The U.S stock market expressed its “approval” of the election results in no uncertain terms: the S&P 500 Index (SPX) rallied 3.5% in just over two weeks, and the Dow Jones (DJIA) did even better, gaining 4.5%.

Many market commentators, including Larry Kudlow in his syndicated radio show, have attributed this fast and explosive rally to expectations for a “Trump pro-growth agenda.” There are plenty of naysayers, both about the staying power of the markets and the speculative nature of what a Trump administration will really accomplish (and how it will pay for it).

In a recent broadcast, however, Kudlow and his guests cited several underpinnings of the “pro-growth” optimism in the markets:

- a return to an economic agenda similar to that of the Reagan administration

- corporate and individual tax cuts

- health-care reform

- fiscal stimulus and infrastructure spending

- financial and energy deregulation

- policies designed to encourage business investment and job creation

- repatriation of corporate cash held abroad

- a new perspective on U.S./global trade “deals”

But while the markets may have shown some initial enthusiasm, what do consumers believe?

Although the time frame has been short for significant analysis, initial signs are leaning toward post-election consumer optimism. Three separate polls capture different perspectives on how the consumer is feeling in the days since the election:

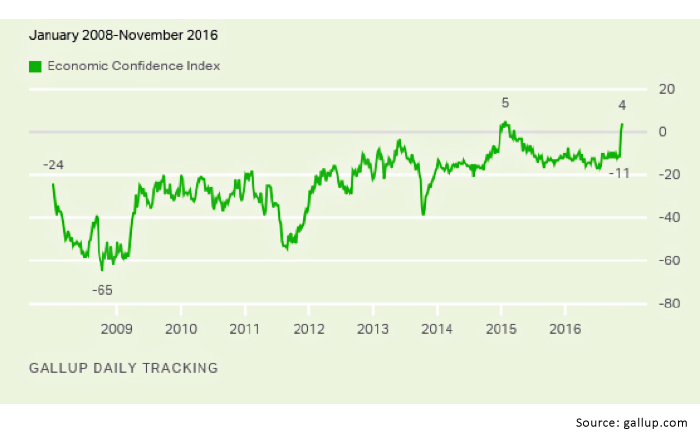

- The final University of Michigan consumer sentiment reading for the month was released on November 23, and according to Barron’s, “reflects in part sentiment in the post-election period.”

Barron’s said the results exceeded expectations, as the “consumer sentiment reading climbed to 93.8 from the preliminary reading of 91.6 and October’s 87.2.”

CNBC quoted Richard Curtin, the survey’s chief economist, who called the results a “presidential honeymoon.” Mr. Curtin added, “The initial reaction of consumers to Trump’s victory was to express greater optimism about their personal finances as well as improved prospects for the national economy.”

FIGURE 1: U.S. CONSUMER SENTIMENT INDEX

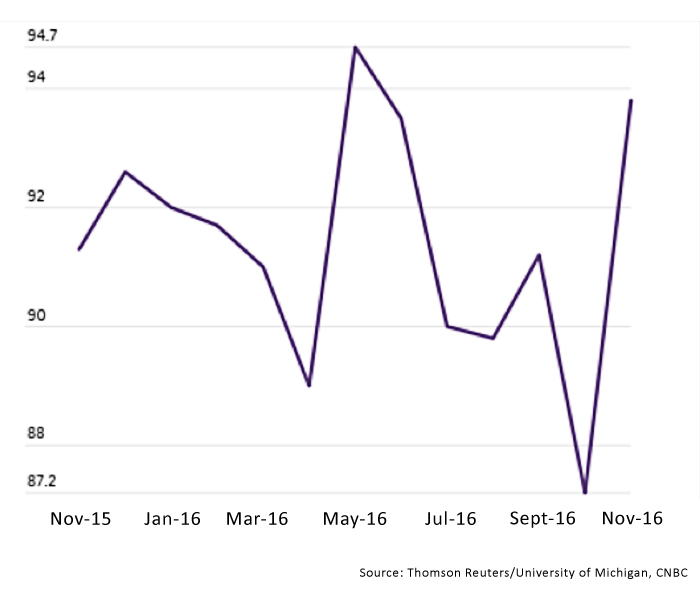

- An independent Quinnipiac University opinion poll conducted November 17-20 showed, according to Yahoo, that “nearly double the number of voters—59 percent versus 37 percent pessimistic—said they are ‘optimistic about the next four years with Donald Trump as president.’”

According to a Quinnipiac press release, “Trump’s policies will help the nation’s economy, 52 percent of voters say; 31 percent say his policies will hurt the economy, and 11 percent say they will make no difference.”

FIGURE 2: VOTERS GENERALLY OPTIMISTIC ABOUT TRUMP ADMINISTRATION

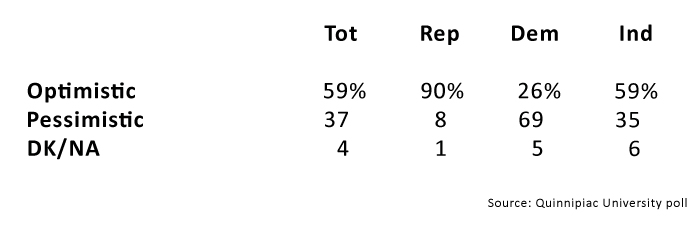

- Gallup’s U.S. Economic Confidence Index “was +4 for the week ending Nov. 20, the first full week of interviewing after the Nov. 8 presidential election. This is the first positive weekly reading in more than a year and a half.”

According to Gallup,

“Americans’ confidence in the economy is now higher than it has been for most of Gallup’s tracking trend over the past nine years. The heightened confidence places Trump on much better footing than what his predecessor Barack Obama started his first term with, but it could also set a high bar for the incoming president’s performance. If Trump rises to the challenge of further improving the U.S. economy, the index could reach heights it hasn’t touched in nearly a decade. But the high hopes could also lead to disappointment if Americans feel Trump hasn’t kept his promises of economic progress. …”

FIGURE 3: GALLUP’S U.S. ECONOMIC CONFIDENCE INDEX—WEEKLY AVERAGES