The lure of the bubble

The lure of the bubble

Stock market bubbles and crashes are nothing new. There seems to be something in human nature that predisposes us to them.

If bubbles are just another part of the natural cycle, why do we care so much about them?

The greatest destroyer of wealth over the centuries is a tight race between wars and investment bubbles. Both situations are a result of human nature and government actions and tend to produce collateral damage well beyond the primary event.

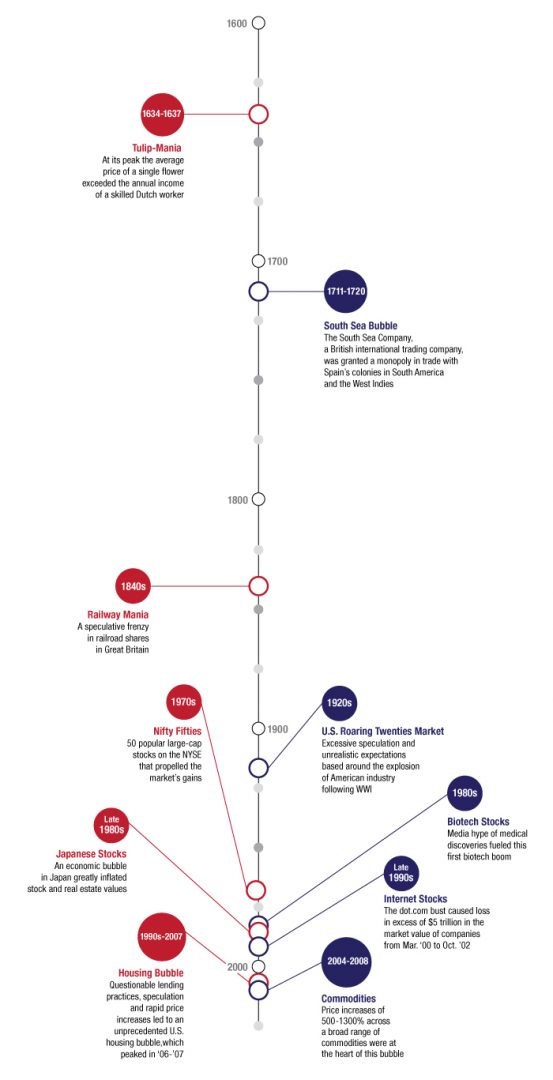

FIGURE 1: FAMOUS HISTORICAL BUBBLES

The persistence of bubbles over time is one of the main reasons active investment management is so important to investors. If we accept that human nature tends to produce cycles and periods of extreme values, then it only makes sense to put in place investment strategies that (a) seek to take advantage of bubbles by riding the up move and minimizing participation in falling markets or (b) seek investments that avoid the highs and lows of bubble-driven markets, such as investing in fixed annuities or income-producing properties.

The challenge with bubbles is that when they collapse, often, so does the broader market, in part because the bubble is typically the leverage propelling the market upward. Even when investors enter a bubble market with the intent to sell at the first sign of weakness, trading technologies can accelerate the speed with which the initial bubble collapses, making it more difficult for everyday investors to avoid catastrophic losses.

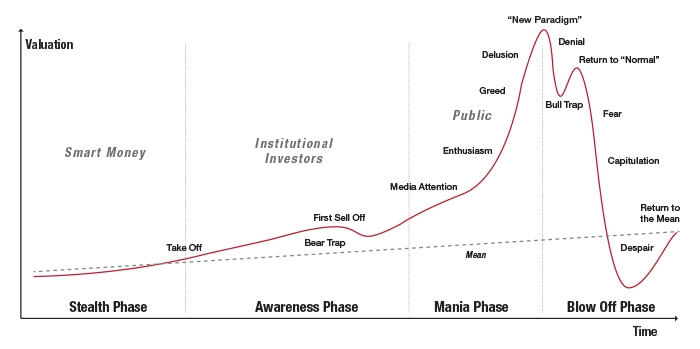

While it may be somewhat easy to declare when the stock market is in a bubble—indicators include high valuations and PE multiples, and individual investors entering the market in droves—predicting the end of the bubble is anything but easy. In fact, predictions of the end of a bubble are often signs that the upward trend still has a ways to run.

FIGURE 2: PHASES OF A BUBBLE

Source: Dr. Jean-Paul Rodrigue, Department of Economics & Geography, Hofstra University

A Google news search for “2014 stock market bubble” showed nearly 15,000 results in the first week of April. Does that mean the bull has a ways to run? Only time will tell.

“The market can remain irrational longer than you can remain solvent.”

Anticipating the collapse of a bubble can be summed up with the following statements, commonly attributed to economist John Maynard Keynes:

“The market can remain irrational longer than you can remain solvent.”

“There is nothing so disastrous as a rational investment policy in an irrational world.”

When bubbles collapse, the finger-pointing begins. An interesting book by Mark Buchanan called “Ubiquity: Why Catastrophes Happen” discusses a lot of fascinating ideas, including computerized sand piles and natural disasters, but much of it comes down to the following:

“In this simplified setting of the sand pile, the power law also points to something else: the surprising conclusion that even the greatest of events have no special or exceptional causes. After all, every avalanche large or small starts out the same way, when a single grain falls and makes a pile just slightly too steep at one point.”

Applied to the financial markets, Buchanan’s theories maintain that underlying every market bubble and its subsequent collapse is not a single reason or explanation, but an accumulation of factors that create an unstable state in which it is possible for the next grain to trigger an avalanche.

The moral for money managers? Stay humble and stay nimble. Predicting the future is a fool’s game. Reacting to reality is essential.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com