As one of our recent articles points out, the persistence of the market rally throughout 2019 and into early 2020 has been remarkable.

Analysts surveyed by Barron’s in December 2019 generally called for further modest gains for the market this year, as well as the return of some volatility. Barron’s noted that the average forecast from the 10 analysts they surveyed was for an increase of 4% for the S&P 500 in 2020, saying, “Layer on a roughly 2% dividend yield, and stocks could deliver a total return of about 6% next year.”

Barron’s added, however, “Headlines on the trade, economy, or election fronts all threaten to drive a reactive market higher or lower for extended periods.”

We have published articles by far more bullish strategists. One makes a quantitative case, citing several historical precedents, that the S&P 500 could return in the area of 20% for 2020. But this strategist also said, “Even given all of these data points, 2020 will be a challenging year, and gains will not be as easy as those in 2019.”

In Guggenheim Investments’ “10 Macro Themes for 2020,” Chairman of Investments and Global CIO Scott Minerd and the firm’s Macroeconomic and Investment Research Group present the following 10 macroeconomic trends, which they believe are most likely to shape monetary policy and investment performance in 2020. (Many thanks to Guggenheim Investments for permission to excerpt findings from their report.)

Guggenheim’s findings include these 10 major points:

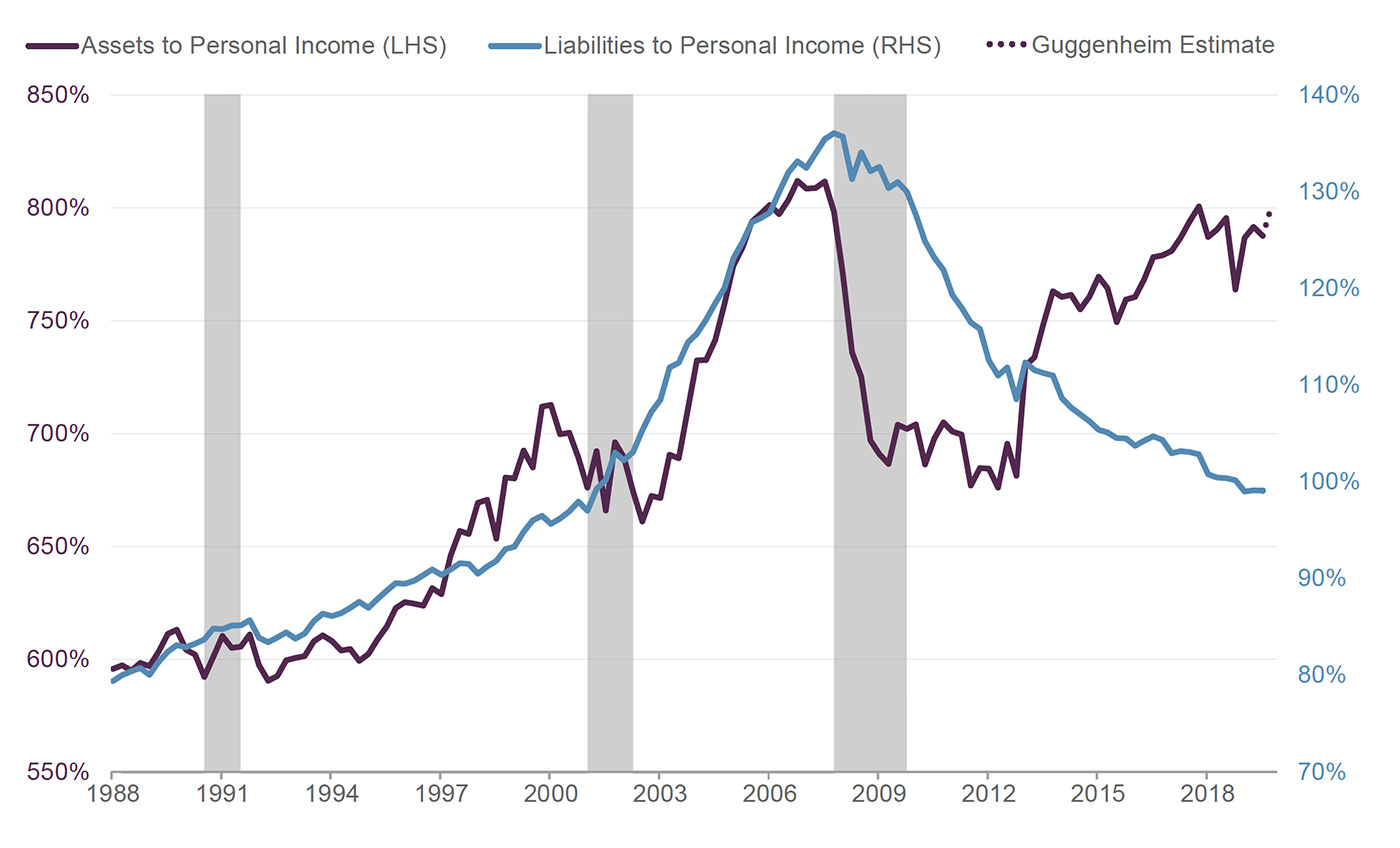

- Household net worth gains will support consumption: Personal consumption continues to be the main driver of the U.S. economy, helping to spur economic growth in 2019 even with business investment contracting and the manufacturing sector experiencing a recession. One reason for the resiliency of consumption has been the health of consumer balance sheets. Post-crisis deleveraging has brought down household debt burdens, while the bull market in stocks and steady home price gains have lifted assets to near all-time highs relative to income.

Note: Data as of 9/30/2019. Estimate shown for Q4 2019 as the data was not yet available at the time of print. Due to the unpredictability of financial markets, there is no guarantee that the estimate shown will prove to be correct.

Source: Guggenheim Investments, Haver Analytics

- Low rates will underpin housing despite valuation concerns: We expect the housing market to contribute positively to U.S. economic growth. Mortgage rates have come down a full percentage point over the past year, helping home sales and construction recover, a trend which will continue into 2020. … However, the rebound will be limited, as high home prices are denting home buying perceptions, offsetting some of the benefits of lower mortgage rates.

- The pace of Fed balance sheet expansion will slow: In September 2019, it became clear that the Fed had drained too many excess reserves, as evidenced by the spike in overnight funding rates. Since then, the Fed has added liquidity through repos and Treasury bill purchases. … We forecast further Fed balance sheet growth in 2020, but at a much slower pace, which could undercut the “QE-lite” market narrative.

- A tight labor market will further depress corporate profit margins: A tight labor market has increased the bargaining power of workers, as the number of job openings now exceeds the number of unemployed workers. This dynamic has pushed up wage growth. At the same time, and despite a recent uptick, productivity growth has remained sluggish, in part due to lack of sufficient business investment during this expansion. The net result is rising unit labor costs. … We expect declining profitability to weigh on firms’ hiring and investment plans in 2020.

- Corporate defaults will rise as debt burdens weigh on credit: Since the high yield market came into existence in the mid-1980s, rising leverage has tended to coincide with an increase in defaults and, ultimately, credit losses for investors. Today’s corporate credit markets include more below-investment grade-rated debt and more BBB-rated debt (the lowest IG rating) than ever before. … In our view, it is unsustainable for firms to operate with historically high leverage without a rise in defaults. Tight credit spreads suggest to us that the market is being complacent about this risk.

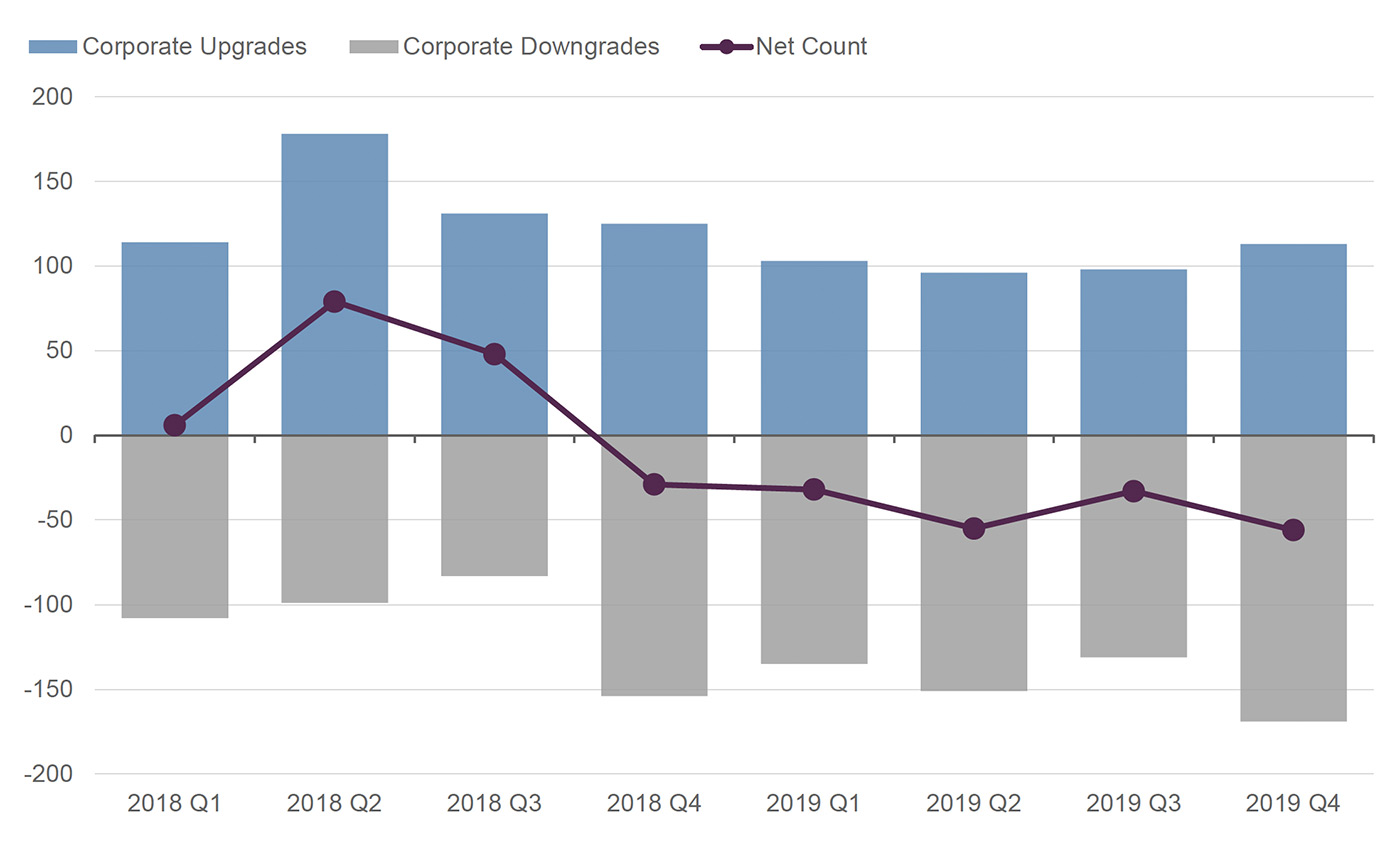

- Credit rating downgrades will add headwinds to business investment: Although credit spreads tightened throughout 2019 for both investment grade and high-yield bonds, the fundamental picture for corporate credit worsened. Weak earnings growth and a continued increase in leverage [have] resulted in more credits being downgraded than upgraded by the ratings agencies. … Lower credit ratings will make it more costly to take on additional debt, and pressure to deleverage will curtail business hiring and investment, resulting in a drag on the real economy.

Note: Data as of 12/31/2019.

Source: Guggenheim Investments, Bloomberg, Moody’s

- The Fed’s “soft landing” theory will be tested: The unemployment rate has fallen to just 3.5 percent, a 50-year low, and below most estimates of the sustainable natural rate. … We expect that momentum in the labor market will continue to fade, with economic growth near potential and further labor market gains constrained by limited slack. Historically, once the two-year change in the unemployment rate turns positive, the economy enters a recession. The historical record shows it is difficult to keep a lid on rising unemployment, calling into question the Fed’s “soft landing” theory.

- Consumer confidence will hinge on the health of the labor market: The rate of change in consumer confidence has proven to be a reliable indicator of our position in the business cycle. Despite a 28 percent stock market rally in 2019, December’s “present situation” consumer confidence reading was essentially unchanged from a year ago. This puts the year-over-year change at a level that has preceded past recessions by just six months, on average. For confidence to rise from here, the economy will need to create jobs at a faster pace in 2020, which seems like a tall order given a fading fiscal impulse and an unemployment rate at a 50-year low.

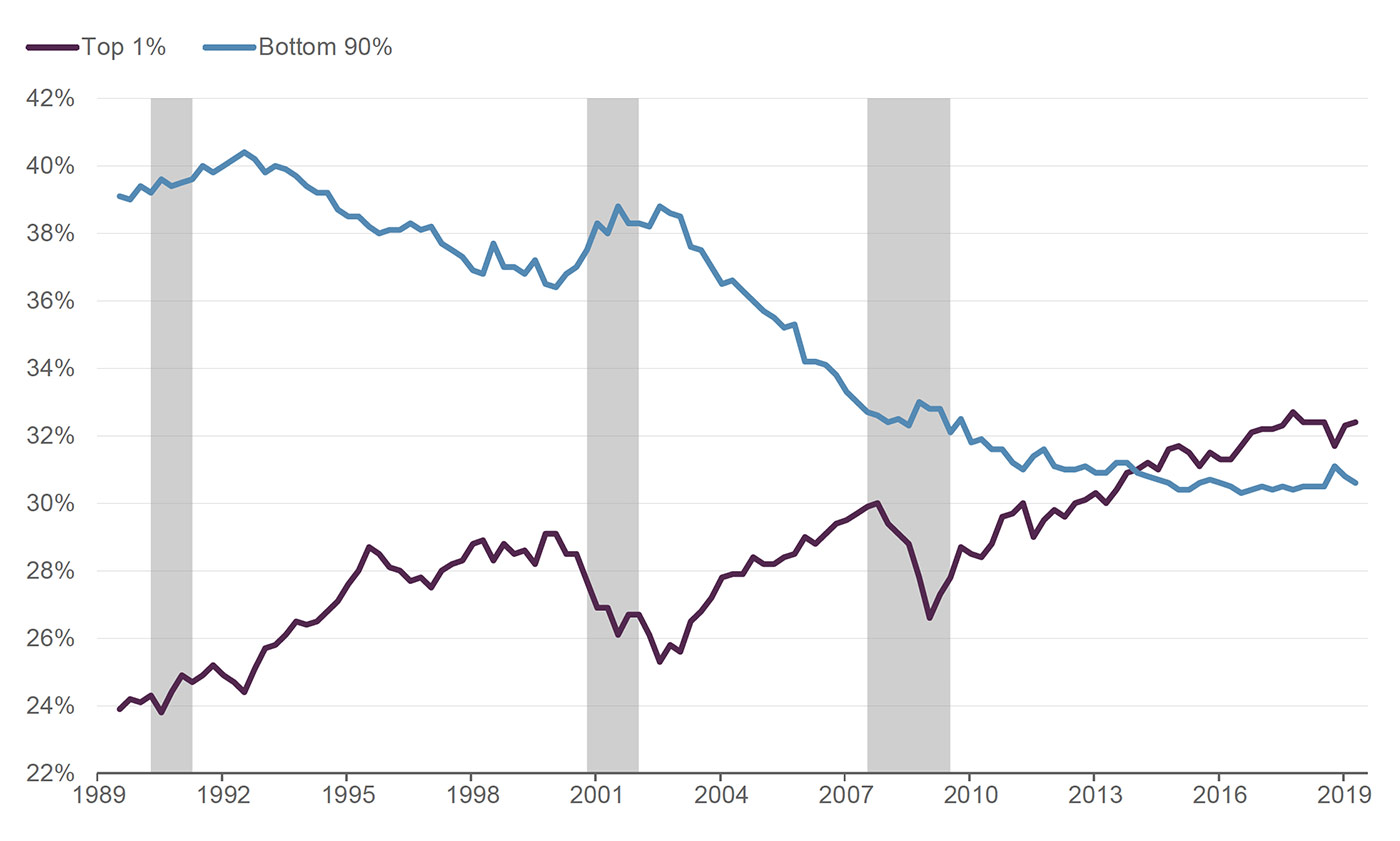

- Historic inequality will fuel support for unorthodox policy proposals: Despite a 50-year low in the unemployment rate and 10 years of economic expansion, many Americans are struggling to get by and are frustrated with government policy. A key reason is income inequality, which sits at multi-decade highs. High inequality will fuel popular support for economically disruptive policies such as a wealth tax, higher corporate tax rates, universal basic income, and Medicare for all. While the prospects for such policies being implemented [are] fairly low, more prominence in the public discussion and among presidential candidates will increase policy uncertainty as businesses and consumers assess their likelihood and potential impact.

Note: Data as of 6/30/2019. Shaded areas represent periods of recession.

Source: Guggenheim Investments, Haver Analytics

- The 2020 election will influence the economy in an unprecedented way: Historically, respondents to the University of Michigan’s Consumer Sentiment survey have cited the labor market as the dominant factor influencing their view of overall business conditions. Over the past several years, the share of respondents citing government policy and elections as driving their perceptions has surged. … This development means that consumers are making economic decisions based on political developments. This will make the outcome of November’s election more immediately consequential for the economy than in the past.

***

Once again, our thanks to Guggenheim Investments. For more detailed analysis, a full complement of supportive charts, and further disclosures please see the entire report, “10 Macro Themes for 2020.”