Barron’s encapsulated “Super Mario’s” (European Central Bank [ECB] President Draghi’s) latest “do-whatever-it-takes bazooka” as follows:

Last week, the ECB came up with a new twist on NIRP, which is the acronym popular in central-banking circles for negative interest-rate policy. So while Mario Draghi’s crew last week said it will lower the rate the ECB charged banks by 10 basis points (0.1 percentage point), to minus 40 basis points, they came up with a new twist. The ECB would provide banks with long-term cash, free of charge but with a twist: The central bank would pay the banks 40 basis points if they actually made loans with the money.

In addition, the ECB also upped its monthly bond purchases to 80 billion euros ($89 billion) from €60 billion currently. And the central bank will start buying corporate bonds from European nonfinancial corporations with investment-grade credit ratings.

With the U.S. Federal Reserve half-heartedly leaning in the opposite direction when it comes to quantitative easing and interest-rate policy, what is driving European decision-makers to these unprecedented actions? Actions which, Bloomberg says, “have just entrenched policies designed for crisis times into the next decade.”

According to Reuters, Mr. Draghi announced that ECB staff had slashed its inflation and growth expectations, predicting that even with fresh stimulus, price growth will not reach its target for years to come and growth will slow. “Rates will stay low, very low, for a long period of time and well past the horizon of our purchases,” Draghi told his regular post-Council news conference. “The measured driver of the economy and the recovery basically remains our monetary policy.”

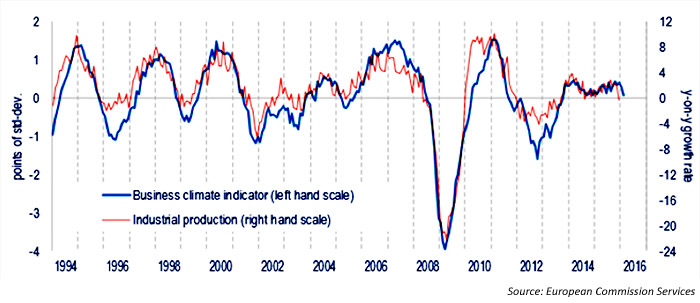

EXHIBIT 2: BUSINESS CLIMATE INDICATOR FOR THE EURO AREA

Investors around the globe are continuing to assess whether the stimulus action has a chance of working, or, as Barron’s said, “Draghi has thrown in the kitchen sink and there isn’t much else he can do to stimulate Europe’s lethargic economy.” The exhibits provide a look at three of the key issues confronting the ECB and the economic policy-makers of European nations.

Inflation. Despite several stimulative policy decisions over the past few years by the ECB, inflation tracking remains on a stubbornly downward trajectory. Inflation estimates for 2017 were cut by the ECB to 1.3% from 1.6% in the latest round of revisions.

Economic growth. Annual forecasts for gross domestic product (GDP) were also slashed. The latest forecast on annual real GDP was for 1.4% growth in 2016, down from December’s 1.7% forecast. However, data on business climate conditions/expectations from the European Commission show even this modest growth to be on the optimistic side.

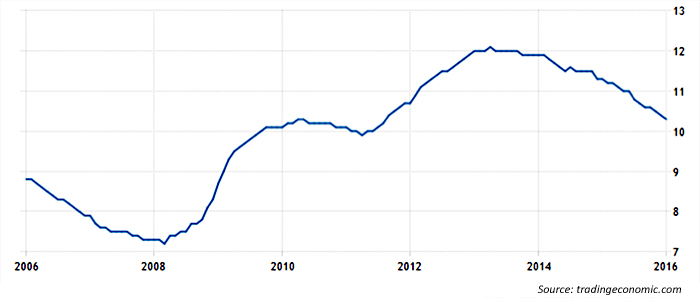

EXHIBIT 3: EUROPEAN UNION UNEMPLOYMENT RATE

Employment situation. While Europe has shown some improvement since the 2007–9 recession, it lags far behind the U.S. in lowering the unemployment rate, and the situation is far worse in the peripheral nations and among younger age groups. The phenomenon of large emigrant populations has now also introduced a new and unknown factor to employment statistics.