We have been meeting with institutional, family office, and retail investors around the world over the past few weeks, and we can only conclude that nearly everyone is nervous and in a defensive position.

The volatility around Brexit, the trade war, a possible impeachment, and global economic deceleration has everyone on edge. Our core thesis, driven by credit, continues to suggest the weak global economy appears to be stabilizing and is likely discounted with the drop in global rates and global central bank accommodation. With a temporary reprieve from the trade-war-related volatility, investors can turn their attention to the release of company Q3 2019 EPS (earnings per share) reports and assess the tactical backdrop as we head into the end of the year.

Q3 2019 earnings season is now underway. Financial stocks are in focus as several key money center banks are reporting this week (week of Oct. 14). We wanted to highlight current S&P 500 (SPX) operating earnings estimates, according to I/B/E/S data from Refinitiv:

- Of the 34 S&P 500 companies that have already reported Q3 earnings, 88.2% have reported above analyst estimates and only 8.8% have reported below analyst estimates.

- Q3 2019 EPS growth is estimated to be down 3.0%. We believe the end result will likely be slightly positive given that, since 2009, every quarter has been revised higher from the first day of EPS reporting season to the end by a median of 3.5%.

- The Q3 2019 revenue growth estimate is 3.3%. The Health Care and Communication Services sectors are expected to show the highest revenue growth.

- The Energy sector is having an outsized impact on the outlook for Q3 EPS and revenue growth. If you exclude the Energy sector, the Q3 2019 consensus estimate for bottom- and top-line growth would rise to -0.7% and 4.5%, respectively.

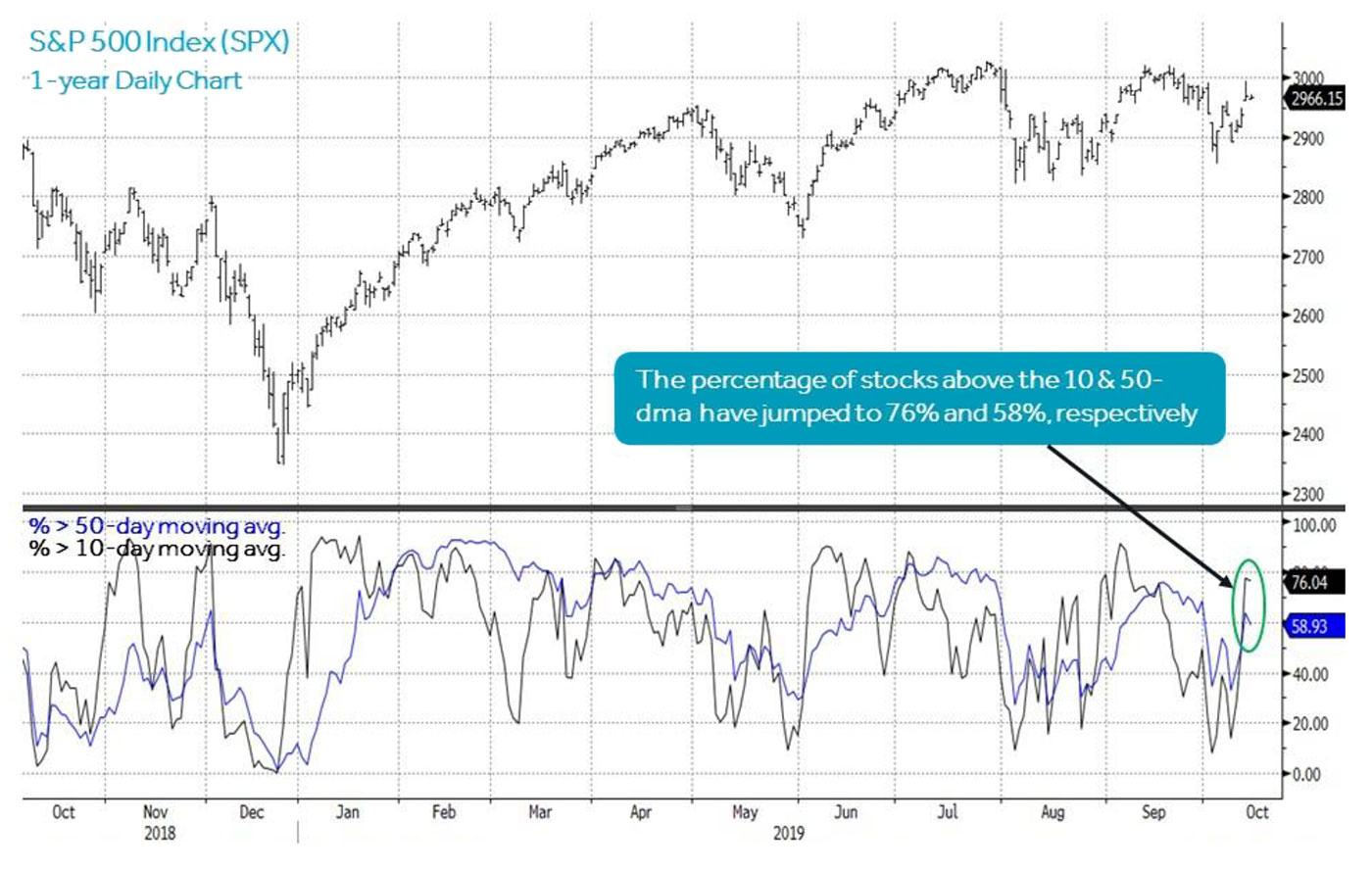

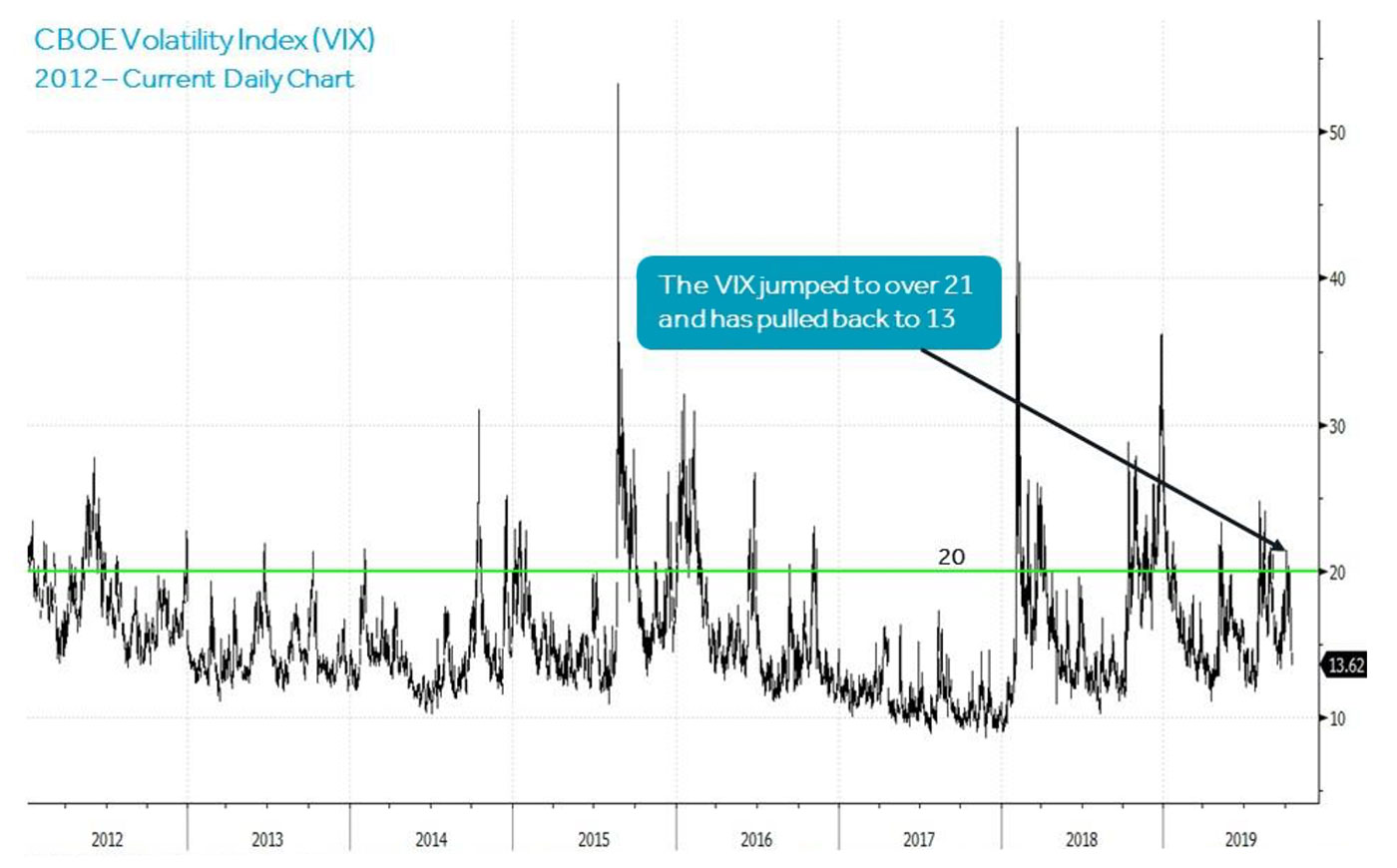

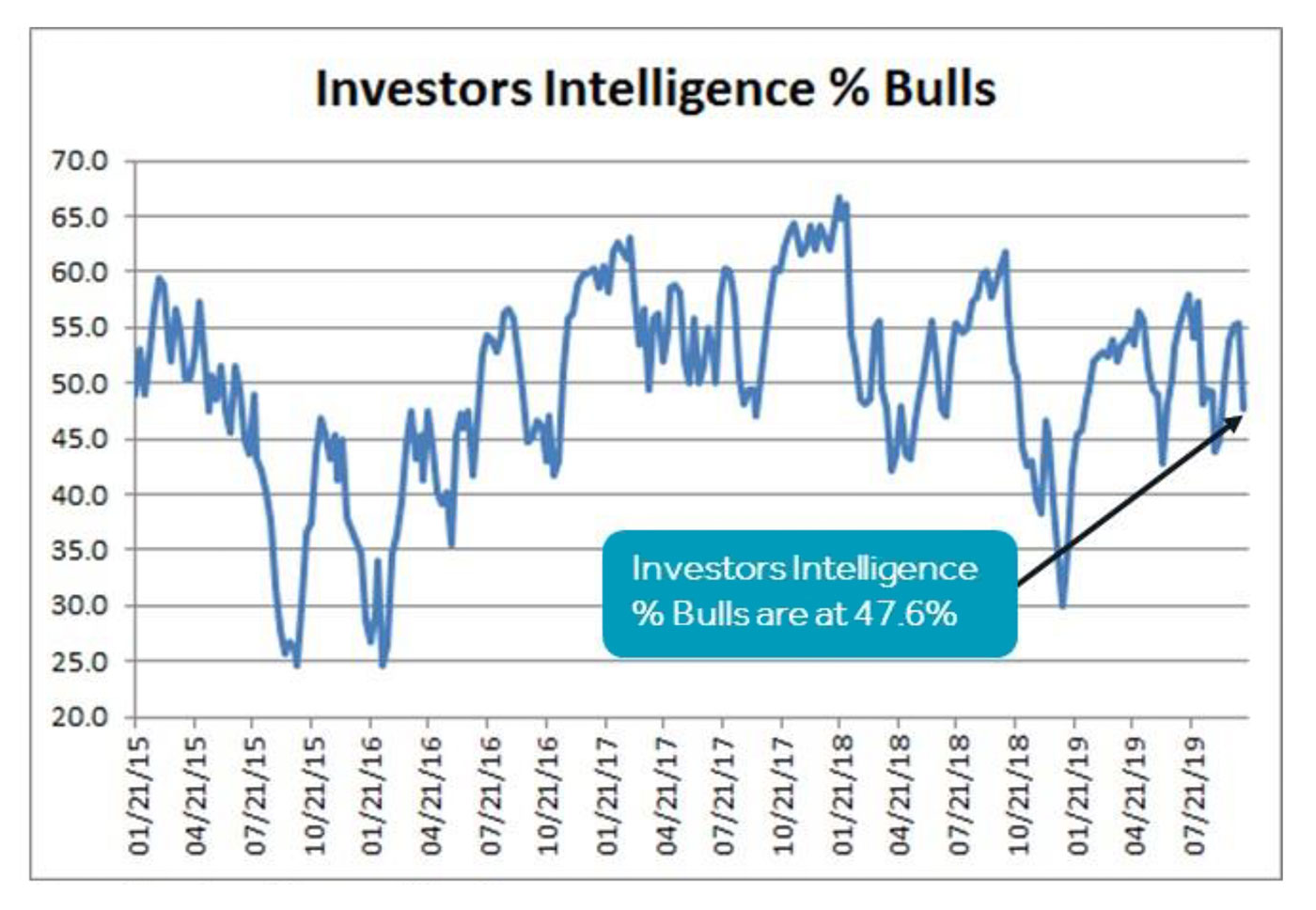

Our four favorite tactical indicators are in neutral territory. The two indicators that hit oversold levels in early October are no longer oversold. The percentage of stocks above their 10- and 50-day moving averages and the CBOE Volatility Index (VIX) continued to reverse from oversold levels hit earlier this month. The slower indicators—the weekly stochastic and Investor Intelligence bulls—became more neutral. Below are the levels we watch for to suggest an oversold condition versus where equities stand today:

- The percentage of S&P 500 (SPX) index components above their 10- and 50-day moving averages drops to 20% and 40%, respectively. They closed at 76% and 58%, respectively (Figure 1).

- The VIX Index jumps to 20 or higher. It rose to over 21 the first week of October and is now back to 13 (Figure 2).

- The 14-week stochastic indicator drops to 30 or below. This is currently at 73.

- The Investor Intelligence percentage of bullish newsletter writers drops to below 45%, or preferably 35%. Last week’s reading showed less optimism as the percentage of bulls declined to 47.6% (Figure 3).

FIGURE 1: PERCENTAGE OF STOCKS ABOVE MOVING AVERAGES

Source: Bloomberg and Canaccord Genuity. Data as of 10/15/19.

Source: Bloomberg and Canaccord Genuity. Data as of 10/15/19.

Source: Bloomberg and Canaccord Genuity. Data as of 10/15/19.

Although the market is very nervous about the prospects for economic growth, the market rates have already done the work of stimulating future growth, and Federal Reserve Chair Jerome Powell’s comment that the Fed will be more aggressive if the data weakens continues to support an offense position.

We believe the stage for the next leg higher toward our 2020 SPX target of 3,350 is set. This is driven by (1) continued accommodative global monetary policy, (2) “less poor” global economic data ultimately leading to reacceleration, and (3) news and tweet fatigue. Very few are betting on an improved growth outlook that data suggest is already happening.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

The original version of this report by Tony Dwyer and Michael Welch at Canaccord Genuity was released Oct. 15, 2019.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com