Oil futures prices hit a two-year high last week, defying recent trends in seasonality for crude oil.

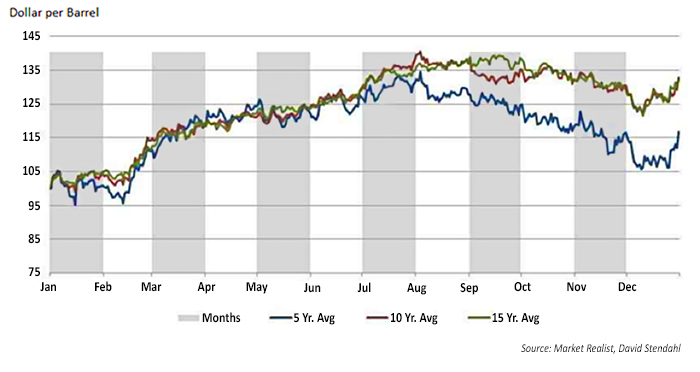

Market Realist writes, “Seasonality plays a key role in influencing crude oil prices. Crude oil prices tend to rise in August due to the summer driving season, which results in a rise in gasoline demand. The hurricane threats in the Gulf of Mexico are also priced in during this period. But, towards mid-September and October, crude oil prices tend to peak out.”

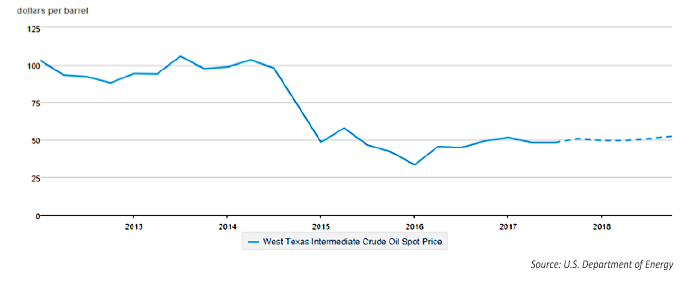

Just the opposite has occurred this year, with oil prices making fresh multi-year highs during November, according to MarketWatch. “U.S. crude oil prices on Friday climbed 2% to $55.64 a barrel, marking the highest settlement price since July 2, 2015. Brent also ended at a more than two-year high, rising 2.4% to finish at $62.07 a barrel.” The trend higher continued this week, with WTI futures trading over $57.

There are various reasons analysts are citing for the moves in oil this fall:

1. The extreme 2017 hurricane season in the U.S.

2. The corruption charges being leveled at prominent figures in Saudi Arabia, creating short-term uncertainty around the nation’s leadership structure and oil policy.

3. The belief that OPEC will continue to limit production into at least 2018.

4. Reductions in oil inventories, rising demand, and “a drop in U.S. oil rig count,” according to MarketWatch.

5. Technical price factors. Bespoke Investment Group says last week’s oil price action was “a key break above resistance that is bullish for the commodity for the remainder of the year.”

“The oil market has rallied as investors have been reassured by a decline in crude inventories and strong rhetoric from Saudi Arabia supporting the deal among the Organization of the Petroleum Exporting Countries and other major producers to stick with supply cuts. Last year, OPEC, along with several other countries including Russia, agreed to cut production by 1.8 million barrels a day to alleviate the global overhang of crude that dragged down prices. Traders are looking ahead to the cartel’s official meeting in Vienna on Nov. 30, to see if producers extend the deal beyond March 2018.”