade all the way back down to $76 again, but here it is. A simple trailing stop would have gotten you out at some point—not at the top certainly, but if you had just used the simple 20-day (not month, but day) moving average as a trailing stop, you would have gotten out somewhere just above $400. Nothing is certain. Use trailing stops or limit your risk by buying options.

Editor’s note: Update on Intercept Pharmaceuticals (ICPT).

A columnist at Motley Fool wrote on Oct. 5, 2017:

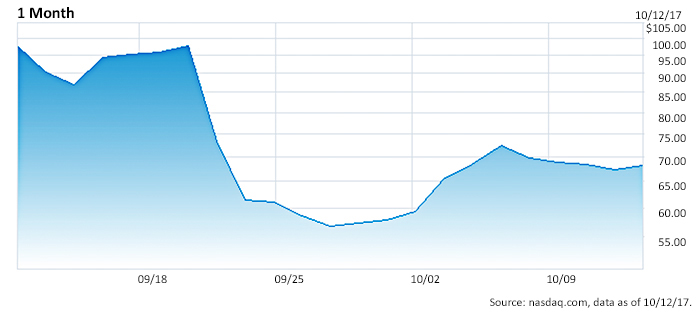

From a stock price perspective, ICPT has not yet made any real comeback, continuing to trade last week under $70.

FIGURE 2: INTERCEPT PHARMACEUTICALS (STOCK PRICE OVER LAST MONTH)

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first appeared at optionstrategist.com on Sept. 22, 2017.

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com