The S&P 500 has gained 11.4% since the U.S. presidential election and is up 5.3% during the Trump administration’s first 100 days (through April 28). This presumably indicates a strong level of market support for the administration’s policy intentions and personnel choices for key positions.

Some cynics, especially on the Democratic side of the aisle and certain media outlets, find some irony in the fact that the “drain the swamp” campaign rhetoric has so far played out with Goldman Sachs’ veterans assuming key roles in economic policy positions in the Trump administration. President Trump had been very critical during the campaign of both Hilary Clinton and Ted Cruz for their ties to the investment bank.

According to The Hill, the appointment in March of James Donovan as deputy treasury secretary marked “the fifth former or current Goldman employee to join the new administration.” The two most prominent members of the Goldman contingent are, of course, Treasury Secretary Steven Mnuchin and Gary Cohn, ex-Goldman chief operating officer, who now serves as director of the White House National Economic Council.

Mr. Mnuchin and Mr. Cohn took the lead last week in announcing the outline of the administration’s tax plan. Cohn said, according to USA Today, “We have a once-in-a-generation opportunity to do something really big. … The president is going to seize this opportunity by leading the most significant tax reform legislation since 1986, and one of the biggest tax cuts in the American history.”

Leaders of the Democratic Party were not so sure, to put it mildly, with New York Senator Chuck Schumer saying, “I can tell you this: If the president’s plan is to give a massive tax break to the very wealthy in this country — a plan that will mostly benefit people and businesses like President Trump’s —that won’t pass muster with we Democrats.”

What was the market’s reaction to the Trump tax plan?

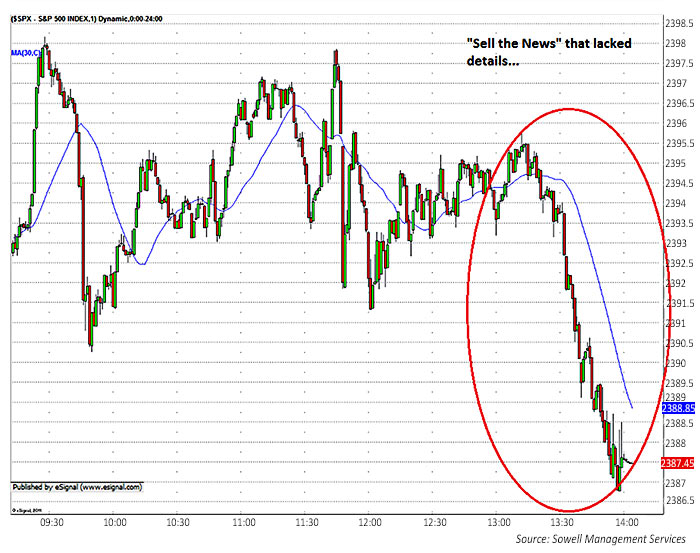

After the preliminary proposal was unveiled on April 26, the S&P 500 was essentially flat for the rest of the week. With earnings reports at the forefront, and tensions with North Korea grabbing headlines, it is difficult to read anything into the market’s tight trading range.

However, the short-term market move on Wednesday, April 26, following the announcement of the tax plan was underwhelming. This was likely due to the abbreviated nature of the proposal and the expectation that many of its major provisions stood little chance of gaining bipartisan support. The Wall Street Journal wrote on April 27,

A week ago, with the 100-day mark looming and no legislative victories, Mr. Trump ordered advisers to have a tax plan ready soon. The result was an outline that is heavy on ambition, light on technical detail, and likely to drive up budget deficits.

Here is what an intraday chart of the S&P 500 looked like on April 26, courtesy of Sowell Management Services:

S&P 500: ONE-MINUTE CHART (APRIL 26, 2017)

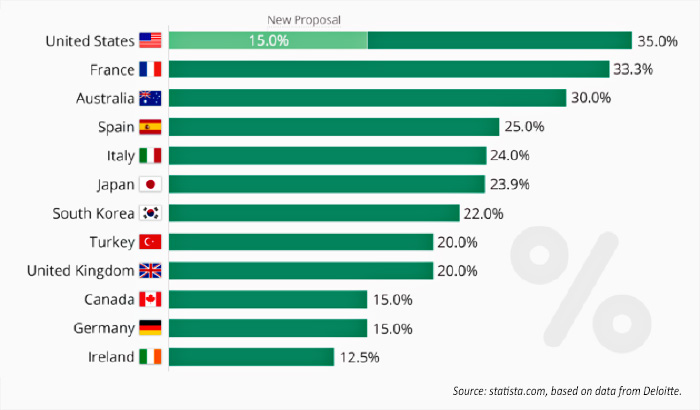

One of the provisions of the plan that will draw the most scrutiny is the proposal to lower the corporate tax rate from 35% to 15%. While many expect some reduction to be feasible, most observers acknowledge that getting down to the 15% rate is unlikely. There is little doubt, however, that many corporate leaders and economists believe the U.S. is put at a competitive global disadvantage with the current corporate tax rate.

Says Statista, “By international standards, the current U.S. corporate tax rate is considerably higher than most other developed countries worldwide. If Trump succeeds with his plan to slash the tax rate, the U.S. would be among the 20 countries with the lowest rates of corporate tax.”

GLOBAL CORPORATE TAX RATES IN SELECTED COUNTRIES (2017)