The following message from Michael Foss, CEO of Sports Authority, hit the email inboxes of registered customers May 25:

Dear Customers,

Sports Authority and its predecessor companies have been serving the sporting goods needs of our customers since 1919. It is with great sadness that we are intending to close all of our stores by the end of August. We will be holding store closing sales at all of our locations that will allow you to take advantage of big discounts on great brands.

On behalf of the entire Sports Authority team, I would like to express our sincere appreciation to our customers for their years of loyalty. It has been a pleasure to serve you and your family.

Sincerely, Michael Foss, Chief Executive Officer

While Sports Authority was not the most iconic American institution, it had, as Mr. Foss alludes, become the go-to sports retailer for many people for a very long time.

So what happened?

Sports Authority Inc., according to Reuters, had filed for Chapter 11 protection in March “in the face of growing online competition. … Outdated information systems, frequent turnover in its leadership, and a history of mergers were also to blame for the chain’s bankruptcy, according to a court filing by its chief financial officer, Jeremy Aguilar.”

The consensus of analysts in the retail sectors came down to three factors:

- Too much debt. Sports Authority was acquired by private equity firm Leonard Green and Partners in 2006, and its overleveraged financial structure was shaky. The Huffington Post noted it had missed a $21 million interest payment in January.

- Failure to “stay on trend” and “differentiate itself,” says Retail Dive. According to their analysis, brands such as Lululemon, Foot Locker, Nike, and Under Armour offered either a superior in-store or online experience (or both). Head-on competitor Dick’s Sporting Goods has developed a much more compelling store presence and merchandising look.

- Online competition in a slowing sales environment. While the sporting-goods sector recovered nicely from its depths in 2009, the last two years have seen modest sales growth under 2% annually, according to Statista. At the same time, e-commerce pressures have grown in the sector, from competitors such as Dick’s, major players such as Nike, North Face, Adidas, and Under Armour, traditional retailers expanding their web efforts, and, of course, discounting sites such as Amazon.

While Sports Authority was not a publicly traded stock, it was a company and brand of some size and importance. It is interesting to look at the issue of large-company failures from a broad perspective. Economist and newsletter publisher John Mauldin had an insightful take on this in 2014, leading off with a memorable quote:

“How did you go bankrupt?”

“Two ways. Gradually, then suddenly.”

– Ernest Hemingway, The Sun Also Rises

Mr. Mauldin noted the increasing danger of your favorite company not necessarily being around 10 or 20 years from now. This includes the phenomenon he termed then as being “Netflixed” (referring to the demise of the Blockbuster chain.) He made the case that while commerce evolution has been a theme throughout history, it has rapidly accelerated in the newest “Age of Transformation,” heightening company-specific risk in the markets. Said Mr. Mauldin,

“And while your job may be one of those that will ride easily into our brave new future, the same may not be true of your stock investments. Companies show the same pattern of destruction and rebirth. Only five of today’s hundred largest public companies were among the top hundred in 1917. Half of the top hundred of 1970 had been replaced in the rankings by 2000.

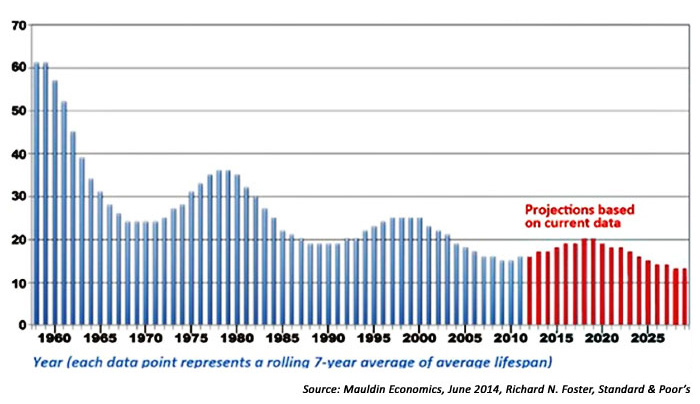

“The chart below was recently produced by Richard Foster at S&P. What it shows is that the average life span of companies in the S&P 500 Index was about 60 years in 1960. Today they last about 15–20 years. That means we are currently replacing a stock in the index about every two weeks.

“Since the index is representative of the largest U.S. companies, that means that each year 25 big companies either can’t grow enough to keep up or are outgrown by other companies, otherwise fail or get merged; but in general terms it means that if you are invested in the S&P 500 Index, it is almost guaranteed that at least 10% of the companies in your portfolio are old dogs.”

AVERAGE COMPANY LIFESPAN ON S&P 500 INDEX (IN YEARS)