Growth of passive index investing increases the need for active management

Growth of passive index investing increases the need for active management

The use of third-party asset managers by financial advisors has grown dramatically over the past decade, particularly those managers using active, risk-managed strategies. A recent industry study, in fact, estimated an AUM growth rate of over 25% for TAMPs in 2012 and 2013. Paradoxically, passive index funds have increased their share of total investment assets at the same time, furthering the risks associated with more highly correlated markets.

John Bogle has said it for years. Warren Buffett joined the chorus in his 2013 Berkshire Hathaway shareholder letter regarding his estate, “My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund.” For the average investor, the popular financial advice is that the best investment is a passive index fund allocation.

The prevalence of that advice is changing the nature of the financial markets. It doesn’t matter how much the phrase “past performance is not indicative of future returns” appears, financial advice tends to be a backward-looking profession. Unable to see the future, one looks to the past for trends and future expectations.

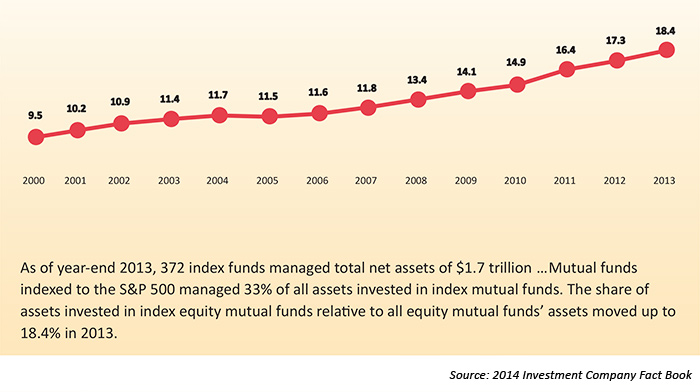

What the past does not tell us is how to deal with a structurally changed financial market in which an estimated 20% of the U.S. market is on autopilot—invested in index funds—while a majority of actively managed mutual funds are benchmarked to indexes, with some 33% indexed to the S&P 500, according to Investment Company Institute data.

Index equity mutual funds’ share

Percentage of equity mutual funds’ total net assets, 2000-2013

ETF total net assets

Billions of dollars, year-end 2013

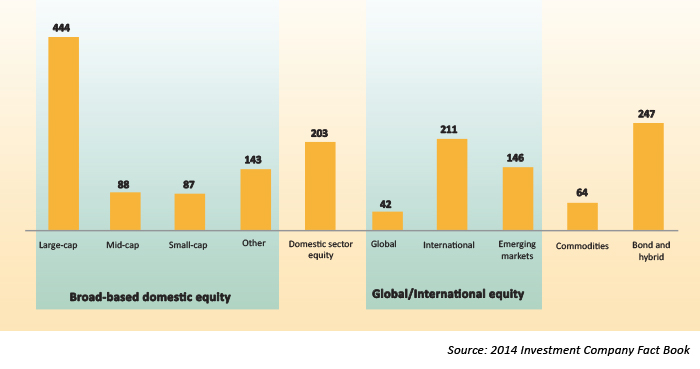

Exchange-traded funds (ETFs), which are primarily index-based, took over the lead in index investing in 2014. At the end of 2013, ETFs accounted for $1.67 trillion in assets, with 26% in large-cap funds. By September 2014, ETF assets had surpassed $1.9 trillion.*

In 2013, the market capitalization of the U.S. stock market exceeded $17.7 trillion, roughly half of the world’s $36.5 trillion total equity valuation. U.S. index mutual and exchange-traded funds held $3.4 trillion. Assuming 15% of all index fund assets are invested in bond and hybrid funds, it leaves $2.9 trillion in equities, with 20% of the total U.S. market equity effectively on “autopilot.”

Why does this matter? In their study of the impact of indexing on the U.S. equity markets, Dr. James X. Xiong, CFA, senior research consultant with Morningstar Investment Management, and Rodney N. Sullivan, CFA, editor of the Financial Analysts Journal, conclude, “Our results suggest the fragility of the U.S. equity market has risen over recent decades.”**

From their findings:

- Stocks are no longer selected for a portfolio based on expectations of outperformance, or at least respectable returns. Their inclusion in an index drives demand and has been shown to add a premium to their valuation.

- Changes to an index fund are often made at excessive values. New additions to the S&P 500 have documented price increases of up to 40% prior to inclusion. Once included in the index, funds have no choice but to purchase the stock regardless of price.

- Correlation between stocks held in the indexes increases, reducing the value of diversification. As new money flows into index funds, demand for all stocks in the index increases, driving price increases.

- In capitalization-weighted indexes, higher capitalization stocks may mask the underperformance of other positions.

- Index derivatives were major contributors to the stock market decline of October 19, 1987, and the “flash crash” of May 6, 2010, setting up feedback loops that accelerated selling pressures, while the concentration of technology stocks among the indexes played a major role in the market’s 2000-2002 decline.

For the active manager, “feedback loop selling” is a major concern. In 1987, index investing was just beginning to make an impact. Since 2010, indexed assets have increased by more than 30%. In the 1987 and 2010 scenarios, an outside shock to the market sent stock prices down, triggering futures selling by portfolio insurers, which were purchased by stock index arbitrageurs, who then sold the relatively overvalued stocks, pushing prices down further. Add in panic selling of index funds by investors of all sizes and the potential decline worsens.

A substantial portion of the equity market is now on autopilot.

There is an important difference between owning a stock or mutual fund purchased for sound fundamentals and owning an index fund. Where an investor might have confidence in the ability of the individual company or investment manager to weather a downturn and continue to prosper, the index fund is more of an unknown. The investor does not have extensive knowledge of all of the stocks that make up an index, limiting that confidence in its prospects for recovery.

Despite the often-repeated message to investors to buy and hold, there is little evidence from past market declines that they will do so. The damage to portfolios from market declines over the last 14 years has further eroded investor confidence, which has left the markets vulnerable to rapid and deep episodes of selling. While there may be valid reasons to own index funds as part of a diversified, actively managed portfolio, there can be no doubt their growth has changed some basic structural facets of the overall financial markets.

The risk management provided by active management may be the saving grace for many advisors and their clients when the next major market decline comes. And come it will. Because there is another new factor to consider that makes active management even more critical: a substantial portion of the equity market is now on autopilot.

*Rising Stocks, $15B Inflow Push US ETF Assets To Record, But Growth Lags 2013, Barron’s, September 2, 2014

**How Passive Investing Increases Market Vulnerability, James X. Xiong, CFA, senior research consultant, Morningstar Investment Management and Rodney N. Sullivan, CFA, editor of the Financial Analysts Journal. August 20, 2011.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com