Setting the stage

The major U.S. indexes have been stuck in a range for months. What’s worse is that the broad-based Russell 2000 remains relatively unchanged for over a year.

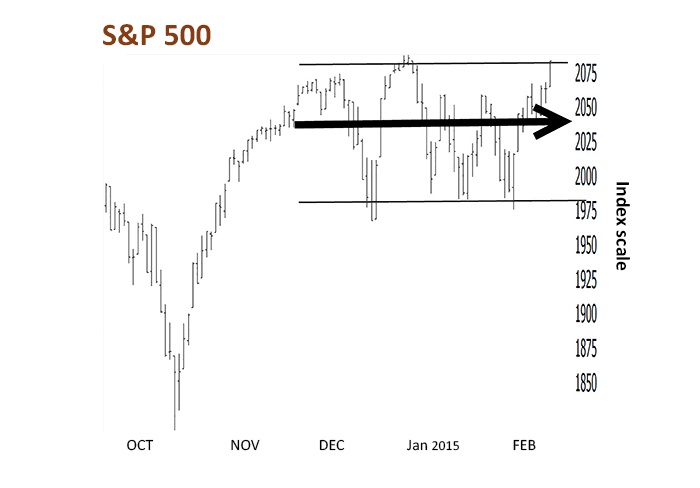

The S&P 500 range is roughly 100 points, between 1,975 and 2,075. The fringes of this range are being well-watched as a break below would signal a bear market and a break above would signal a new bull leg. Unfortunately, it’s not as easy as just playing the breakout. Markets often have fits and starts. This is why breakout trading is difficult at best. You are better off waiting for the market to follow through and then looking to take action. Remember, as a trend follower you’ll always be a little late to the party.

The plot thickens

I try to avoid news, but I do seem to get some through osmosis. Apparently, there was some Fed jawboning about interest rates on Friday (02/06/15). This in and of itself isn’t relevant but the reaction to it is. The markets took it as the proverbial shot across the bow. Bonds accelerated lower in their short-term slide, losing over 1.7% for the day. This spike in rates was reflected in interest-rate-sensitive areas such as Real Estate and the Utilities, which ended down over 2.5% and 3.6%, respectively.

The rate shock should be putting continued pressure on the market, but for now it doesn’t seem to care. The NASDAQ peeped out of its range to close at 14-year highs. And, the S&P 500 and Russell 2000 are just shy of all-time highs. Internally, the market is beginning to strengthen with areas such as Retail, Computer Hardware, and Semiconductors leading the way. This renewed strength is obviously a good thing, but again, follow-through will be key.

Source: Sentive Trading LLC, data from Telechart Platinum

The climax

Ed Sekoyta suggested at the American Association of Professional Technical Analysts’ 2014 Annual Conference that we could see recurring bubbles. Bubbles are dangerous, but the boom-bust cycle can be a wonderful thing for the trend follower. Trends go much further and last much longer than most are willing to believe. The disbelief in and of itself helps to fuel them. Logic rarely applies. Eventually they end badly, though, so you have to have a chair ready for when the music stops. Aggressive traders can then look to profit as the market subsequently plummets.

Currently, the U.S. dollar and bonds seem to be in bubble mode. Equities could be entering a bubble phase since they have been in a longer-term trend since 2009. The good news is that as trend followers we don’t have to question it. If equities continue higher, then we will simply follow along.

Commodities such as gold and silver appear to be in the process of bottoming. “Process” is the key word in that sentence. So far, the move higher has been filled with fits and starts. We are seeing some emerging trend “pioneer”-type patterns, especially in the Energies. These early trend patterns can be risky to trade, but the chance of catching the next bubble early makes them worthwhile. Like the American pioneers, you will either get the gold or arrows in your back.

Action?

Equities are improving, but for now we need to continue to wait for the market to prove itself by following through. As a good friend once said, “Don’t invent trades.” For the trend follower this means waiting as long as the market remains stuck in its range.

In the meantime, noncorrelated areas such as Energy stocks could provide opportunities, especially if the underlying commodity continues to bottom.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Dave Landry has been trading the markets since the early 1990s and is the author of three books on trading. He founded Sentive Trading LLC in 1995 and since then has been providing ongoing consulting and education on market technicals. He is a member of the American Association of Professional Technical Analysts and was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. davelandry.com

Dave Landry has been trading the markets since the early 1990s and is the author of three books on trading. He founded Sentive Trading LLC in 1995 and since then has been providing ongoing consulting and education on market technicals. He is a member of the American Association of Professional Technical Analysts and was a registered Commodity Trading Advisor (CTA) from 1995 to 2009. davelandry.com

Recent Posts: