Writing covered calls is not one of our normally recommended strategies. We prefer ratio writing (or the equivalent) since it is a more neutral strategy. However, writing covered calls is a strategy practiced by many option investors and therefore is a topic worthy of discussion.

First, the basics. A covered call is nothing more than the sale of a call option and simultaneously being long 100 shares of the underlying stock. It makes no difference whether the stock is bought for the express purpose of the covered writing strategy, or if the call is sold against stock already owned. The strategy is generally considered to be a conservative one since it involves less risk than owning stock. (But whoever said stock ownership wasn’t risky?).

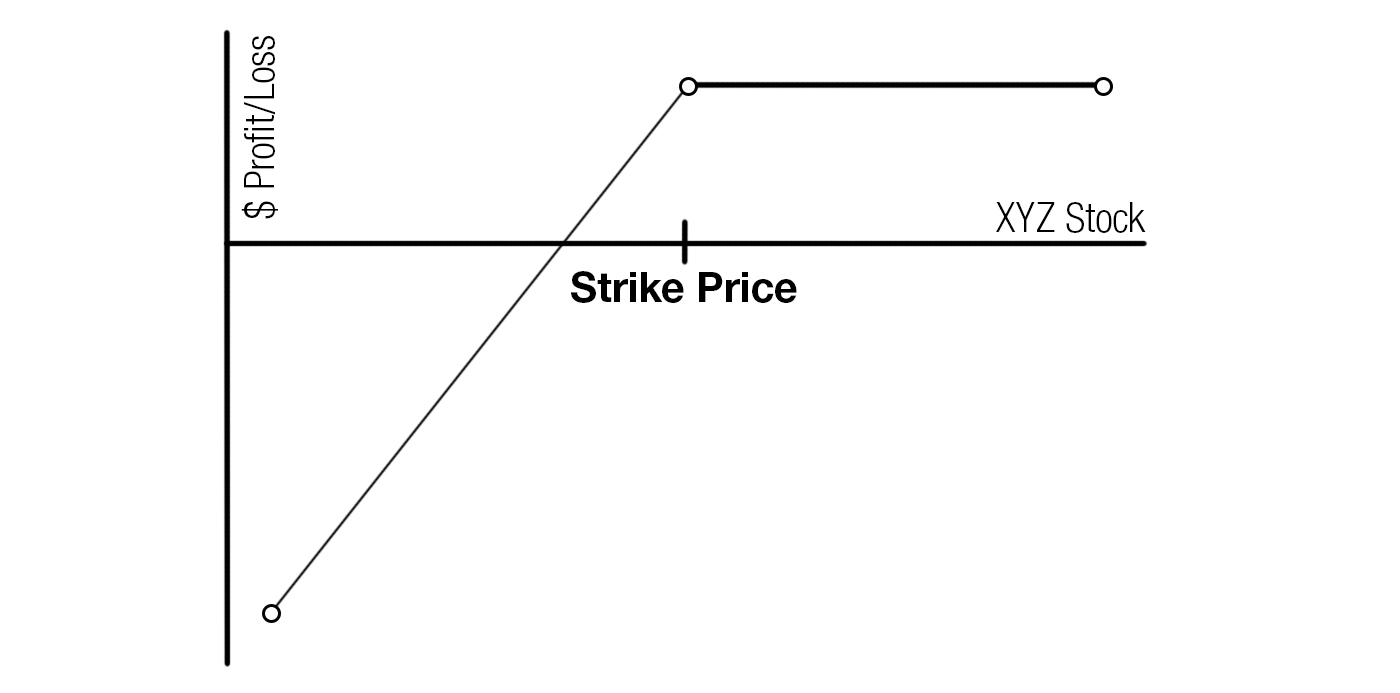

The following graph depicts the general profitability of this strategy at the expiration date of the written call option: If the stock is above the striking price at expiration, the profit potential is limited since the stock can be called away. Below the strike, the covered writer gets to keep the call premium that he or she received when he or she sold the option originally. This premium may be viewed either as downside protection against a decline in price by the underlying stock, or as income—an addition to the dividend of the common stock.

COVERED CALL GENERAL PROFIT GRAPH

Source: Option Strategist

The overall profit picture from this strategy is, therefore, one in which there are limited rewards (if the stock rises above the striking price) and large potential losses (if the stock should decline in price by a great deal).

On the surface, that type of profit picture might not be attractive to many individuals. Virtually all stock owners realize that they have risk if the stock declines, but at least they can make large profits if the stock rises.

However, one needs to look at writing covered calls a little more closely to evaluate the strategy fairly. First of all, a covered-call strategy will provide a better return than owning stock if the stock price is relatively unchanged over a short period of time. That is, if the stock does not decline in price by more than the premium received from selling the call, or if the stock does not advance too far beyond the striking price, then the covered call is a better strategy than owning stock.

Of course, the drawback is that if the stock rises substantially, one will not participate if he or she has sold a call. The other advantage of writing calls against stock that is owned is that it reduces the overall volatility of the portfolio of stocks—that is, the portfolio will not decline in price as much as a portfolio of stocks in a bear market, nor will it advance as much during a bull market.

This reduction in volatility is often an attractive feature, especially if one is looking for more stable returns on his or her portfolio. Thus, if one is constantly writing calls during a large bull market, he or she will underperform the “market” but will outperform it during a bear market.

One of the problems with writing covered calls is that investors don’t like underperforming the market when it rises.

A case in point was illustrated by Jim Yates of DYR Associates, who recently wrote that one of the “option income” funds was disbanding. The “option income” funds practice the strategy of writing covered calls exclusively. Over the past 10 years, the fund “only” rose about 10% per year, as opposed to the market average of about 15% over that time.

Thus, the fund was being shut down due to “underperformance.” However, Jim points out that no one bothered to mention that over those 10 years, the fund had less volatility and less risk than the market. This is a common complaint when writing covered calls is viewed over the long run.

A similar situation existed and probably still does exist in PERCS. A PERCS is a preferred stock with an extra dividend; the PERCS can be called away by the company at a fixed price. Thus a PERCS is really a covered-call strategy all rolled up into one security. Many fund managers and investors who originally bought them were disappointed that they didn’t perform better on the upside when the underlying stocks rose in price. Again, the same complaint about the same strategy.

The bottom line is that one must understand an option strategy in terms of both risk and reward before fairly evaluating its performance.

Editor’s Note: This is an abbreviated version of an article first published by Larry McMillan on May 13, 1993, and republished on October 1, 2019. For a full version of the article, which presents a more technical viewpoint and compares covered calls with the sale of naked puts, please visit optionstrategist.com. The full article also discusses how this comparison leads to conclusions regarding neutral strategies such as ratio call writing or straddle and combination selling.

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com

Professional trader Lawrence G. McMillan is perhaps best known as the author of “Options as a Strategic Investment,” the best-selling work on stock and index options strategies, which has sold over 350,000 copies. An active trader of his own account, he also manages option-oriented accounts for clients. As president of McMillan Analysis Corporation, he edits and does research for the firm’s newsletter publications. optionstrategist.com