It is very difficult to have a high near-term conviction level as we approach the June 2 OPEC meeting, the June 14–15 FOMC meeting, and the June 23 UK Referendum (Brexit) vote. That said, the two key market issues early in 2016—poor market breadth and spiking corporate bond yields—have reversed to a degree that suggests they have become major historical buy signals:

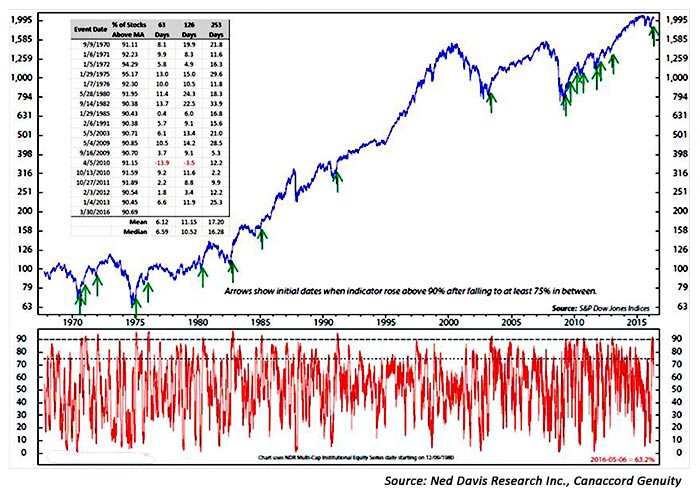

- Breadth thrust like March 30 suggests 16.2% gain. Whenever more than 90% of the market is trading above their respective 50-day moving averages, the SPX has not been down a year later.

FANTASTIC FOUR: STRONG STOCK PARTICIPATION = +16% BUY SIGNAL

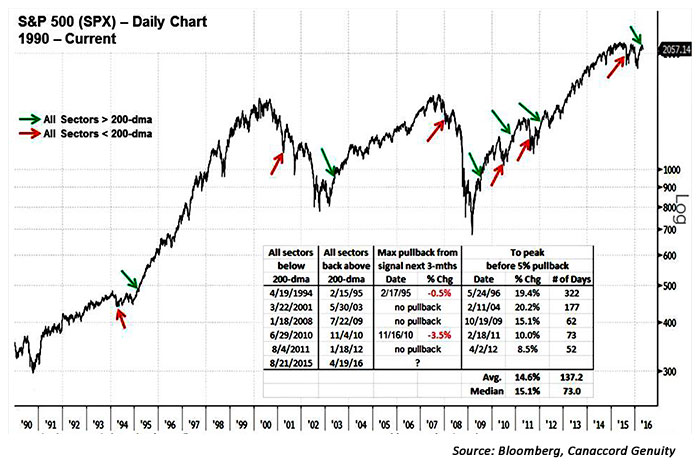

- Sector reversals like April 19 suggest 15.1% gain. Over the past 25 years, when all 10 SPX sectors have gone from under to above their respective 200-day moving averages, the SPX rose a median 15.1% over the next 73 business days.

FANTASTIC FOUR: STRONG SECTOR PARTICIPATION = +15% BUY SIGNAL

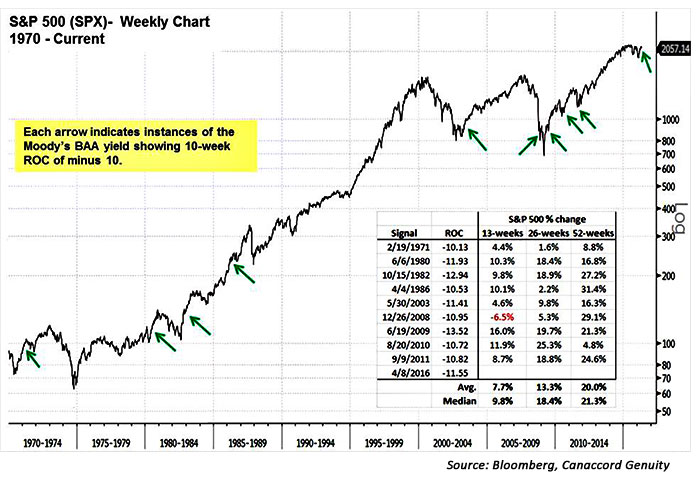

- Corporate bond surge like April 8 suggests 21.3% gain. Since 1970, anytime the yield on the Moody’s BAA Index saw a 10-week rate of change (ROC) of minus 10 or below, there was never a negative six- or 12-month SPX return.

FANTASTIC FOUR: STRONG CORPORATE CREDIT RECOVERY = +21% BUY SIGNAL

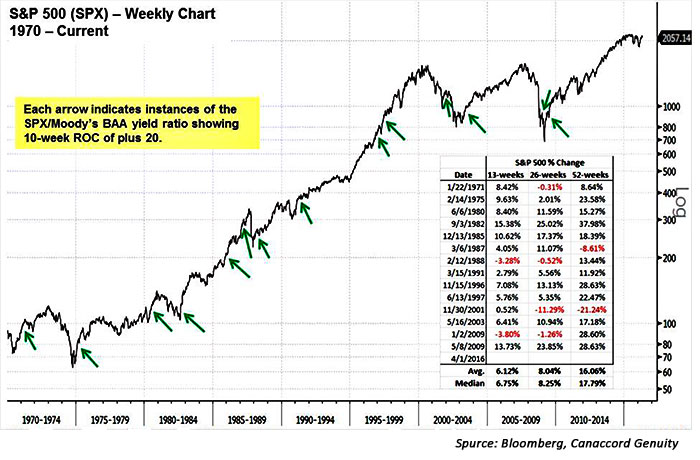

- Stock/bond ratio ramp seen April 1 suggests 17.8% gain. Again, since 1970, when the SPX went up enough and the Moody’s BAA corporate bond yield dropped enough to drive the 10-week ROC, it was a great SPX buy signal.

FANTASTIC FOUR: STRONG SPX/CORPORATE CREDIT RATIO = +18% BUY SIGNAL

Three key indicators suggest no U.S. recession is likely through 2017

Factors we look closely at in considering the risk of recession include (1) the Real Fed Funds rate reaching over 2%, (2) an inversion of the U.S. Treasury Yield Curve, and (3) the Chicago Fed National Financial Conditions showing elevated levels of systemic stress. We point this out because even if the Fed is “pushing on a string” and doesn’t matter anymore, surely there would be signs of stress in the system, yet there are none.

A chain of positive factors

Our core thesis is that (1) core inflation drives Fed policy, (2) Fed policy drives the slope of the yield curve and availability of money, (3) the yield curve drives economic activity, (4) economic activity drives EPS, and (5) EPS drives the market. The following observations support our view on how these positive factors should be working in concert over the intermediate term:

- Easy Fed and yield curve. The Fed has taken a much more dovish view, with only two rate hikes expected this year, while the market view is for even less.

- Expect moderate growth to continue. We expect the tailwinds of (1) historic global monetary accommodation, (2) stable commodities and emerging currencies, (3) positive trending U.S. economic growth, and (4) an inflection in the global economy.

- Valuations should still move higher. When core inflation is between 1%–3%, the average SPX operating EPS valuation is 19x. Given the current global headwinds, our 2016 target of 2,175 is based on an 18x $EPS ($121).

The challenge is in trusting the signals (including “The Fantastic Four”) and maintaining conviction—a consolidation/correction period will inevitably show up at some point. We believe a great market year for 2016 could still lie ahead.

Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues, author a widely respected monthly overview of market conditions, technical factors, and future outlook called the “Strategy Picture Book.” The following provides a broad summary and excerpts from May’s report, released May 10, 2016.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com