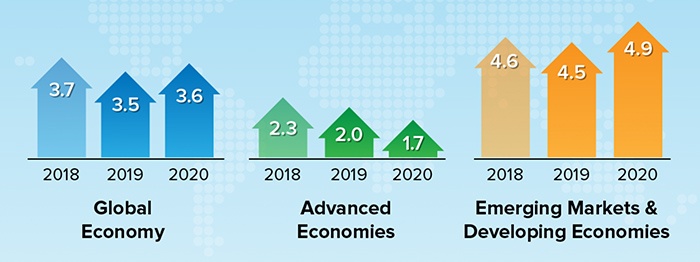

CNN reported last week that the International Monetary Fund (IMF) had announced a second downward revision to global growth estimates in the past few months. They wrote on Jan. 21,

“The International Monetary Fund is warning that the world economy is slowing—and that it will get worse if countries keep squabbling over trade. The agency’s updated World Economic Outlook lowered estimates for growth in 2019 by 0.2 percentage points to 3.5%, its second downward revision, this time on account of weakness in Germany and Turkey.

“But the new report, released as bankers and other global leaders gathered for an annual conference in Davos, Switzerland, made clear that the biggest known risks to growth are the unresolved trade war between the United States and China, and the possibility of Britain exiting the European Union without a deal.”

In opening remarks by IMF Managing Director Christine Lagarde at the World Economic Outlook, she said, in part,

“As you know, in October the IMF cut its global growth forecast for 2019 and 2020, partly because of the negative effects of rising trade barriers. Today we are announcing a further downward revision of our forecast. The bottom line is that after two years of strong expansion, the world economy is growing more slowly than expected and risks are rising. …

“And even as the world economy continues to move ahead, it is facing significantly higher risks, some of them related to policy. These risks are now increasingly intertwined: think of how higher tariffs and rising uncertainty over future trade policy fed into lower asset prices and higher market volatility. This in turn contributed to tightening financial conditions, including for advanced economies, which is a major risk factor in a world of high debt burdens.

“Does that mean that a global recession is around the corner? The answer is ‘no’—but the risk of a sharper decline in global growth has certainly increased. Add to this geopolitical worries and disappointing long-term growth prospects, and you have an economic picture with a clear message:

“Address remaining vulnerabilities and be ready if a serious slowdown were to materialize.”

FIGURE 1: WORLD ECONOMIC OUTLOOK UPDATE—GROWTH PROJECTIONS

Source: International Monetary Fund, Jan. 2019

The IMF’s downbeat assessment came as other evidence is starting to point to a slowdown over the next two years, especially as it relates to the economic outlook for the U.S. and China and profit forecasts for major multinational corporations:

- Apple CEO Tim Cook announced a lower forecast for revenue growth on Jan. 2, saying, “While we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China. In fact, most of our revenue shortfall to our guidance, and over 100 percent of our year-over-year worldwide revenue decline, occurred in Greater China across iPhone, Mac and iPad.” Apple’s quarterly report on Jan. 29 triggered at least a temporary rally in the stock, according to MarketWatch, as the company’s “below-consensus forecast was still better than feared.”

- As Mr. Cook noted in the same statement on Jan. 2, “China’s economy began to slow in the second half of 2018. The government-reported GDP growth during the September quarter was the second lowest in the last 25 years.”

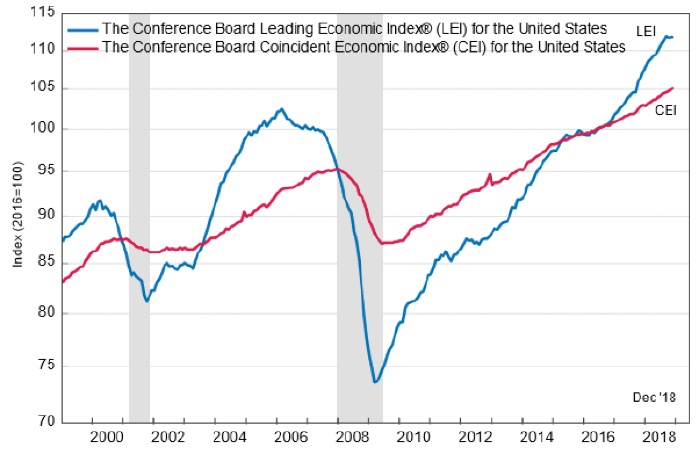

- A recent report from The Conference Board on its Leading Economic Index (LEI) for December 2018 shows some weakening of momentum, with the index falling in two of the three final months of 2018. “The US LEI declined slightly in December and the recent moderation in the LEI suggests that the US economic growth rate may slow down this year,” said Ataman Ozyildirim, director of economic research at The Conference Board. “While the effects of the government shutdown are not yet reflected here, the LEI suggests that the economy could decelerate towards 2 percent growth by the end of 2019.”

FIGURE 2: THE CONFERENCE BOARD’S LEADING AND COINCIDENT ECONOMIC INDEXES

Source: The Conference Board, Jan. 24, 2019

- MarketWatch recently reported that “American companies are still growing, but they expanded in January at a more moderate pace compared to the same period a year earlier, according to IHS Markit’s flash PMI. The manufacturing index rose slightly to 54.9 from 53.8. The services barometer slipped to 54.2 from 54.4. … Similar Markit indexes for Europe and Japan, however, weakened considerably in January to fuel growing worries about a global economic slowdown.”

- While the Q4 earnings season so far has had its share of winners and losers, the run-up to the reporting of Q4 2018 results was not very positive. According to FactSet, there were “the largest cuts to S&P 500 EPS estimates in four years” for the first half of 2019. They added, “The Q1 bottom-up EPS estimate (which is an aggregation of the median EPS estimates of all the companies in the index for Q1) dropped by 5.0% (to $39.37 from $41.43) during this period (Oct. 15–Jan.15).”

One of the most notable earnings stories came out on Jan. 28, when multinational equipment-maker Caterpillar (CAT) missed profit expectations for the fourth quarter and full-year 2019 profit estimates were in a range below consensus estimates. Analysts are obviously wondering if Caterpillar’s performance is foreshadowing a macro-economic slowdown.

***

Please see a related article that speaks to the U.S. economic outlook for 2019 and beyond, “10 market insights for the coming year.” Guggenheim Investments provides a close look at several key economic indicators, saying, “Our recession model is signaling relatively low recession risk in the next 12 months, however we continue to expect a recession will begin in 2020. …”

Yet, Guggenheim’s Global CIO Scott Minerd also reported from Davos recently that perhaps the consensus outlook was getting too gloomy, too fast. He wrote, “The last I looked, global growth, while slowing, was still plowing ahead. Growth in the U.S. will probably slow but remain at or ahead of potential in 2019. … While I concur with my colleagues here in Davos that a synchronized global slowdown is underway, fears of recession are overblown.”