Economist A.W.H. Phillips studied the relationship between inflation and unemployment in the United Kingdom and noticed that they were usually moving in opposite directions. He, therefore, theorized that when unemployment is low (and it is hard to find workers), prices of things rise because employers have to pay more to hire qualified employees. That led several generations of economists to undertake an effort to determine the exact trade-off between inflation and unemployment, thinking that if a government or central bank changed one factor, there would be an equal and opposite reaction in the other factor.

The problem is that neither Dr. Phillips nor the generations who came after him understood the real relationship. It is not one of opposition, but rather of lead-lag.

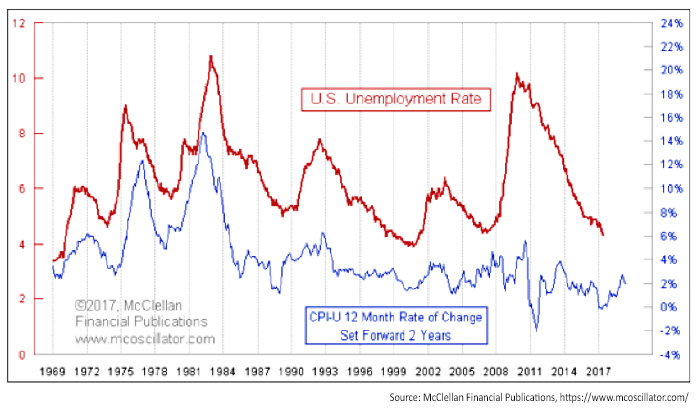

In the following chart, the plot of the CPI-U inflation rate is shifted forward by two years (24 months) to reveal how the U.S. unemployment rate follows in the same footsteps. That is important because the inflation rate bottomed in early 2015—the echo of that bottom is coming due right now for the unemployment rate.

U.S. UNEMPLOYMENT RATE VS. INFLATION RATE (CPI-U) SHIFTED FORWARD TWO YEARS

This is not a perfect relationship, though. Sometimes outside events put a thumb on the scale. We saw that especially in 2008, when the commodities bubble sent the inflation rate up to an unnatural high, which was followed by a crash of equal magnitude to the downside. Two years later, the unemployment rate did not exactly match those dance steps. But after a few months, the relationship got back into step again.

The CPI-U inflation rate rose from the low in April 2015 to its high in February 2017. Add two years to those dates and we get a low for unemployment due in roughly May 2017 and a high in February 2019. But it does not appear to be as big of a rise as some of those we have seen in the past, so don’t worry too much. But do brush up your résumé.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com