Most investors are familiar with the Rule of 72, a formula for approximating the time it takes an investment to double at a given compounded annual return. The rule states that dividing 72 by the annual return equals the number of years it takes to double. Conversely, the Rule of 72 can also determine the annual return by dividing 72 by the number of years. For example, it takes nine years to double an investment compounding at 8% a year (72/8% = 9 years). Similarly, the return required to double an investment in just six years is 12% (72/6 years = 12%).

Retirement is the primary goal of many investment plans. These long-range plans require more than just a doubling of an investment, and involve time horizons that are longer than those easily estimated with the Rule of 72. To make the planning process easier, I have developed the Rule of 240, a formula for approximating the time and/or compounded return needed for an investment to increase by a factor of 10. The mathematical term for a factor of 10 is called an “order of magnitude,” and it may be easier to think about it as “adding a zero” to your investment. The methodology for using the Rule of 240 is the same as the Rule of 72. Specifically, the number of years it takes to increase an investment by an order of magnitude, multiplied by the annual return, is equal to 240. For example, an investment will take 20 years to add a zero ($100 will grow to $1,000) if the return is 12% a year (240/12% = 20 years). With an 8% annual return, it will take an investment 30 years to increase by a factor of ten.

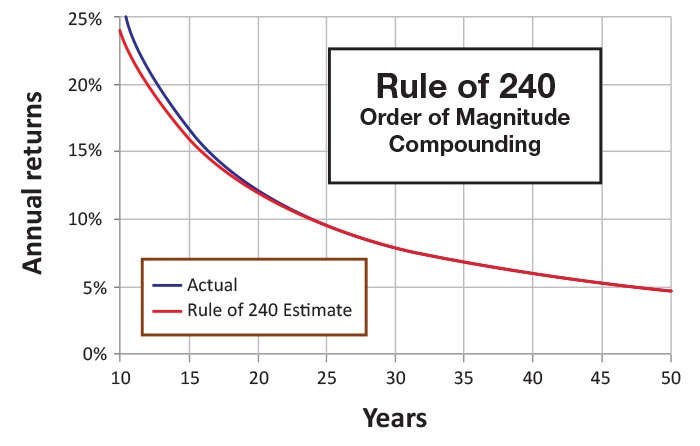

Although the Rule of 240 is an estimation technique, it is a reasonably accurate estimation. The Rule of 240 is accurate to within six months for all returns in the 6% to 15% range and is accurate to within 0.1% a year for all periods greater than 21 years. (See exhibit for comparison of actual compounding results versus Rule of 240 estimates—the two curves are remarkably close.)

The rule refers to an “investment” gaining 10X, but in reality it can be anything in nature that compounds—including inflation. Inflation at 3% a year would be 10X after 80 years (240/3). In other words, an item costing $1 today will cost $10 in 80 years at 3% inflation. If you prefer to think of it in terms of diminishing value, your $1 will be worth just 10 cents in 80 years at 3% inflation.

Investment results adjusted for inflation are called “real” returns. If you are concerned about the impact of inflation, the Rule of 240 still applies. You just need to adjust for inflation to get to the “real” return. For example, a 12% nominal return takes 20 years to increase 10X. With 3% inflation, your 12% nominal return becomes a 9% real return, and the years to 10X becomes 240/9= 26.7 years. The formula can also handle tax impacts, as long as you can express your annualized return as an after-tax figure.

The Rule of 240 doesn’t care how you generate the annual returns. It works for buy-and-hold investing as well as day trading and all points in between. It doesn’t care whether we are in a deflationary environment or inflation is running at 7% a year, or whether your holdings are in a taxable or tax-sheltered account.

You can also use it to provide a reality check to clients that believe their $100k nest egg is going to turn into a $1 million retirement fund at 5% return per year. With no inflation, that lofty goal requires about 48 years. With 3% inflation and a 2% real return, it quickly extends to multiple lifetimes (240/2 = ??…the answer is left as an exercise for the student).

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.