Editor’s note: David Moenning of Sowell Management Services publishes a biweekly commentary that “(a) is designed to indicate the firm’s ‘outlook’ for the stock market over the short-, intermediate-, and long-term time frames, (b) are for informational/educational purposes only, and (c) do not factor in any portfolio management decisions.” This commentary was written on June 8, 2016.

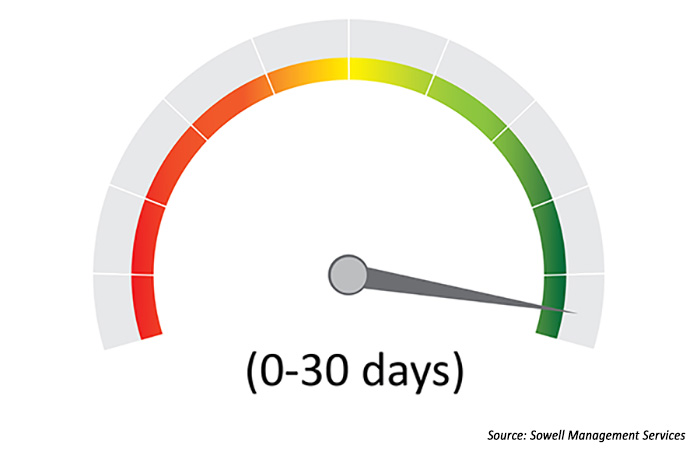

Market outlook in the short term

Don’t look now fans, but the S&P 500 is back to within spitting distance of the all-time closing high of 2130.82 set on May 21, 2015. In my humble opinion, the current joyride to the upside is being sponsored by Janet Yellen and her merry band of U.S. central bankers. The latest development in this seemingly never-ending saga is the idea that May’s jobs report was weak enough to take a June rate hike completely off the table. In fact, Fed funds futures currently forecast just a 24% chance of a hike at the September meeting!

And given that the Fed doesn’t like to hike rates too close to presidential elections, traders see the uber-low rates in the U.S.—and all of the associated fancy big-money trades—sticking around for a while longer. The question of the day, of course, will the current attempted jailbreak become the beginning of a new leg higher in the ongoing bull market, or will it be the latest in a long string of “breakout fake-outs”? Stick around, this is about to get interesting.

SHORT-TERM MARKET OUTLOOK

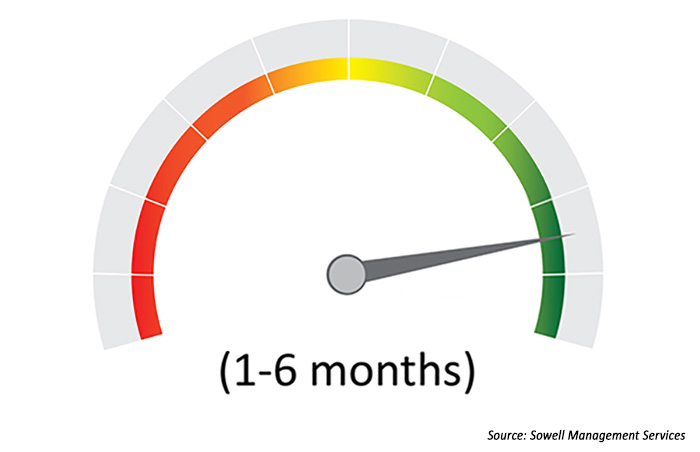

Market outlook in the intermediate term

From an intermediate-term perspective, it appears that the stock market is climbing a wall of worry, and the bond market (i.e., the yield on the 10-year), well, it’s just plain worried. But before you succumb to the laundry list of reasons why the sky is about to fall, remember that, in the stock market, “what is known by all, isn’t worth knowing.” Put another way, advisors should focus on the fact that the stock market is essentially a discounting mechanism of future expectations.

As such, traders appear to be looking ahead to better days as opposed to trading based on the current concerns such as punk earnings, a “plow horse economy” (hat tip to Brian Wesbury at First Trust), the Brexit, the election, etc. Keeping things simple, I’m of the mind that we can “let price be our guide” at the present time. In other words, should the stock market break out of the trading range that has been in place for what seems like forever, it would be a sign that the bulls have taken control of the ball and that clear skies are ahead. However, should prices fail to “break on through to the other side,” the most likely scenario would be more of the same sideways action.

MID-TERM MARKET OUTLOOK

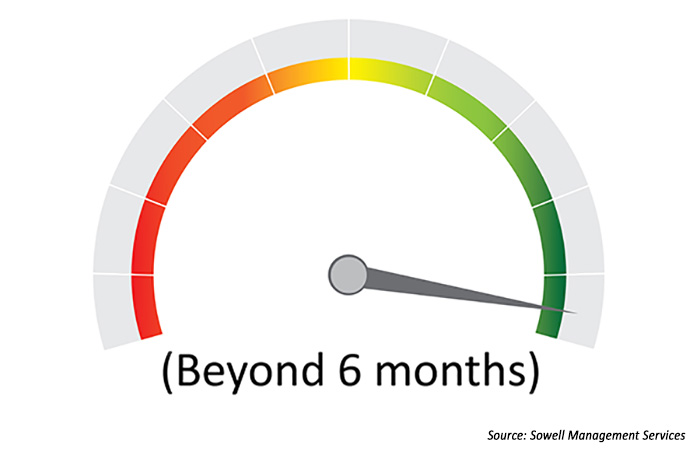

Market outlook in the long term

From a longer-term perspective, valuations continue to be an issue the bears are focused on. However, it is important to recognize that after sentiment, valuations may be the most misunderstood of all of the stock-market indicators. Cutting to the chase, high valuation is not, in and of itself, a reason to avoid stocks. You see, stocks can remain overvalued for many years before they present a problem.

One of my favorite Wall Street clichés is, “In the stock market, things don’t matter until they do—and then they matter a lot!” So, since investors appear to be looking ahead to an improving economy (which would, in turn, cause earnings to rise and valuations to improve), we must recognize that unless the threat of recession suddenly becomes an issue, stock-market valuations do not present a reason to sell stocks. However, until we start to actually see the economy improving, valuations may continue to present a reason to curb one’s enthusiasm about the upside potential. From my seat, this continues to be a “buy the dips” market environment.

LONG-TERM MARKET OUTLOOK

![]() See Related Article: A repeatable process: The only thing we can control

See Related Article: A repeatable process: The only thing we can control

David D. Moenning is chief investment officer at Sowell Management Services, an independent RIA firm focused on modern portfolio diversification. Mr. Moenning has been a full-time money manager since 1987 and is also the founder of Heritage Capital Research. Mr. Moenning is a former president and chairman of the National Association of Active Investment Managers (NAAIM). heritagecapitalresearch.com

David D. Moenning is chief investment officer at Sowell Management Services, an independent RIA firm focused on modern portfolio diversification. Mr. Moenning has been a full-time money manager since 1987 and is also the founder of Heritage Capital Research. Mr. Moenning is a former president and chairman of the National Association of Active Investment Managers (NAAIM). heritagecapitalresearch.com