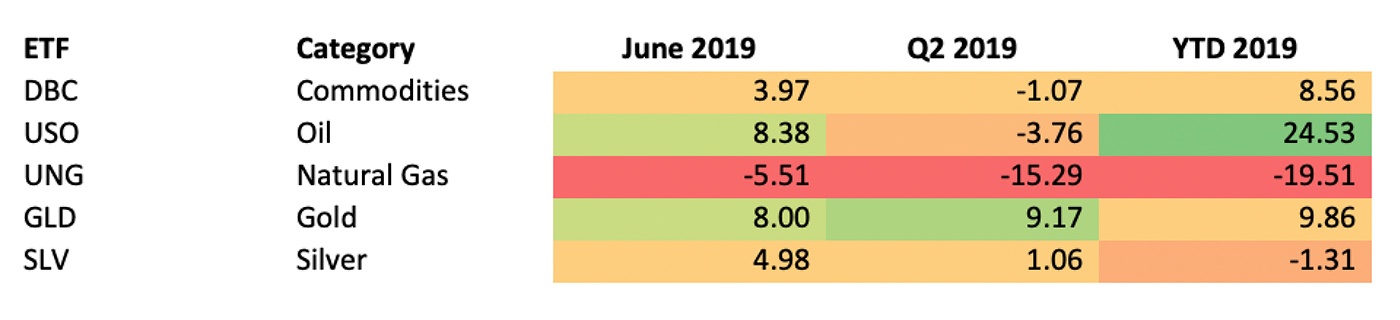

Despite significant weakness on Monday (7/1), gold has had an impressive run recently. The price of one major gold ETF, GLD, moved almost 8% higher in June and close to 10% through the end of the first half of 2019. GLD outpaced the broader commodities market and silver through the end of June, although its gain was overshadowed by much higher prices for the crude oil ETF, USO.

TABLE 1: ETF PRICE TRENDS FOR SELECTED COMMODITIES AND OVERALL CATEGORY

Source: Bespoke Investment Group, price trend as of June 28, 2019

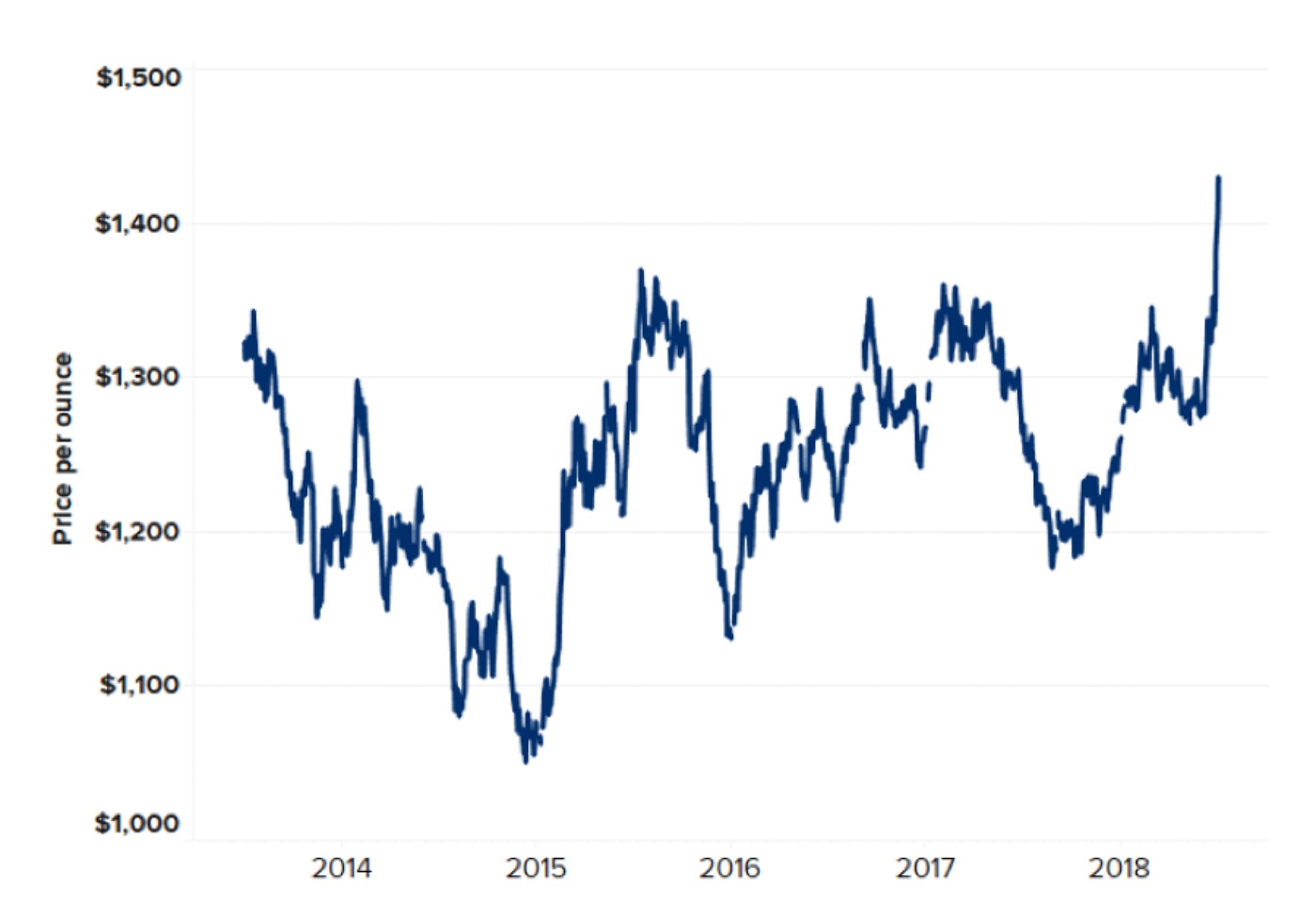

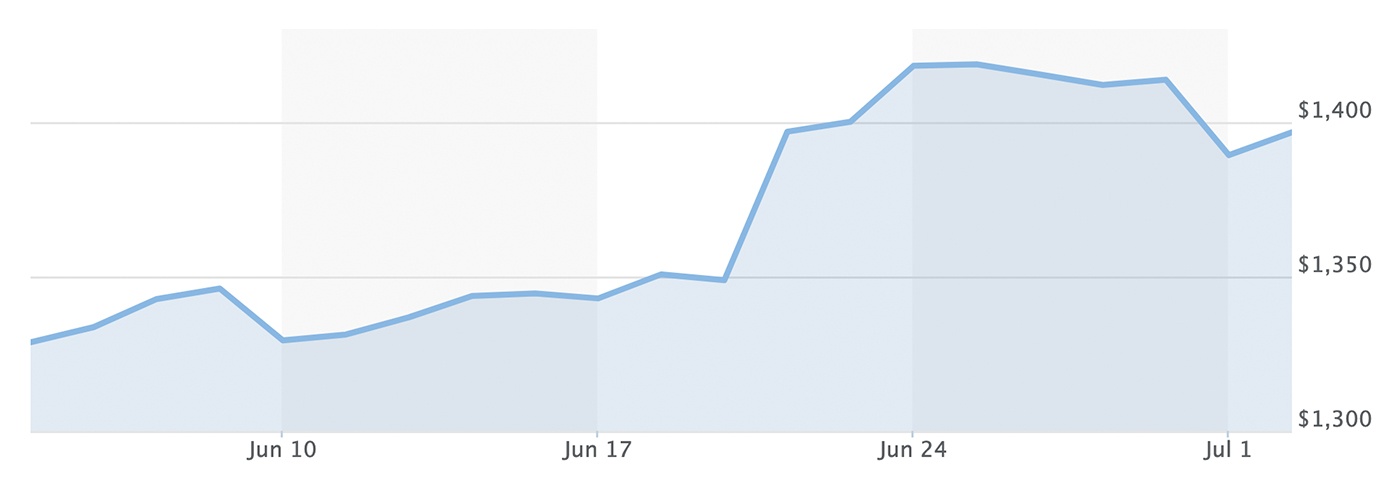

According to CNBC, overnight futures prices for gold reached their highest level since May 2013 last week, moving above $1,440 per ounce.

FIGURE 1: GOLD PRICES SPIKE HIGHER IN JUNE

Source: CNBC, based on data from the St. Louis Federal Reserve

CNBC also noted the following about gold’s move higher in an article published June 25, 2019,

“Gold prices hit their highest level in six years on Tuesday as investors plowed into the precious metal amid the prospects for lower interest rates, a softer global economy and increased geopolitical tensions. …

“The Fed said last week it will ‘act as appropriate’ to maintain the current economic expansion. The announcement sent rates along with the U.S. dollar lower. Gold is seen as a store of value in times of a weakening dollar and economic activity.

“‘The decision by the Fed to leave rates unchanged was the consensus expectation among economic forecasters, but an outside chance of an early “insurance” cut was reflected in the interest rate market ahead of the meeting,’ James Steel, chief precious metals analyst at HSBC, wrote in a note. ‘While this should support gold, we wonder how much further gold can rally as much of what the Fed said is already in the price we believe. Also the USD looks firm longer term.’”

Here is a sampling of some additional recent commentary regarding gold:

“Gold has been on a monster run since the Federal Reserve hinted Wednesday (6/19) that it could cut interest rates in the coming months. … That brings us to our call of the day from Citigroup analysts who say this ‘bullish gold fever is justified,’ and say the metal could reach between $1,500 to $1,600 an ounce in the next 12 months, and $1,500 by end-2019 in the most optimistic of their new predictions for the metal.”

“From a sentiment perspective, investor enthusiasm surrounding gold remains subdued, which means there are plenty of once or future gold bugs still on the sidelines. … While gold hasn’t been able to keep its upside momentum following strong months in recent years, we do think the upside breakout above $130 for GLD gives it legs to run even higher given the more dovish tones from both the FOMC and ECB last week.”

“As we’ve been discussing for the last few weeks, gold’s bull run has been driven by four key forces: the implication of easing monetary policy (lower rates) all over the developed world, safe-haven buying (as a reaction to US-Iran tension and fear of a global slowdown), bullish technicals, and a slumping US Dollar.”

Gold investors will have to closely monitor sentiment from the Federal Reserve and the constant daily changes in the macro geopolitical environment, particularly the latter. “Good news” in terms of rate policy, an easing of trade tensions, and calmer rhetoric concerning relationships between the U.S. and other nations has the potential to create volatile moves in gold, as seen over the last month.

Source: MarketWatch, data as of July 1