If you own all of the sectors, you own the market and achieve average returns. The goal is to “aim higher,” strive for higher returns, and accomplish that with less risk. Based upon several decades of sector investing, we have found several “secrets” for building a rules-based, quantitative sector strategy.

#1—Build a better sector universe

Too many managers stick with the original 10 sectors within the S&P 500 Index. However, the world has changed dramatically in the past 30-50 years. Don’t make that mistake; break out the newer sectors such as Biotechnology and Internet. If you leave them buried within their broader sectors (like Internet within Technology), their individual potential is diluted.

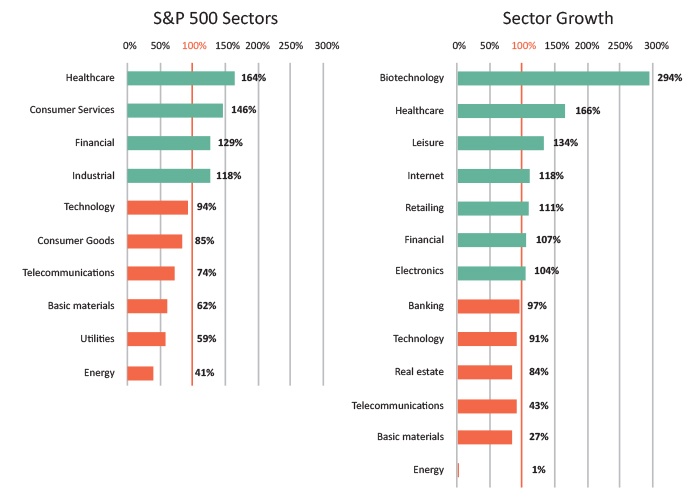

The following chart reflects the performance of the original 10 S&P sectors versus the “better sector universe” during the current bull market. Only four of the S&P 10 sectors have hit triple-digit returns, while almost twice as many did in the expanded sector universe.

S&P 500 SECTORS VS. GROWTH SECTORS (10/03/11-03/20/15)

Source: FastTrack.net

#2—Rotation occurs

Many do not understand the rotation in performance that can occur between one bull market and the next. As an example, during the bull market of 3/2009-4/2011, Biotechnology was at the bottom of the 13 sectors in performance. But things change, and rotation in leadership occurs. In the next bull market phase (9/2011-3/2015), Biotechnology was the clear leader with a 292% gain versus 95% for all sectors.

The rotation in sector leadership provides opportunity for an active manager. How do you identify leadership? Look to relative strength/persistency in price and momentum. The strong tend to get stronger, while the weak tend to get weaker.

#3—Focus on the leaders

Some sector strategies tend to lose focus during a bull market. When the market is very strong, such as in 2013, these strategies end up buying all of the sectors. They are content with market returns, which you can achieve by buying a Vanguard 500 fund.

A smarter strategy is to focus on the leading sectors. Why settle for market returns of 30% in 2013, when sector leaders such as Biotech jumped 66% and Internet was up 54%? Laggards, such as Utilities with a 14% gain, pulled down returns. Owning all sectors is being too diversified. Follow the advice of Warren Buffett, “Diversification is protection against ignorance. It makes little sense for those who know what they’re doing.” A focused group of just the four leading sectors provides a level of diversification without sacrificing potentially higher returns.

#4—Tailor fit your risk management (and your use of leverage)

Risk management is a cornerstone for any successful long-term investment strategy. Changes in economic trends or political events do occur that can lift or drop a specific sector regardless of the overall market’s direction. Last summer the Energy sector swooned, falling 30% when crude prices dropped 50%. However, the overall market continued to rise. If your risk management was only focused on the overall market, you would have been hit with large losses in your Energy sector holdings.

Similar to this, consider employing leverage on a sector-by-sector basis when conditions are favorable. Employing ultra-sector funds (1.5X or 2X) at the right time has the potential of making a great move into a spectacular move. Of course, along with the greater potential comes the real possibility of higher risk. Therefore, we follow both individual sector signals and a broader market environmental signal to apply an extra measure of risk management.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Recent Posts: