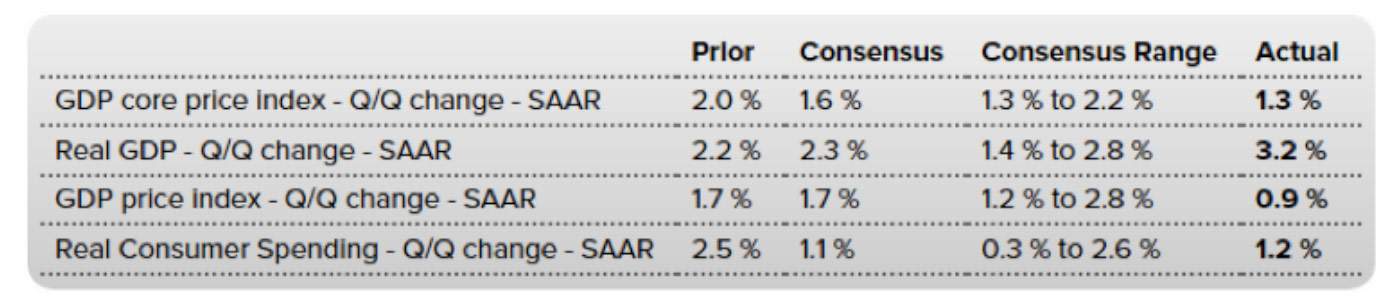

Real gross domestic product (GDP) increased 3.2% in the first quarter of 2019, according to the “advance” estimate released by the U.S. Bureau of Economic Analysis (BEA) last week. In the fourth quarter of 2018, real GDP increased by 2.2%.

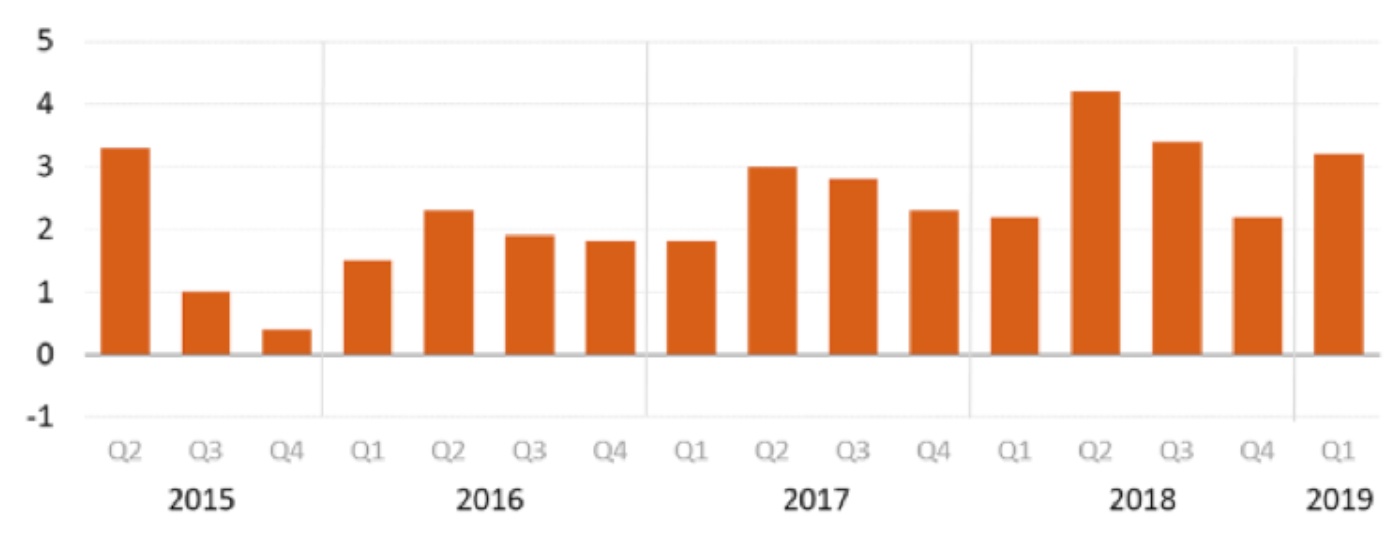

Source: Investors.com, using data from the Bureau of Economic Analysis

A growth rate over 3%, especially in the face of ongoing trade issues and the government shutdown, surprised even the most optimist analysts, with a consensus expectation in the area of 2.3%. Some economists had forecast a reading below 1% prior to the start of the Q4 earnings season. According to Nasdaq.com, “This is the strongest Q1 read since the 3.3% we saw in 2015.” The preliminary report has also raised some expectations for Q2 2019 GDP, which over the past few years has represented the strongest quarter for GDP growth.

Seasonally adjusted at annual rates.

Source: U.S. Bureau of Economic Analysis

According to the press release from the BEA,

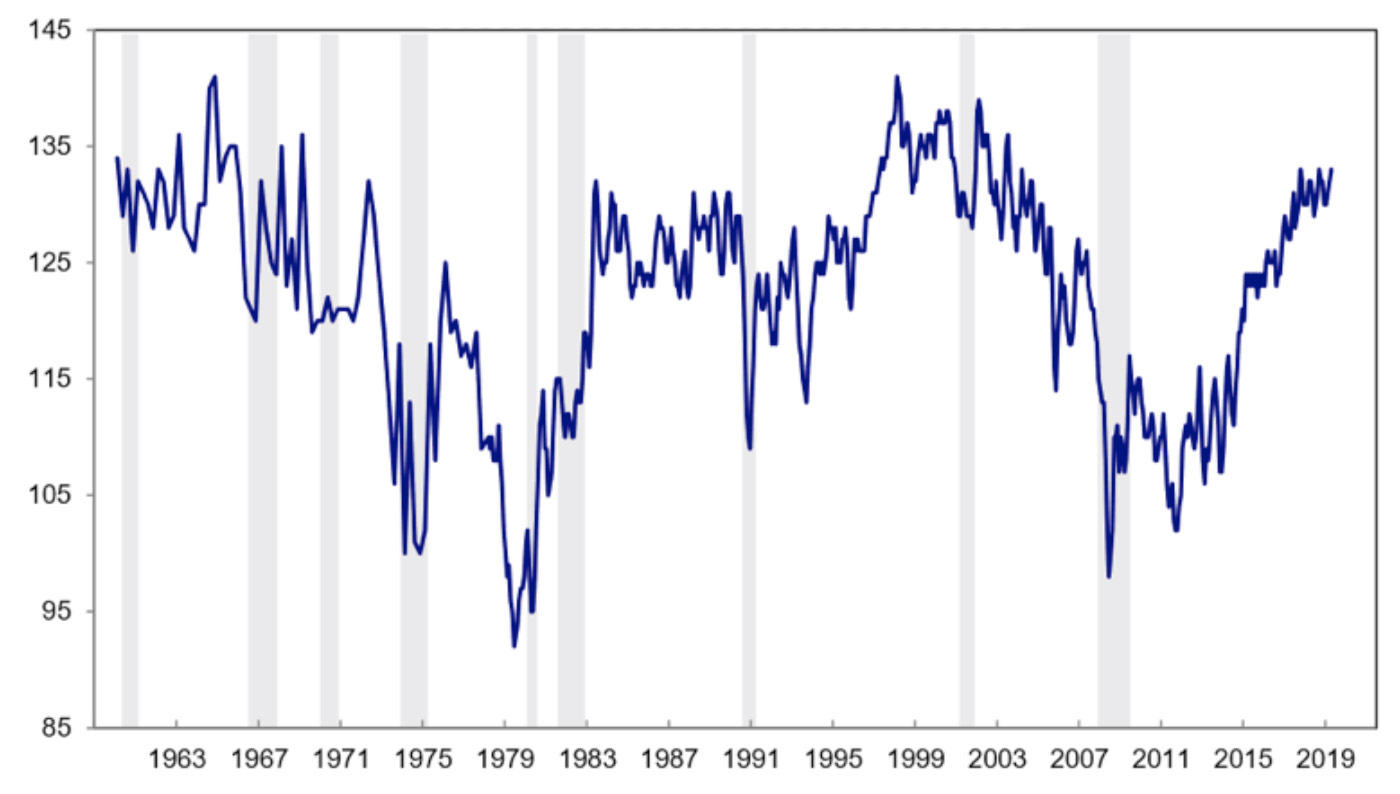

On the same day of the GDP release (April 26), the University of Michigan’s Consumer Survey data was published. This showed little change from prior months but maintained the overall strong picture for consumer sentiment and future household economic expectations.

Surveys of Consumers chief economist, Richard Curtin, noted,

“The Index of Consumer Sentiment has moved sideways, recording only small monthly variations since Trump first entered office. The Sentiment Index has averaged 97.2 in the past 28 months, identical to the April 2019 reading. Moreover, the Sentiment Index has remained between 95.0 and 99.0 for 21 of the past 28 months. … The last time consumer sentiment was as favorable for as long a period of time was during the late stages of the Clinton expansion.

“When asked about their financial prospects for the year ahead, 44% of consumers anticipated improvements compared with just 8% who expected worsening finances. This was the best overall reading since 2004. Moreover, when asked about longer term financial prospects, 60% reported in the April survey that they expected to be better off financially over the next five years. This was the highest proportion ever recorded. …”

Source: University of Michigan

Despite the positive broad reading on Q1 growth in the GDP report, and the encouraging consumer sentiment readings, The Wall Street Journal reported that “the stock market had a muted reaction … in part it showed that even as exports rose, other key drivers such as consumer and business investment slowed.”

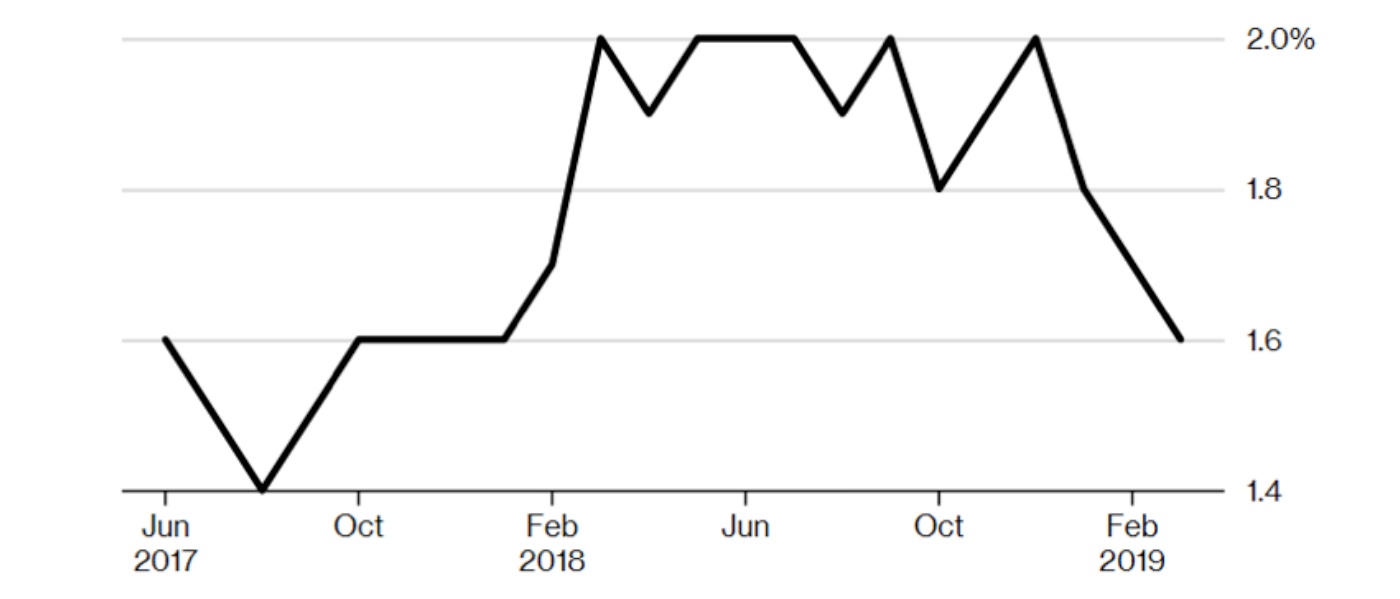

On the flip side, the relatively lower numbers on price inflation, seen in Table 1, are encouraging in terms of keeping the Federal Reserve on the sidelines for interest-rate hikes. The Wall Street Journal says,

According to CNBC, the outlook on inflation remained largely unchanged after data was released this past Monday, “The core personal consumption expenditures index—the Federal Reserve’s preferred measure of inflation—remained unchanged in March. …”

Bloomberg noted on the most recent data that “U.S. consumer spending rebounded in March while the Federal Reserve’s preferred underlying inflation gauge eased to a one-year low, reinforcing the central bank’s patient stance on interest rates even as the economy’s main engine holds up.”

Source: Bloomberg, BEA

Bespoke Investment Group wrote last week that the topline number of the preliminary Q1 GDP report should be taken with some caution, based on the disruptions to reporting created by the government shutdown and some internal numbers that were not as strong as the overall growth figure. Says Bespoke,

“As far as ‘hard’ data goes, it’s hard to get a messier release of GDP than what we saw today in the Q1 advance estimate from the BEA. Back in mid-March, the Atlanta Fed’s GDPNow tracker was suggesting barely positive growth around 0.17%. The final estimate was 2.67%, above consensus of 2.2%, but far below the 3.2% actual result. However, the underlying details were weaker.

“Consumption added only 82 basis points to growth (second weakest since Q2 ‘13), fixed investment was pretty weak, inventories boosted the reading by over 0.5%, trade one-offs sent growth 1% higher, and spending from state/local governments looks unrealistically high. … Suffice to say they make this a relatively ‘weak’ 3.2% number. It’s also important to remember that these numbers are heavily interpolated and estimated in the BEA’s first release; we need to see more revisions before we can pass final judgement.”