The real estate sector had a difficult 2018, though from a sector-investing basis it was not as bad as one might have expected.

While the S&P 500 was down 4.38% on a total-return basis, the real estate sector was off 2.2%. However, one of the largest real estate ETFs, Vanguard’s VNQ, was down 5.9%. VNQ has the bulk of its holdings in different categories of REITs.

According to Bankrate, 2018 was a year of conflicting trends for the housing market in the U.S.:

“Science fiction writer William Gibson once said ‘the future is here—it’s just not evenly distributed.’ The same could be said for the affordability and availability of housing in 2018. It existed—just not everywhere.

“As we look back at 2018, many experts say it was a pivotal year in the housing market. Headwinds, like tight inventory and high home prices, led to a gradual cooling over the past 12 months. On the plus side, homeowners saw their equity grow as property values shot up and markets blasted by the housing crisis finally made a comeback.”

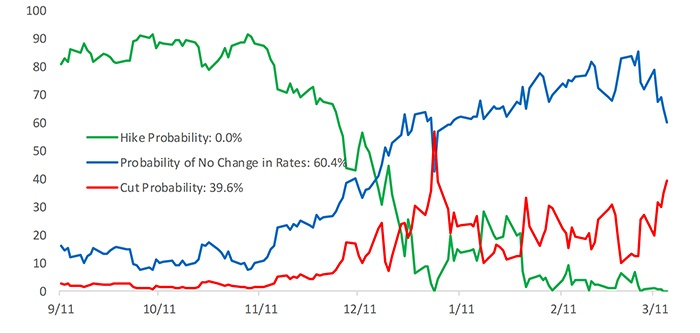

They also point out that in 2018, “Affordability pressures affected demand in 2018, which was compounded by rising interest rates. … After several years of historically low rates, hovering around 3.5 percent, 2018 was the year of the 5 percent mortgage interest rate. Rates hit the 5 percent mark in early October, only to sink back into the 4s in the fourth quarter.”

With the Federal Reserve indicating in early January that the likelihood for further rate increases in 2019 had diminished, mortgage rates have continued to back off from the peak of 2018.

FIGURE 1: 30-YEAR FIXED MORTGAGE RATE—HISTORICAL 10-YEAR CHART

Source: Macrotrends

While trends for 2019 in the residential real estate market are still going to be highly variable by geographic market and influenced greatly by the path of interest rates, an analyst at Charles Schwab feels the commercial real estate sector has positive tailwinds in 2019 and upgraded the sector to “market perform.” He cites the following as positive factors for the sector:

“Low interest rates: Low rates have enabled real estate investors to buy property with relatively ‘cheap’ money, which provides the potential for greater income.

“Expanding economy: An expanding U.S. economy typically helps the real estate area, as rental rates increase for apartments, retail and office buildings.

“Apartment trends: Due to the financial crisis and housing crash, as well as demographic factors, demand for apartments has been strong, supporting rental rates and benefiting those companies that have a stake in that arena.”

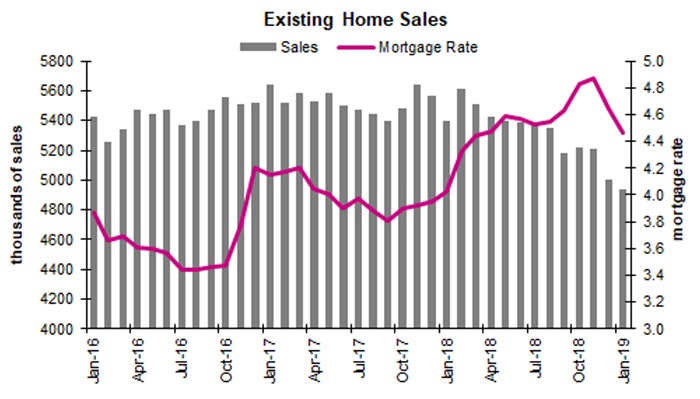

On the possibility of a resumption in interest rate hikes, Bespoke Investment Group says,

“Based on pricing in the futures markets, there is now a 60.4% chance that the Fed sits on its hands between now and the meeting next January (2020).

“The odds of a rate cut have actually shot higher this week, rising to just under 40%.

“Not only are markets pricing in little chance of an FOMC rate hike anytime in the near future, they are actually pricing in ZERO chance of a rate hike!”

FIGURE 2: ODDS OF RATE HIKE, CUT, OR NO CHANGE BY JAN. 20, 2020

Source: Bespoke Investment Group

The outlook for the residential market for 2019, according to National Association of Realtors’ (NAR) chief economist Lawrence Yun is for “more of the same, in terms of growth” versus 2018. His outlook calls for combined existing and new home sales “to increase a little less than 1 percent, from 5.97 million to 6.1 million.” There will be disparity between geographic markets and between lower-priced and high-end homes, with demand for more affordable housing being strong. The sales of more-expensive homes are going to suffer on a relative basis from higher inventory and the impact of changes in the tax law, which caps mortgage interest deductions and state and local tax deductions.

Data on new home sales was released for January 2019 last week. Though the report was within consensus expectations, Barron’s called it “a mostly favorable report,” with the three-month average having “the best showing since June.”

The homebuilders’ monthly confidence index was unchanged at a seasonally adjusted reading of 62 in March, according to the release on Monday of the NAHB/Wells Fargo Housing Market Index. While this was somewhat disappointing, the index has rebounded over the past three months from a reading of 56 in December.

Existing home sales for January, however, fell for the third straight month and “hit a 3-year low,” according to MarketWatch’s analysis from late February.

The picture, therefore, remains very mixed for the housing market.

Source: Barron’s, Econoday, Haver Analytics