We reiterate our bullish intermediate-term view due to the combination of a still-positive core fundamental thesis and the post-crash history in the context of an ongoing bull market. While we still think another move to the lower end of range is possible, we believe it is time to focus on the intermediate-term opportunity rather than the very near-term risk.

Fundamental overview

- Our positive fundamental core thesis remains in place, as we believe low inflation and tame economic growth allow the Fed to remain accommodative for a very long time.

- While corporate credit has been under pressure, it has been largely limited to the commodity-related sectors. We are watching corporate paper and CDS very closely to get a sense of a more problematic spread of credit tightening.

- It is pretty hard to imagine a sustainably negative economic environment with a steep yield curve, easy Fed policy, a new cycle high in consumer confidence, generational lows in initial unemployment claims, historically low household debt service ratios and delinquency rates, and improved housing trends.

- Despite fear of a global recession, (1) global PMIs, (2) historically accommodative world central banks, and (3) the recent uptick in money supply readings in Europe and Asia may suggest fear might be worse than reality.

Tactical indicators suggest a retest followed by a ramp higher for the markets

- The intermediate-term (1) price action, (2) volatility, and (3) correlations suggest further upside, but our near-term view is that we might still be in a bottoming process.

TACTICAL SUMMARY: IDENTIFYing BUY-POINT IN CORRECTIONS

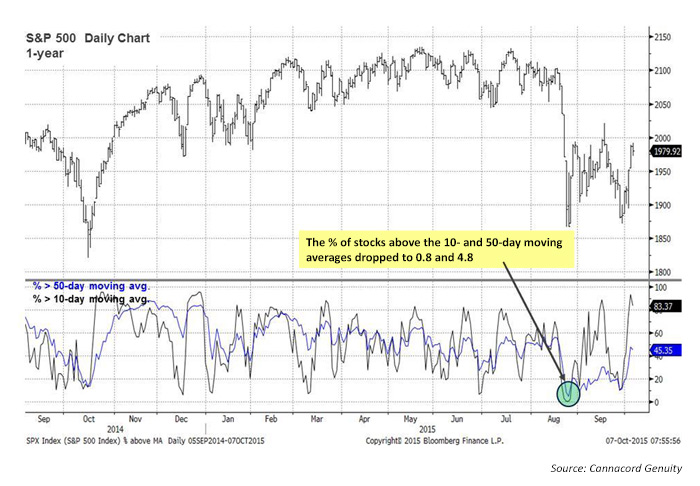

The % of stocks above various moving averages hit extremes in August ‘crash’

Observations

- A post-crash bounce retrace of 50% of the recent drop was accomplished, but it is unclear if the September low represented the final retest.

- Post-retest bounces should be greater than 16% and 20%, over three and six months, respectively.

- Intermediate-term view: The pullback brought our key indicators to a buy zone following the August “crash” (see chart).

- The NYSE and S&P 500 advance/decline lines are still in long-term uptrends. Despite recent weakness, they are not yet in a downtrend, suggesting the bull market is still in place.

- Correlations remain historically high. The median 63-day correlation of individual stocks to the S&P 500 Index remains historically high, especially with comparisons outside of this cycle. Bull peaks typically come with much lower correlations.

Bottom line

We reiterate our 2015 S&P 500 (SPX) year-end target of 2,150 and are initiating a 2016 target of 2,360. The equity market is most closely correlated to the direction of earnings, which remains positive, as the negative effect of the energy sector rolls off. We believe the move out of the bottoming process should be led by the areas that have seen the most damage, as was the case in 2011.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

0 Comments