Refocusing on key aspects of financial planning for 2020

Refocusing on key aspects of financial planning for 2020

A report by Spectrem Group reveals the underlying factors motivating individuals and families to set up a financial plan—as well as what planning components most people expect to see included.

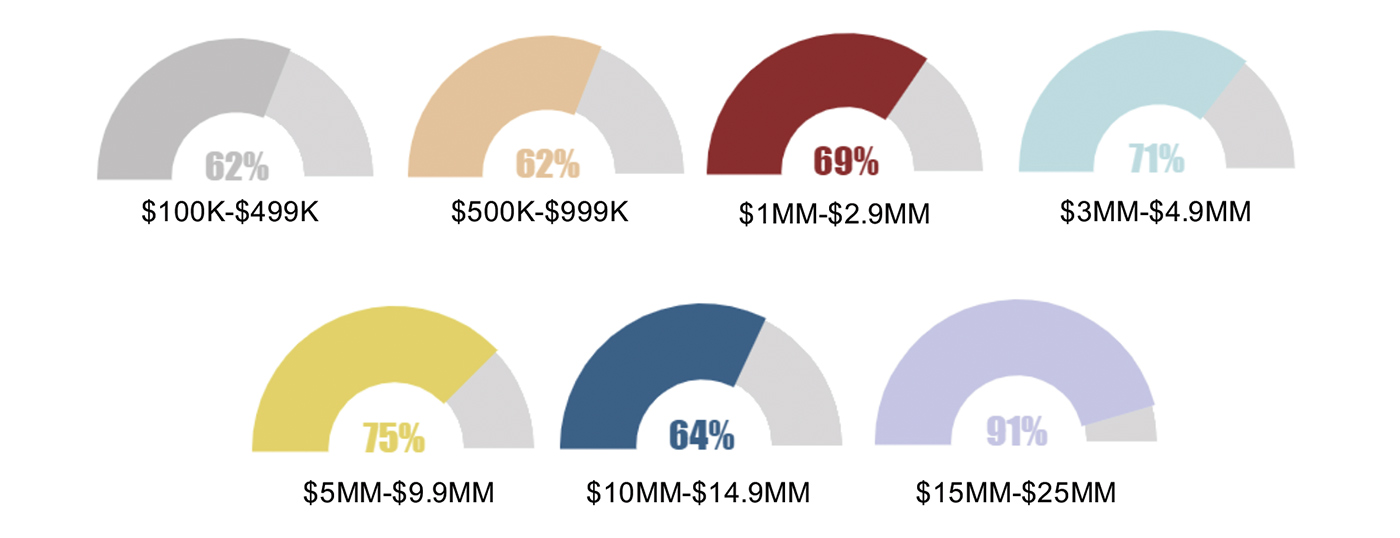

Spectrem Group issued a report in July 2019, “Defining Financial Planning,” that focuses on what prompted investors to create a financial plan, the exact services or topics addressed in their plan, and those they would like to have included but may not currently receive. The study covers a wide range of respondents, interviewing investors with a net worth between $100,000 and $25 million, not including the value of their primary residence.

A second report from Spectrem in 2019, “High Income Millennials,” focuses on millennials who are building wealth and have individual incomes over $100,000 or household incomes over $150,000. Millennials are now overtaking baby boomers as America’s largest generation. As millions continue to further their careers and accumulate significant wealth, their decisions about capital allocation will play a significant role in the direction of U.S. financial markets. They are an important segment for all financial advisors to understand—and they have some different attitudes from preceding generations.

The key findings of the two reports include:

- The stickiness of financial planning. Once an advisor develops a financial plan for a client, that client is more likely to use that advisor for a higher proportion of their asset management, and their loyalty to that advisor is significantly strengthened.

- The shortfalls of many financial plans. Despite the first finding, there is a significant gap between the financial-planning services being delivered by many advisors and what clients feel should be delivered.

- Retirement planning drives advisor engagement. Over 80% of those with a financial plan say retirement planning was the key factor in their interest in developing a plan with an advisor.

- Millennials represent a significant opportunity for advisors. While approximately 74% of the broader audience studied have a financial plan, under 50% of higher-income millennials currently work with a financial advisor. They are also more likely to find an advisor through channels other than personal referrals.

“The financial industry uses countless terms to describe and define exactly what it offers to wealthy investors. ‘Wealth Management,’ ‘Financial Planning,’ ‘Investment Management,’ ‘Comprehensive,’ ‘Holistic,’ ‘All-Encompassing,’ ‘Thorough’—these are just a few of the various terms used by the financial advisory industry.

“Wealthy investors struggle to understand what the differences are between all of these terms and exactly what they are getting when they start working on a ‘comprehensive financial plan.’ ‘Does a comprehensive plan tell me whether I can buy a boat or just that I need to buy more insurance?’ Based upon their experience with different types of advisors, investors have various beliefs regarding what is and what is not part of financial planning.

“Understanding how investors define financial planning and gaining an awareness of their expectations regarding what is to be included in a financial plan is crucial for financial firms. Missing the target regarding client expectations of financial planning can result in reduced client satisfaction and fewer referrals.

“Delivering every aspect a client desires in a financial plan, reviewing the plan at their desired frequency, and interacting with clients regarding the plan in the manner they wish, will increase client loyalty and assets under management.”

- The majority of investors interviewed (74%) have a financial plan. The segment of business owners is the most likely subgroup to have a financial plan. Over 25% of investors have created their own financial plan without the guidance of a financial advisor.

- Investors indicate that their financial plans were developed primarily to plan for retirement (83%) and because it is “important to plan for the future.”

- Only a third of investors (36%) believe they have a plan that is completely customized. The majority of investors have a plan they believe is “somewhat customized.”

- Only half of investors “follow their financial plans closely.” Older investors are far more likely to follow their financial plan closely, as are the wealthiest investors.

- For those investors who do not have a financial plan, the primary reason is that they feel they can adequately manage their financial affairs themselves.

- Three-quarters of investors spent five hours or less meeting with a professional to understand the financial-planning process and identify what documents are needed in the process. Less than 10% of investors spent more than 10 hours in this type of meeting.

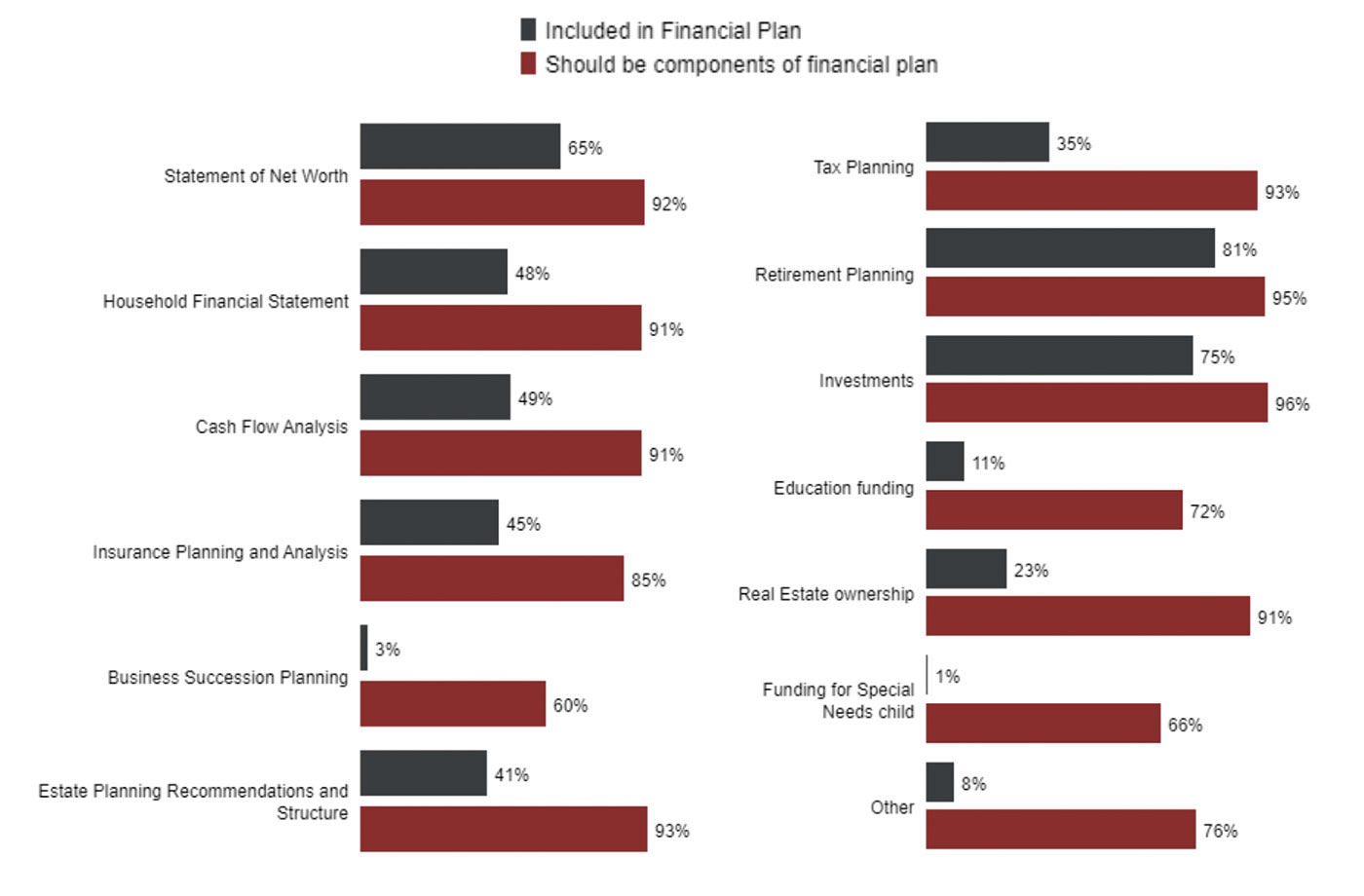

- A significant gap exists between what is being provided in financial plans and what investors would like to have as part of a financial plan.

- Educational funding, guidance in planning for special needs family members, business succession planning, and real estate purchase guidance stand out as areas having the widest gaps between a desire for services and delivery of those services. For example, while 72% of investors believe education-funding advice should be included in a financial plan, just 11% receive advice or guidance on that topic.

- Certain segments expressed a desire for more guidance in understanding health savings accounts (HSAs). Business owners have a stronger-than-average interest in including insurance and real estate in financial plans.

- Not surprisingly, as wealth increases, so does the interest in the estate-planning components of a financial plan.

- It is significant to see large “delivery gaps” in the areas of tax planning and estate planning for inclusion in financial plans, as well as many financial plans not including fundamental financial analysis statements. These represent areas of opportunity for financial advisors in terms of differentiation and client satisfaction.

Source: Spectrem Group, “Defining Financial Planning,” Oct. 2019

- Over two-thirds of investors state that they become more loyal to the firm that created their financial plan.

- Over half of investors have moved assets to the firm that worked in developing their financial plan.

- Two-thirds of investors believe they will achieve their financial goals through the development of defined goals and nearly two-thirds have already developed those goals.

- Client loyalty to advisors creating a financial plan tends to increase with a client’s net worth.

Source: Spectrem Group, “Defining Financial Planning,” Oct. 2019

Says Spectrem, “High-income Millennials have many similarities to wealthy investors of different generations, but they also have some significant differences. It is critical for financial advisors to understand both the similarities and the differences and to respect those feelings and beliefs accordingly.”

The importance of planning for retirement and the desire to achieve and maintain financial stability are commonalities across generations. However, according to Spectrem’s research, there are several distinguishing factors for millennials that have implications for financial advisors as they cultivate this segment:

- Millennials are less likely to have a financial plan than baby boomers (62% versus 80%), and less than half of this segment has a financial advisor (49%). A comparatively higher percentage of younger millennials than older generations found their advisor via marketing efforts from advisors rather than from referrals.

- While many millennials and baby boomers have or had student loan debt, the absolute level of debt appears more of a concern for millennials. While education-related debt is a factor in the lives of many high-income millennials, they place a higher value on saving for retirement than paying off student loans.

- In general, high-income millennials are worried about the health and care for their aging parents. Approximately 50% are more concerned about the health of their aging parents than they are about their own health, which could have an impact on financial-planning decisions.

- For many millennials, being able to pursue a desired lifestyle and afford leisure activities is more of a definition of success than having a family. 53% consider “being able to afford leisure activities’’ as a definition of success, more so than “raising a family” (45%).

- High-income millennials are more likely to define “The American Dream” as equal opportunity for all Americans versus older generations, who define it as “homeownership” or “improved economic prospects for future generations.”

- Almost three-quarters of millennials plan to retire between the ages of 50 and 70. This indicates that few millennials put themselves in the “I will never be able to retire” or “I don’t plan to ever retire” categories.

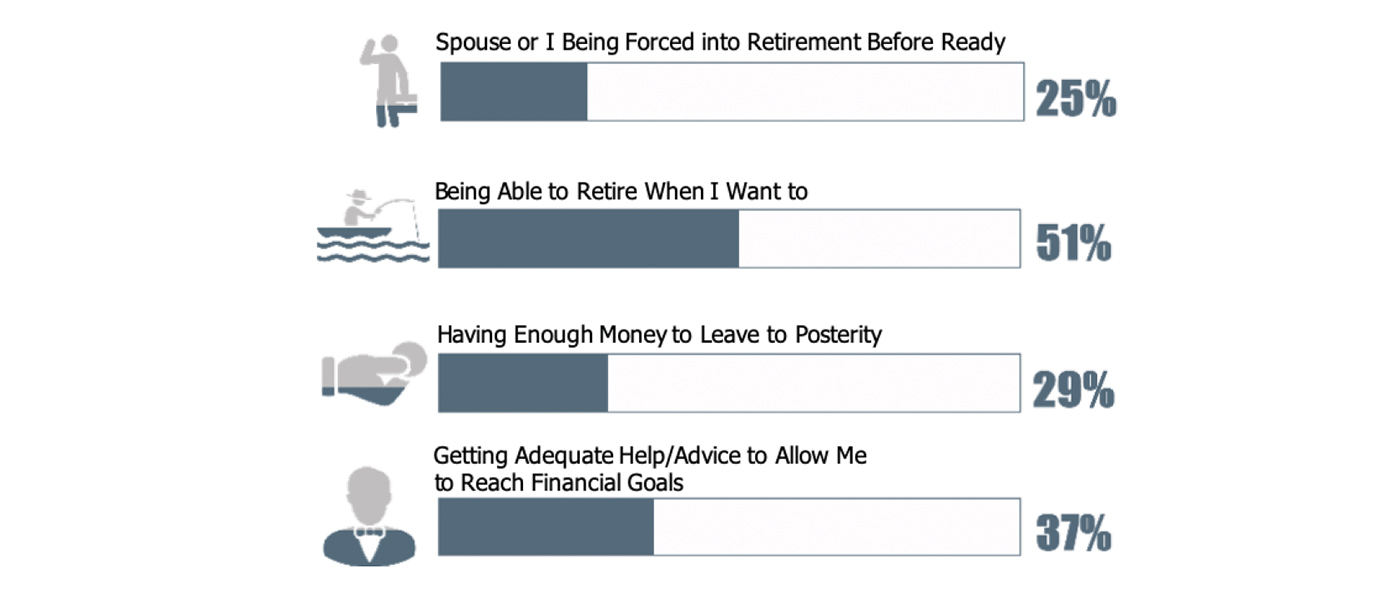

- More than half of high-income millennials are concerned with being able to retire when they want to and 37% are concerned with receiving adequate help or advice to allow them to reach their financial goals. This presents an opportunity for financial advisors.

Source: Spectrem Group, “High Income Millennials,” Sept. 2019.

- While high-income millennials are still on an upward career trajectory and, in many cases, move from job to job more than prior generations, they rank the following factors as most important in making financial decisions:

- Employment status (51%).

- Current level of debt (43%).

- Tolerance for risk (41%).

- Financial needs of children (37%).

- Marital status (36%).

- Homeownership (28%).

- Future/current care for parents/grandparents (18%).

Spectrem Group articulates its major findings as follows:

- “Firms need to provide ongoing monitoring of financial plans, as investors are not looking for a static one-time plan. They expect their plans will change and they prefer a plan that is managed in an ongoing manner.

- “Advisory firms that develop completely customized plans will distinguish themselves from other firms that only provide somewhat customized plans. There is opportunity with investors that have either a standardized plan or only a semi-custom plan to provide added value by creating a fully customized financial plan.

- “Firms need to address the gap between what investors want included in a financial plan and what they have received. Providing access to each of those topics and ensuring the issues have been addressed or offered will ensure the investor feels the financial plan is addressing all their concerns and is more customized.

- “Health insurance, HSAs, and property and casualty insurance need to be a component of a financial plan. Advisors do not need to be experts in this field, but they do need to have a comprehensive understanding of how these various types of insurance products impact their clients’ financial lives.

- “Advisors should address client concerns over the amount of time it takes to gather the information necessary to create a viable financial plan. Explaining the value of the detailed information provided will allow clients to understand the necessity of going to the trouble to provide as much information as possible.

- “Financial firms that do not currently provide financial plans need to consider changing their service model to include financial plan creation. The process of developing a financial plan is an involved process with many in-depth and intimate questions, which solidifies client relationships and increases loyalty.

- “Advisors need to have the capacity to consolidate documents from various sources because investors will provide information primarily in hard copy format. It is critical to allow clients to provide the documentation in whatever format is easiest for them.

- “The time that an advisor spends discussing and reviewing a financial plan should more closely mirror what clients would like included in the financial plan. Gone are the days of being able to (solely) discuss portfolio construction and investment selection. Advisors need to become conversant regarding a wide variety of topics that impact their clients’ lives.

-

“Meeting the needs of younger investors will have many similarities to older generations but there will also be significant differences. It’s easy to presume that as the high-income Millennials get older their priorities may change. But doesn’t that happen to all generations?

“Financial advisors today need to identify the financial goals of these young investors and guide them in how to meet these goals in both the short term and the long term. How do you balance current leisure-activity spending with long-term retirement planning? Long-term financial stability is really the goal for most investors.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Proactive Advisor Magazine would like to express thanks to Spectrem Group for permission to excerpt findings from their two 2019 studies, “Defining Financial Planning” and “High Income Millennials.”

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.