For almost a half-century, I have practiced and preached risk management. But that doesn’t mean that there will be no risk. For 2 1/2 years (February 2016 through September 2018), the market did virtually nothing but rally. Gains were big and plentiful.

Then Q4 2018 popped up, with the weakest December in decades. Bear markets were the norm around the globe. The U.S. had been immune to the global “bear market cold,” but finally succumbed. On an intraday high to low basis, there wasn’t a major U.S. index that didn’t suffer a 20% decline or more.

It was painful. Volatility reappeared. Some investors panicked, possibly making their worst investment decisions by abandoning great strategies. Unfortunately, that is the typical emotional behavior of retail investors. Investors are their own worst enemies, buying during a period of great performance and selling on the dips.

For the professional financial advisor, this type of moment is the most challenging. The need is to help investors get through their emotional decision-making, talking them “off the ledge.” While investors are inclined to quit a proven strategy during the inevitable dip, advisors need to point out that this may be the best time to stay the course or even invest additional funds.

Peter Lynch did not just beat the Street … he absolutely destroyed it. Peter Lynch’s spot in the list of history’s greatest investors stems from his work with the Fidelity Magellan Fund between 1977 and 1990. During this 13-year period, the fund posted an annual average return of 29%.

Fidelity made sure investors were very aware of Magellan’s success, building the fund’s assets from $20 million to $14 billion during Lynch’s tenure. You would think investors would have cleaned up, sharing in those impressive gains, right?

Not true.

Fidelity did an internal study and discovered that the average investor in the fund actually lost money. How? New investors and new money poured in during periods of great overperformance (typically after the bottom and closer to the top), only to sell after a setback. Then, when Lynch got back on track, investors would return, and money began flowing back in. Many investors missed the best and biggest parts of the recovery—only to repeat the same cycle on the next dip. Investors lacking professional guidance were practicing an emotional investment strategy of buying high and selling low.

Let’s look at another example.

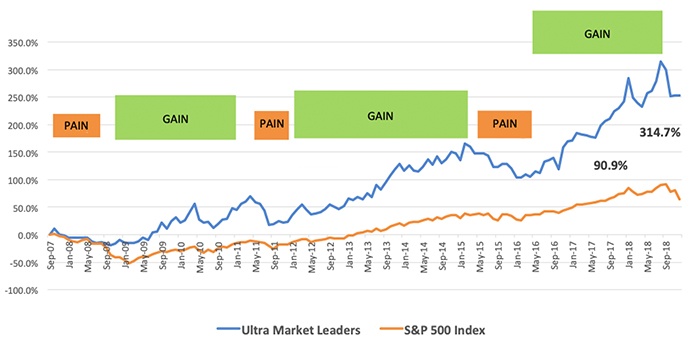

At STIR Research we publish the Ultra Market Leaders strategy. This risk-managed strategy can go from 0% invested up to 200% exposure. In rising markets, it strives to own the leading global asset classes using leverage. In falling markets, it moves to playing defense. While it actively practices risk management, that does not mean it is risk-free. It will experience periods of pain, only to be followed by periods of great gains.

Source: STIR Research

If you practiced “had the pain, stay for the gain,” you were well-rewarded over the last 11 years. The Ultra Market Leaders strategy certainly had its moments of pain, but ultimately produced a gain that was more than three times that of the market (represented by the S&P 500).

Q4 2018 provided another swift bout of pain. Even with risk management, not all of the pain could be avoided. But now that we have “had the pain,” it is time to “stay for the gain.” I believe this is true for Ultra Market Leaders and many other risk-managed strategies.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com