Market seasonality can be viewed many ways on its own. An analyst may break down performance based on things like day of the week, time of the month or year, or using other cycles such as the four-year presidential cycle. Additionally, holiday periods will often offer seasonal edges. One that is coming up soon is Thanksgiving.

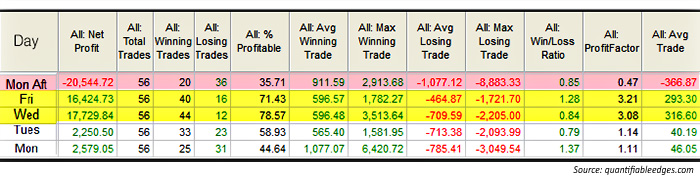

The time around Thanksgiving has shown some strong seasonal tendencies over the years—both bullish and bearish. In the table below, I show SPX performance results based on the day of the week around Thanksgiving. The bottom row is the Monday of Thanksgiving week. The top row is the Monday after Thanksgiving.

THANKSGIVING WEEK PERFORMANCE BY DAY OF WEEK

Based on $100k/trade in SPX. 1960–2015

Note: Table is based on $100,000 trades each year in the SPX, with trades made each day of Thanksgiving week and the Monday after.

Monday and Tuesday of Thanksgiving week do not show a strong, consistent edge. But the data for both Wednesday and Friday looks quite strong. Both of those days have seen the S&P 500 rise over 70% of the time between 1960 and 2015. The average instance managed to gain about 0.3% for each of the two days. (This is shown in the last column “Avg. Trade,” where $300 would equal a 0.3% gain.) That is a hearty one-day move. (It is especially impressive for Friday, since that is typically a shortened trading day during Thanksgiving week.) Meanwhile, the Monday after Thanksgiving has given back over half the gains that the previous two days accumulated. The market has declined 64% of the time, and the average Monday after Thanksgiving saw a net loss of 0.37%.

Of course, I am not the first person to notice this. Strong Thanksgiving market seasonality has been noted by many analysts over the years. So one (valid) concern that traders have with well-known seasonal tendencies is that they can be easily front-run. If people know there is a good chance that the market will rise Wednesday through Friday, they will look to get long on Tuesday. And if everyone buys ahead of the bullish period, then that may either dilute or eliminate the seasonal edge.

From 1960 to 1986, someone who bought Tuesday’s close and sold Friday’s close would have seen the SPX decline only one time. But from 1987 to 2015 there were eight instances where SPX did not close higher on Friday than it did on Tuesday. So perhaps the edge became so well-known that it was diluted by front-running.

Seasonality, or any tool, is typically more useful when used in conjunction with other tools than it is on its own. To determine whether the Wednesday–Friday Thanksgiving edge may have been front-run in a particular year, you could examine price action. I have repeatedly found that a market that is oversold going into a strong seasonal period will perform better than a market that is overbought going into a strong seasonal period. A very simple metric that could be used in this case would be to see whether the market closed in the top or bottom half of its intraday range on Tuesday of Thanksgiving week. To do this, I used SPY instead of SPX, because it has better intraday data.

Since 1993, I found that years in which SPY closed in the top half of its intraday range on Thanksgiving Tuesday posted a 7–5 record from Tuesday’s close to Friday’s close. When SPY closed in the bottom half of its range on Tuesday, the performance over Wednesday to Friday was 10–1. And the average instance posted a 0.8% gain these years, versus a 0.1% average gain the other years. Here you can see that the combination of seasonality and price action analysis provides a more robust edge than either could on their own.

I would encourage traders to examine the market from multiple angles using multiple tools. I would also encourage you to pay attention to both price action and seasonality as we approach Thanksgiving.

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com

Rob Hanna has worked in the investment industry since 2001. He is the founder and publisher of Quantifiable Edges, a quant-based website where he also publishes a newsletter. After managing a private investment fund through Hanna Capital Management LLC from 2001 to 2019, Rob joined Capital Advisors 360, where he now serves as a registered investment advisor and focuses on short-term and quantitative strategies. quantifiableedges.com