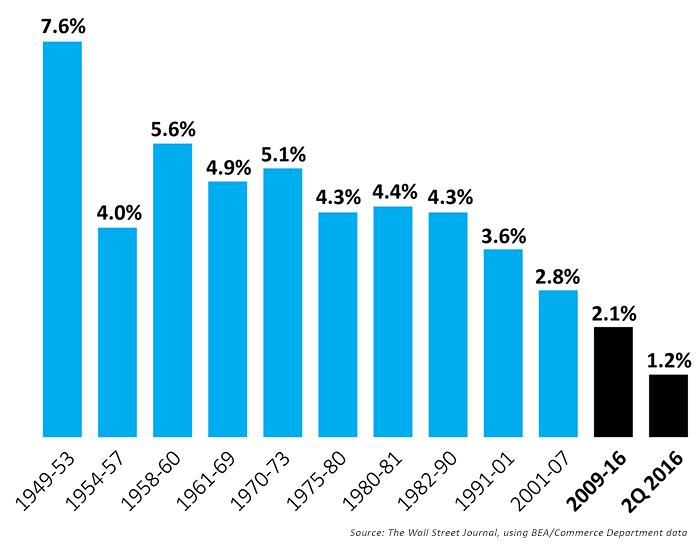

Why? The reported 1.2% quarterly growth rate was less than half of most going-in estimates. On the surface, it should have been universally discouraging to all observers. After all, according to The Wall Street Journal, it confirmed that the “U.S. is in the weakest recovery since 1949.”

The Journal added,

“Economic growth is now tracking at a 1% rate in 2016—the weakest start to a year since 2011—when combined with a downwardly revised reading for the first quarter. That makes for an annual average rate of 2.1% growth since the end of the recession, the weakest pace of any expansion since at least 1949.”

Note: Figures are adjusted for inflation and seasonality

With most predictions for Q2 GDP coming in at a 2.6% growth rate, economists were split on the impact of this single report. Some foresaw it as predictive of further disappointing reports in upcoming quarters, while others thought the internal components were setting up for a relatively decent second half of 2016.

A recent article from The Wall Street Journal compiled reactions from a variety of commentators, partially excerpted below:

“This report was very weak, and this report supports our forecast of a coming U.S. recession. Industrial production data convey that we are in a recession right now. We still expect a slowing of U.S. growth in the second half of the year as lower oil prices affect oil and gas credit and financial players.” —Jason Schenker, Prestige Economics

“GDP growth in the second quarter shows the economy barely above water. It marks the third consecutive quarter of near 1% growth as opposed to the historical long-term average of 3%. … Going forward, GDP should avoid recession for the simple reason that more new homes need to be constructed.” —Lawrence Yun, National Association of Realtors

Barron’s economics columnist, Gene Epstein, saw some things to be positive about in the Q2 report:

“‘Final sales,’ which is growth of real GDP excluding inventories, rose at an annualized rate of 2.4%. All that is required in the current quarter is for consumer spending to perform reasonably well—say, at 3%, while all of the other drags on growth disappear or go mildly positive. … Meanwhile, to look on the bright side, the expansion has now lasted seven full years, a year longer than the previous one.”

And, according to Reuters, San Francisco Fed President John Williams “said the second-quarter gross domestic product reading was weak because of swings in inventories and government spending, noting that some underlying data in the report ‘look good.’” Williams also posited that the most recent data did not necessarily forestall rate hikes by the FOMC this year, commenting, “There is definitely a data stream that could come through in the next couple of months that I would think would be supportive of two rate increases.”

Bespoke Investment Group put forth a detailed analysis of the BEA’s GDP report, noting the good news that “consumption surged to the highest growth rate since 2014 in Q2, adding over 2.8% to total growth in the quarter.” On the flip side, “investment plunged, mostly due to a collapse in inventories,” but “inventories are a temporary headwind/tailwind for GDP, and it’s hard to envision the current -1.16% impact on growth continuing at anything close to the same pace over the next couple of years.”

Bespoke’s analysis finished on a very upbeat note:

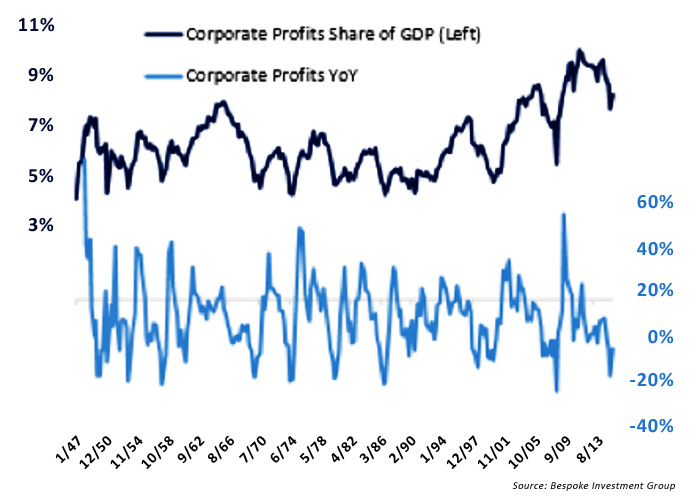

“The one sunny side of the story here: businesses are ploughing money into research and development at record rates. Unless businesses are as a whole behaving irrationally, it’s hard to argue this is a sign that low productivity and investment will persist. Instead, we believe that corporations are careful allocators of capital (generally speaking) and that existing projects are likely to yield new products, efficiencies, and markets which will fuel growth in the future. Labor productivity should benefit, as should corporate profitability. On that note, hats off to the long-term thinkers in board rooms!”