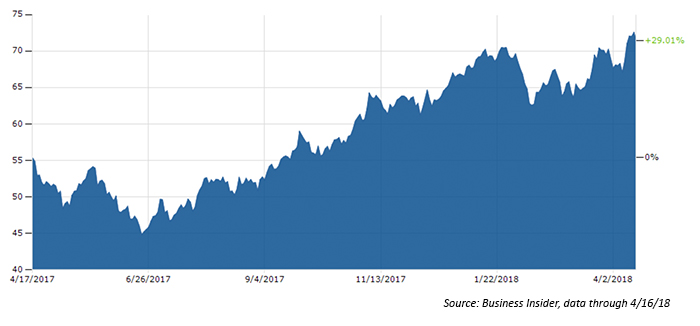

Oil prices spiked around the world last week, with the international benchmark, Brent crude oil, up 7.8% and futures prices around $73 a barrel for Brent.

Barron’s observed, “Crude oil prices last week reached their highest price level since 2014—when they began their precipitous drop to $26 a barrel in 2016.”

CNBC noted two key observations last Friday (4/13):

- “The long era of too much oil sloshing around the world and low prices is coming to an end, just as global events are heating up crude prices.

- “That means there’s a new higher floor under oil prices as the peak summer demand season approaches, and it also makes the market vulnerable to a ‘super spike’ if there’s any significant supply disruption.”

FIGURE 1: ONE-YEAR TREND IN BRENT CRUDE PRICE ($/BARREL)

In addition to trade policy and geopolitical tensions around the world, most specifically regarding Syria, Russia, and the status of the Iran nuclear agreement, the Organization of the Petroleum Exporting Countries (OPEC) has continued to operate with self-imposed supply restrictions.

At April’s International Energy Forum, where oil producers and consuming nations met in New Delhi, India, Saudi Arabia’s energy minister Khalid Al-Falih told reporters, according to Arab News, that he “was happy with the current state of the oil market.”

Arab News wrote at that time:

“Saudi Arabia’s energy minister said on Wednesday that the world’s biggest exporter of oil will not sit by and let another supply glut surface, but also does not want oil prices to rise to ‘unreasonable levels.’ … Members of the Organization of the Petroleum Exporting Countries (OPEC) are seeking a close balance between supply and demand, Khalid Al-Falih said. … OPEC, Russia and several other non-OPEC producers began to cut supply in January 2017 in an effort to erase a global glut of crude that had built up since 2014. They have extended the pact until the end of 2018.”

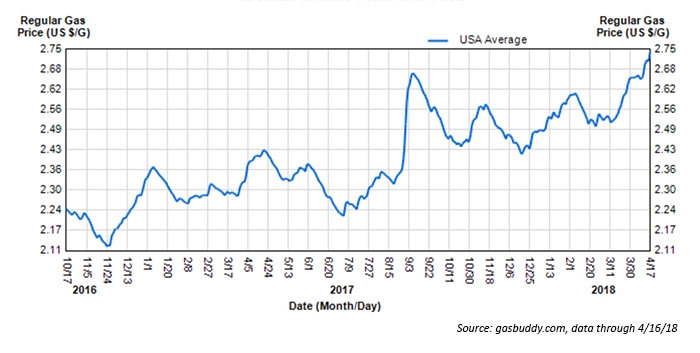

In terms of gasoline prices at the pump, the price of a gallon of regular gasoline has, on average, now surpassed 2017’s highest price. Jeanette Casselano, AAA spokesperson, said recently, “Expensive crude oil prices, unrest in the Middle East, strong domestic demand, record production rates and global oil supply surplus have created the perfect storm to drive spring gas prices toward new heights. Consumers can expect gas prices to increase another 5 to 10 cents this season, but the national average is not expected to reach the $3 mark.”

FIGURE 2: 18-MONTH AVERAGE RETAIL PRICE CHART (GALLON REGULAR)

FIGURE 3: AVERAGE REGULAR GAS PRICES BY STATE

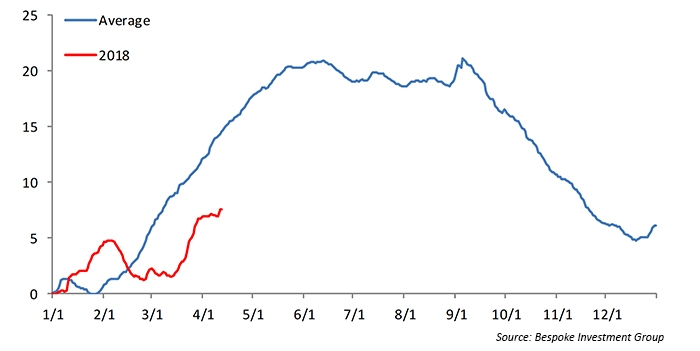

Bespoke Investment Group notes, however, that the price increases for gasoline are actually below recent historical trend on a seasonal basis:

“While prices have been on the rise this year, the magnitude of the move has hardly been out of the ordinary for this time of year. … While prices are up 7.6% this year, that’s actually only a little more than half the average YTD change of 14.4% as of early April and over three percentage points below the median change of 8.7%. … Based on historical trends, we’re also only about two months from the point in the year where gas prices typically peak, and from that point through the summer, prices typically level off before plummeting to close out the year.”

FIGURE 4: CUMULATIVE AVERAGE YTD CHANGE IN GAS PRICES SINCE 2005 (%)