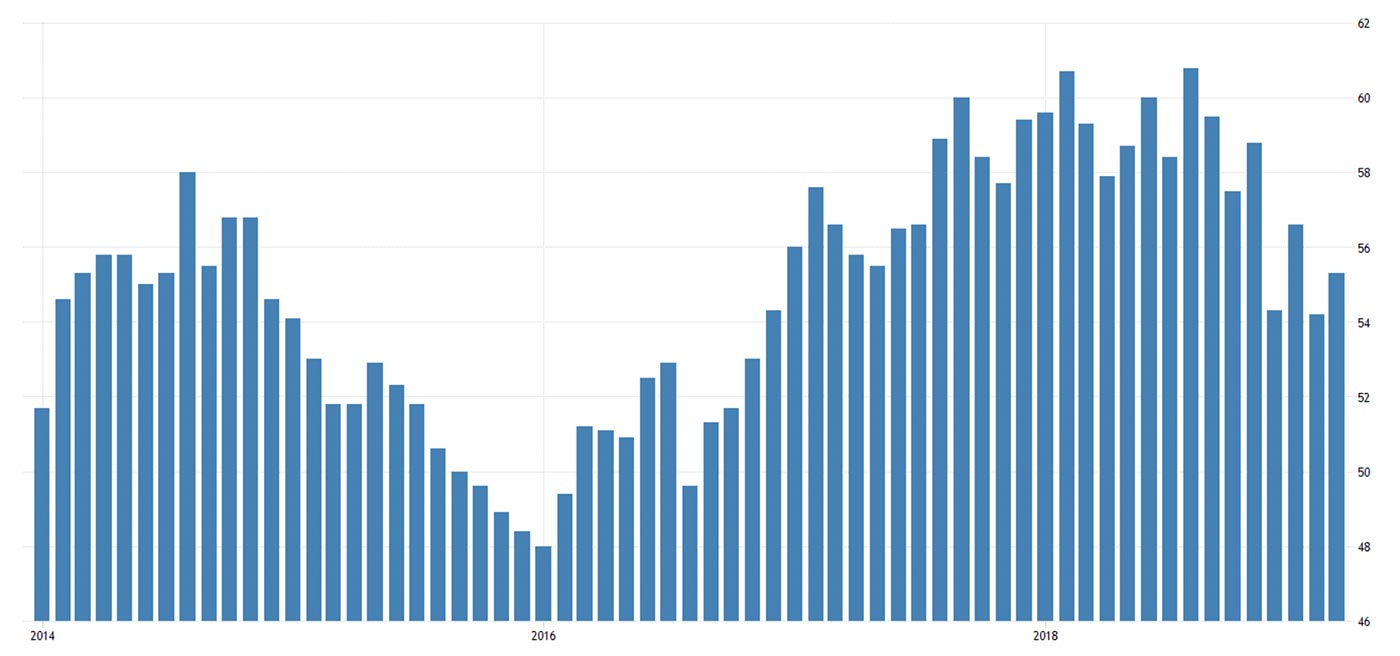

There was some positive news in the last two weeks on the global economic front for both the U.S. and China. According to CNBC,

Source: Trading Economics

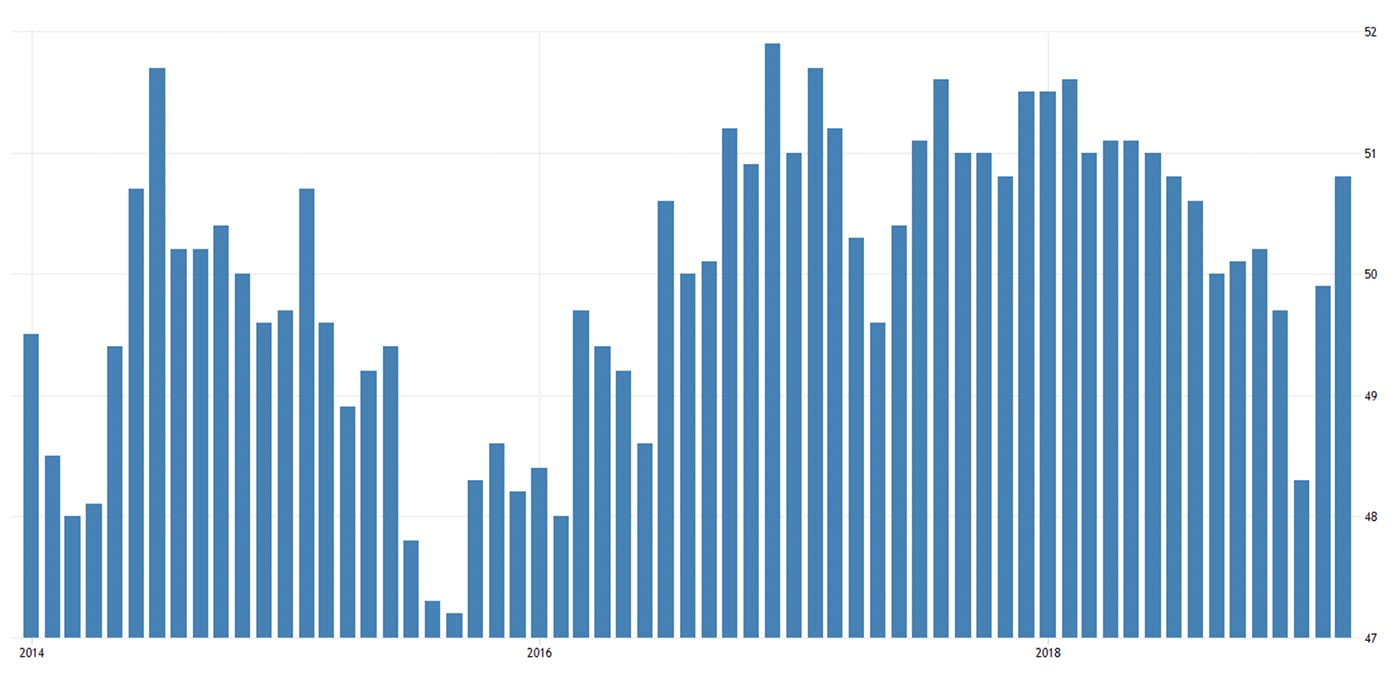

And Reuters reported regarding China,

“China’s manufacturing sector unexpectedly returned to growth for the first time in four months in March, in a sign that government stimulus measures may be slowly gaining traction, a private business survey showed on Monday. …

“The Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) expanded at the strongest pace in eight months in March, rising to 50.8 from 49.9 in February, above the neutral 50-mark dividing expansion from contraction on a monthly basis and the highest level seen since July 2018.

“Economists polled by Reuters had forecast the reading for March would stay unchanged at 49.9. The surprise expansion seen in the Caixin survey echoed that seen in the official PMI released on Sunday, which also showed factory activity defying expectations for another contraction in March.”

Source: Trading Economics

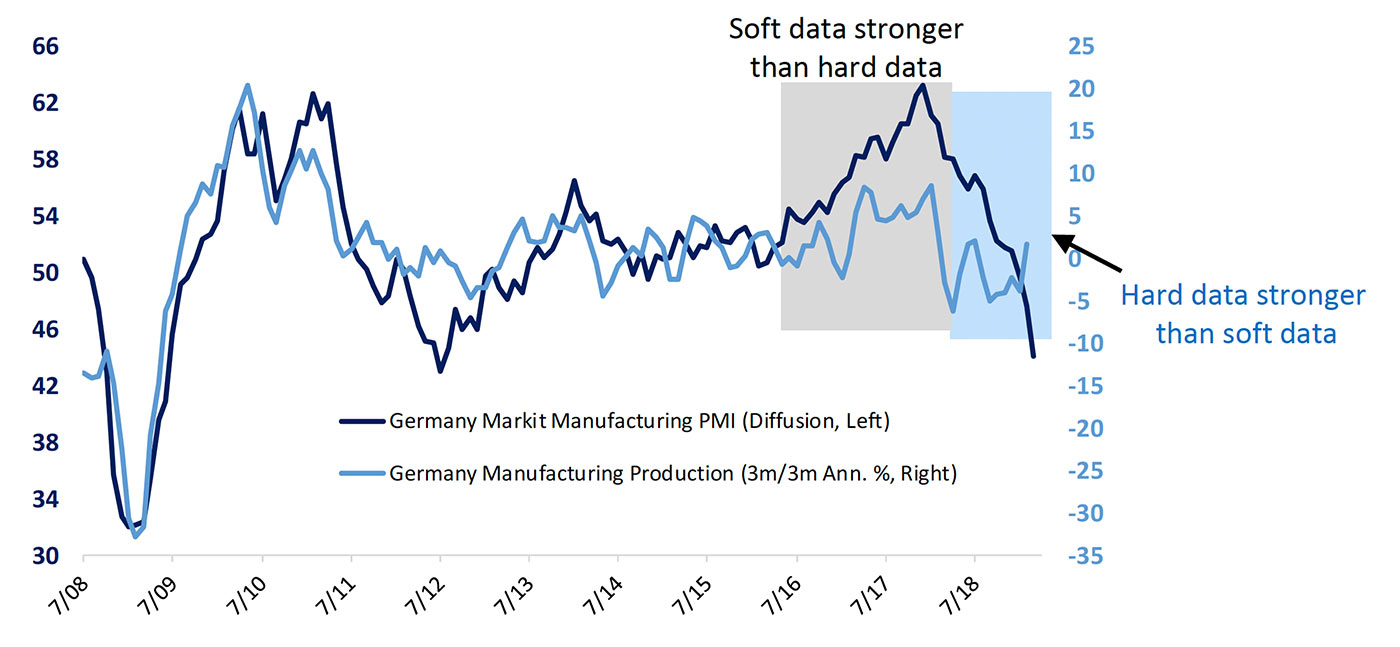

The economic news is much less clear for Germany, as recent economic reports have shown both positives and negatives for the German economy.

Bloomberg wrote on Monday (4/8),

“Analysts are banging their heads over the contradictory data emanating from Europe’s largest economy after it narrowly escaped a recession at the end of last year. …

“Industrial factory orders posted their worst decline since the financial crisis, falling by 4.2 percent between January and February, according to data published last week. Those figures followed an equally gloomy reading from the Purchasing Managers’ Index. The manufacturing indicator fell to 44.7 in March, the sharpest contraction since 2012. From these numbers, one could easily conclude that Germany stands on the brink of a recession. Yet, if you look elsewhere, it is clear that the outlook isn’t as bad as it seems.

“Industrial production climbed by 0.7 percent on a monthly basis in February, beating expectations. True, the increase was largely due to construction, while manufacturing contracted. However, the industrial production reading for January was revised up sharply from -0.8 percent to zero. Furthermore, indicators tracking the services sector— including the Purchasing Managers’ Index—are faring better. These figures give the impression of an economy which is slowing, but not imploding.”

Bespoke Investment Group commented on the same dichotomy in Germany’s data:

Source: Bespoke Investment Group

Most recently, Germany’s exports and imports both fell more than expected in February. According to Reuters, “German exporters are suffering from a slowing world economy, trade disputes, and Brexit angst. Leading economic institutes last week slashed their forecast for 2019 growth and warned a long-term upswing had come to an end.”

To the last point, The Guardian reported on a speech from the IMF last week,

“The head of the International Monetary Fund has warned that the majority of countries around the world can expect slower growth in 2019 as the global economy loses momentum. Christine Lagarde said rising trade tensions, concerns over Brexit, and tougher financial conditions as central banks raised interest rates had ‘increasingly unsettled’ the world economy over recent months. …

“In January, the IMF said it expected that the world economy would expand by about 3.5% in both 2019 and 2020. But Lagarde said: ‘It has since lost further momentum, as you will see from our updated forecast next week.’”