This article is about sentiment. So what am I talking about? Sentiment is based on the feelings, either to buy or to sell stocks, that portfolio managers and the general investing public have regarding the stock market. If there is a feeling that all is well and that the economy is growing, bullish feelings will appear. The press will call it “risk-on.” Why? A risk-on trade is one which is based on taking some risk when the economy appears to be stable and growing. A “risk-off” trade occurs when the general feelings regarding the market are very cautious. At that time, purchases of insured bonds will be made even with next to nothing on a coupon: Buyers are scared of a market retreat and will take safety with little income rather than risking money on growth or uninsured investments. The feelings, sentiment-wise, are negative.

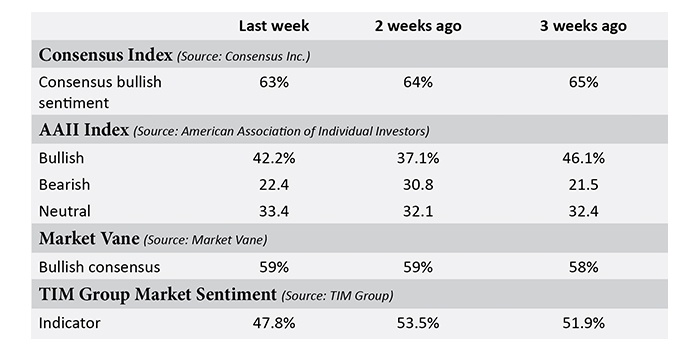

There are many services providing weekly sentiment readings. Investors use this as a gauge to measure the mood of the market, and it is widely seen as a contra-indicator. It is generally believed that when there are too many buyers or bulls in the market, the market is near a top and that a retreat will occur in the not-too-distant future.

On the other side of the coin, if there are too many sellers or bears in the market that may indicate nearing a bottom and a rally is in the future. The theory, which actually works, states that the crowd is always wrong and that when the market becomes too frothy, something will knock it off its perch. The readings are always a lagging indicator but can be used to understand how close we are to a decline or a rally.

Investor Sentiment Readings

February 2, 2015

There is a lot of data showing us that, for example, that when bullish sentiment gets to be above 50%, something will knock the market down in the not-too-distant future. At the same time, if bears gain traction, the opposite could occur. This year, we have not seen the bears able to consistently rally much above 20% on bearish sentiment. When the differential between bullish sentiment and bearish sentiment is more than 40%, then a major market move is usually going to happen. (Actually, a difference of 30% is worrisome for me.) Services also measure the correction camp or fence-sitters.

Basically, the takeaway from all of this is that if there are too many bulls or too many bears hovering around the marketplace, you should take note of that and perhaps adjust your investments to protect yourself: hedge it if bearish or just go long if you are bullish.

Remember that when the bulls run, you cannot stand in front of that herd without getting trampled—this not a time to short but rather a time to hedge or to place tight trailing stops on your positions. On the other hand, when the bears are prowling around and there is blood in the streets, it may be difficult to buy, but perhaps you should begin to nibble on a few selected favorites.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com

Recent Posts: