The Global Dow Index, a 150-stock index of corporations from around the world, was up 24.6% on a total return basis in 2017, making it difficult to find many true categories of losers for the year.

Of the major indexes around the world, Hong Kong’s Hang Seng Index finished 2017 as the global leader, up 36.0%. While typically not thought of as a major index, Russia’s RTS Index was one of the poorer performers, up just 0.2%.

Two of the more unexpected performances of the year came out of Brazil and Greece, with Sao Paulo’s Bovespa Index up 26.9% and the Athens Stock Exchange General Index gaining 24.7%. London’s FTSE, with a gain of 7.6%, overcame some dire predictions based on the impact of Brexit but was still one of the weakest of the major international markets. The Shanghai Composite also trailed most markets, gaining just 6.6%. According to Bloomberg, “Mainland (China) equities have been buffeted by a government campaign to cut leverage in financial markets.”

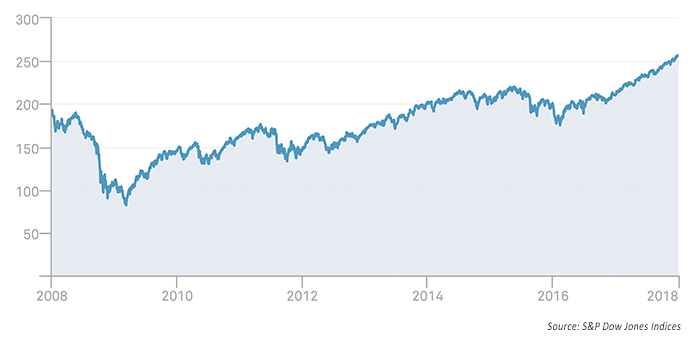

Looking at S&P’s global broad market indexes, they also found that total world equities were up close to 25%, with the U.S. registering a gain of 21.2% and the rest of the world increasing by 28.5%. The Pacific Region moved higher by 28.8% year over year, leading all geographic regions.

FIGURE 1: S&P BROAD MARKET INDEX—10-YEAR TREND

In terms of major global asset classes, the clear winner, according to Britain’s The Telegraph, was the Emerging Markets category, up about 35.5%. Fox Business noted, “Gold rallied 14% in 2017, the best annual performance since 2010, as a weakening dollar and political tensions around the world helped lift prices.” According to The Telegraph, “Not a single type of asset delivered a loss in 2017—for the second year in a row.”

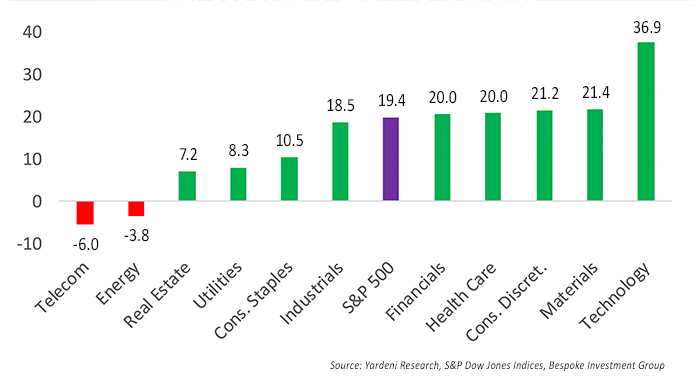

In the United States, the information technology sector was far and away the biggest winner among S&P’s sector groupings, finishing the year up 36.9%. Bespoke Investment Group commented toward the end of the year,

“Five sectors are finishing the year up 20%+. Financials and Health Care are the closest to the 20% threshold. … Energy and Telecom remain the only two sectors in the red, and both have made valiant attempts to get back into the black with monster moves higher over the last few weeks. … Most sectors are ending the year in overbought territory.”

FIGURE 2: S&P 500 SECTORS—2017 % CHANGE

Among individual stocks in the S&P 500, MarketWatch notes that the leader was NRG Energy Inc. (NRG), which gained 132% primarily on a major refocusing and restructuring of its business. The biggest decliner was Baker Hughes (BHGE), a GE company and one of the world’s largest oil field services companies. BHGE declined 51%.

There were no shortage of major tech names making huge gains in 2017, with Apple up 46% and Alphabet C shares (GOOG) gaining 36%. Among Dow Jones Industrial Average stocks, Boeing (BA) turned in the best performance with a year-over-year increase of 89%. The fortunes of two “old economy” names headed in opposite directions, with Wal-Mart shares (WMT) gaining 43% and General Electric (GE) declining 45%.

Of course, one of the major stories of 2017 was the meteoric rise of everything cryptocurrency-related. Bitcoin stole most of the headlines, with, according to business news outlet Quartz, a rise in value of 1,300%. But notes Quartz, “that wasn’t enough to even place it among the 10 best-performing crypto assets of the year.” They say that the “craze for initial coin offerings (ICOs) attracted over $3.7 billion in funds” in 2017.