Gold and crude oil have both had an interesting 2017. There have been several reversals on the charts, and analysts have had difficulty confirming a trend. Volatile geopolitical events have played a major role in determining short-term direction for both commodities.

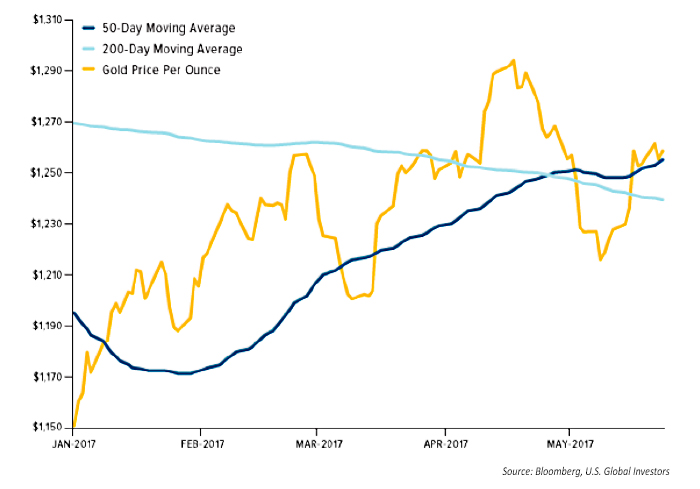

While gold, as represented by the EFT GLD, is up more than 10% for the year, the precious metal’s ride has been bumpy. During its advance in 2017, GLD saw a 5.3% correction in March and a 5.9% retreat in May.

However, gold investors were encouraged this spring to see a bullish technical move, the “golden cross,” where the 50-day moving average passes above the 200-day moving average. Gold’s price continued to decline in the days immediately after this event but soon rebounded with a 5% move higher off May’s lows.

Given the continued turbulence in U.S. politics, several ongoing threats from various hotspots abroad, and headline-grabbing terrorist acts in developed countries, it would not be surprising to see the “golden cross” play out in a new uptrend for gold.

“With so many unknowns still lingering in the marketplace, investors shouldn’t forget about gold just yet, at least that’s what some RBC Capital Markets analysts suggest.

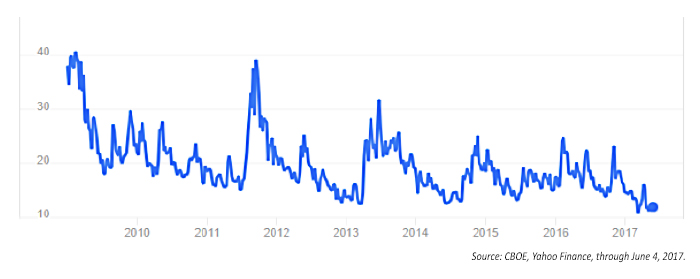

“‘We see a number of risks in the marketplace to either side but our baseline view is the reason to hold gold is as a risk overlay, especially in this market of low volatility,’ Chris Louney, commodities strategist for the bank, said in a Bloomberg interview Wednesday, quoting a recent report from the bank.

“He added that the risks currently in the market are ‘inherently difficult to forecast’ and that makes gold an attractive safe-haven asset for investors. ‘Gold is a good opportunity and merits an allocation in a lot of portfolios,’ he said.

“The risks Louney refers to include political uncertainty in the U.S. with the Trump administration as well as unknowns when it comes to the Federal Reserve’s pace of tightening for the remainder of the year. There are also persistent geopolitical tensions in Russia, North Korea and the Middle East.”