Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides a broad summary and excerpts from their December 19, 2016, report on the short-term market outlook.

We have downgraded market and sector views to neutral. We believe the broad equity market and leadership sectors are due for a pause in the upside over coming weeks as investors grapple with improved economic data, fear of higher interest rates, a less dovish Fed, and buying exhaustion. A few days before the presidential election, we upgraded our market and sector views to reflect a much more offensive position. At that time, the drama surrounding the coming U.S. election caused investors to largely ignore the global economic acceleration, and our four key tactical indicators had moved into deep oversold territory that warranted a more aggressive position. Our offensive market and sector upgrade had nothing to do with the election; it was purely based on the data and extreme intermediate-term oversold condition.

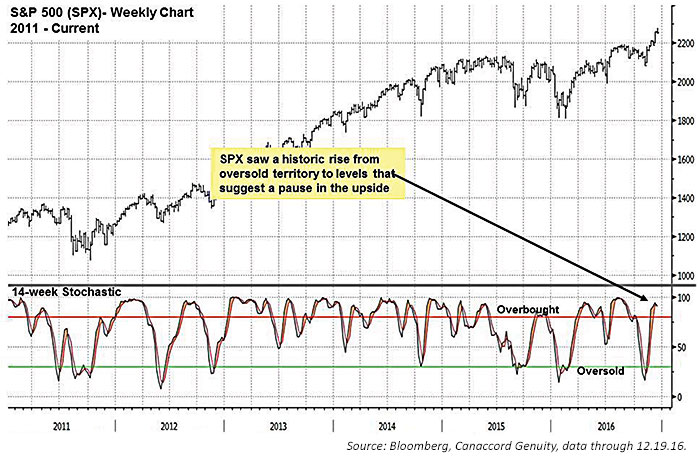

“Making the markets great again” as optimism trumps pessimism. Following the Trump win, and the subsequent 8% rally, investors and the Fed have acknowledged the strengthening global economy, and our indicators have moved into extreme overbought territory. In addition, a study of similar “buying climaxes” suggests weakness over the coming weeks. It is essential for us to remind investors that unless the economy is in recession or the markets are firmly in bear territory, periods of weakness should be bought rather than sold. It is hard to adopt a more offensive posture if you are already positioned that way, so we are moving to a neutral position looking to add exposure on any pullback as some of the investor optimism abates.

Key tactical indicators are extremely overbought, creating an environment ripe for correction. It is important to remember that corrections are normally considered natural, normal, and healthy—until they actually happen. By definition, they only come with a perception of fundamental problems, or no one would sell. Such overbought conditions in our four key indicators suggest the market is ripe for some degree of profit taking. Our four key tactical indicators point to a market buy when the following occur:

- The 14-week stochastic indicator drops to 30. This indicator dropped to under 20 in early November and rose in just four weeks to over 90. In the history of the S&P 500, that has only happened twice, both in the 1960s. Again, it isn’t a “sell” signal, but it does show how quickly investor sentiment improved.

- Investors Intelligence percentage of bullish newsletter writers drops to below 35%. The most recent survey came in at a quite optimistic 59.6%, a level that has matched sentiment peaks this cycle. A couple of weeks ago, when the bullish percentage hit 50%, we pointed out that it typically takes a bit longer than most think for such optimism to retreat, and that has already been the case for the past two weeks.

- The VIX jumps to 20 or higher. The CBOE Volatility Index (VIX) closed last week at 12 and has been below 15 since just after the election. Again, this doesn’t mean it spikes right away, but the environment is riper for a surge in volatility.

- The percentage of S&P 500 (SPX) index components above their 10- and 50-day moving averages drops to 20% and 40%, respectively. Current readings are at 51% and 73%, respectively, and off their recent peaks at over 80%.

We are looking to buy any fear-based weakness as it develops. Given the likelihood of a temporary pause in the upside given the recent market ramp and subsequent high optimism, we are adopting a tactical neutral market and sector view. We would look to become more aggressive as the market works off its overbought condition because (1) our positive fundamental core thesis remains in place, (2) economic data and earnings per share (EPS) continue to improve, and (3) nothing in our credit-based indicators suggest any significant and sustainable deterioration that would warrant a more defensive position. Although we are now market and sector neutral, we want to be positioned to capitalize on any fear-based weakness and believe our SPX 2017 target of 2,340 may prove to be conservative.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com