Survive and thrive in the next bear market

Helping clients maintain composure in the face of market volatility pays long-term dividends for your firm.

After a long day of conference meetings and presentations, you can’t wait for the happy hour and dinner, which is being held in a beautiful outdoor setting. Once there, you greet your friends, and then your eyes fall upon the feast on the tables. This buffet might be the single best spread of food you’ve ever seen at any event before.

As the line for dinner begins to form, suddenly you hear thunder. For the first time, you look up and notice just how dark the sky has become, and large drops of rain begin pelting everyone and everything.

The sudden storm catches the crowd by surprise. They’re forced to panic and run for cover. It is their only option.

Unlike the crowd, you checked the weather forecast before leaving home to travel. You’re ready for good weather and bad.

Because you planned ahead, you have a much better option: Calmly put on your rain jacket, move to the head of the line, and make the best of the situation until conditions improve.

After a long day of conference meetings and presentations, you can’t wait for the happy hour and dinner, which is being held in a beautiful outdoor setting. Once there, you greet your friends, and then your eyes fall upon the feast on the tables. This buffet might be the single best spread of food you’ve ever seen at any event before.

As the line for dinner begins to form, suddenly you hear thunder. For the first time, you look up and notice just how dark the sky has become, and large drops of rain begin pelting everyone and everything.

The sudden storm catches the crowd by surprise. They’re forced to panic and run for cover. It is their only option.

Unlike the crowd, you checked the weather forecast before leaving home to travel. You’re ready for good weather and bad.

Because you planned ahead, you have a much better option: Calmly put on your rain jacket, move to the head of the line, and make the best of the situation until conditions improve.

Welcome to the next bear-market correction!

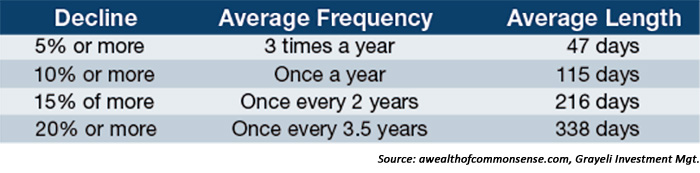

Investment managers have enjoyed a rising market for years. History tells us a bear market will be coming along again eventually, if not soon (see “The inevitability of market declines” table). You will be faced with the same decision—run and hide or see the opportunities.

THE INEVITABILITY OF MARKET DECLINES

A bear market will bring threats to your business. It will also present opportunities to strengthen and grow your business. To the degree you can eliminate the risks and capture your best opportunities, you can not only survive but also thrive.

Having lived through the bear market of 2000–2009, here is how our firm survived and thrived.

Take care of yourself first

When you board an airplane, you are instructed to put on your oxygen mask first if an emergency arises. After that, you can safely help others. The same thing applies here. If you don’t take care of yourself first, you won’t be in the position to lead and care for your team and clients. What should you do when the next bear market starts in earnest?

- Realize that these types of corrections and bear markets are out of your control. Clients will understand this if you deal with the situation by remaining calm and in control. Don’t beat yourself up over what has already happened. Though client emotions and markets will always be unpredictable, it is how you handle both of these that matters most.

- Your investment models will likely have given back some portion of their gains. Realize no strategy works perfectly in every market. Traditional investment approaches—like buy and hold, classic asset allocation, or some variation of the modern portfolio or the efficient frontier theories—typically experience losses of 50 percent or more in a full-blown bear market. Hopefully, you will have a more dynamic and risk-managed approach to client portfolios in place. But even the most sophisticated and time-tested active strategies may suffer some degree of loss in times of market turmoil.

- Understand that your confidence, your leadership, and your guidance will get you, your team, and your clients through the difficult days ahead. Take the time to get your head together first, get clarity about what you must do to survive, and then lead with compassion. You aren’t the only one with fears.

Here are the questions I use to prepare myself when these events occur. Take time to answer them yourself. Later, ask them again together with your team.

- How can we create value for our clients in this challenging environment, as measured through their eyes? What will give them peace of mind?

- What potential dangers threaten the future of our firm and how can we eliminate them now? List them and choose actions to neutralize them. Making this list and brainstorming solutions will give you renewed confidence.

- What new opportunities do we have now because of this event? As an example, some of the best clients of other firms will now be far more receptive to your message about active investment management. How will you capture these opportunities?

Communicate immediately. Communicate repeatedly.

Our inclination is to avoid emotional turmoil. Resist that urge and reach out to your clients. Market declines are not the time to ignore your clients. Fear, loss, grief, disappointment, and uncertainty are playing in clients’ minds. Clients will assume the worst-case scenario. They need you now, far more than in a rising market. Clients are looking for help from you to understand the meaning and impact of this event on their lives. They need you to help them deal with their fears.

What clients want to know now is simple:

- What happened and why?

- What does it mean?

- Will I be OK?

The impact on your business—negative and positive

When your clients lose money—even if losses are far less than those of the market—you will have less money under management and less revenue. Unfortunately, your company expenses rarely go down in a bear market. What do you do?

- Look into the future. Ask yourself where you want to be five or 10 years

from now. Focus on that future reality to make the right decisions now. The future brings hope. You need this perspective of a bigger and better future, now more than ever.

from now. Focus on that future reality to make the right decisions now. The future brings hope. You need this perspective of a bigger and better future, now more than ever. - Restructure if necessary. What expenses can you defer or drop? How can you maintain stability and profitability in this new environment?

- Consider your employees. If your employees are fearful and insecure, it will hurt your business. They need your leadership now, more than ever. They need your constant communication that they too will be OK and secure.

- Understand the opportunities in front of you. It isn’t all negative news. Many clients of other firms will find themselves disillusioned and without the strong leadership they desire. When asset-allocation strategies lose money, minds open to other approaches. What can you do to capture that opportunity? How can you best reach them?

- Offer free “second-opinion reviews” to friends of your clients. It is much easier than asking for referrals. People desperately need guidance in the aftermath of a market meltdown. Make this offer in many ways and many times. If you are already employing risk-managed active strategies for clients, your story will only be stronger and your firm’s value proposition more differentiated.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on April 14, 2016, Volume 10, Issue 1.

David Lucca was a partner at Rhoads Lucca Capital Management for 25 years, managing investments through all types of market conditions and rapidly adding $150 million under management. He focuses now on advisor growth coaching and investments in operating businesses, real estate, and royalty interests. See his profile here.

David Lucca was a partner at Rhoads Lucca Capital Management for 25 years, managing investments through all types of market conditions and rapidly adding $150 million under management. He focuses now on advisor growth coaching and investments in operating businesses, real estate, and royalty interests. See his profile here.

Recent Posts: