The SPDR Gold Trust, symbol GLD, reports total assets held in the ETF every day. Asset levels vary along with investor interest. If more investors want to own GLD, then the price goes up above the net asset value (NAV), and so the sponsoring firm issues more shares to restore the proper balance between share price and NAV. The money taken in from those additional share sales gets used to buy more gold to be held by the trust. Similarly, when everyone wants to get out of GLD, the sponsoring firm sells the gold bullion, getting cash to redeem those shares, and thus keeps the NAV and share price close together.

Generally speaking, GLD assets rise and fall in sympathy with gold prices. Rising gold prices get people more excited about owning gold, and falling prices have the opposite effect.

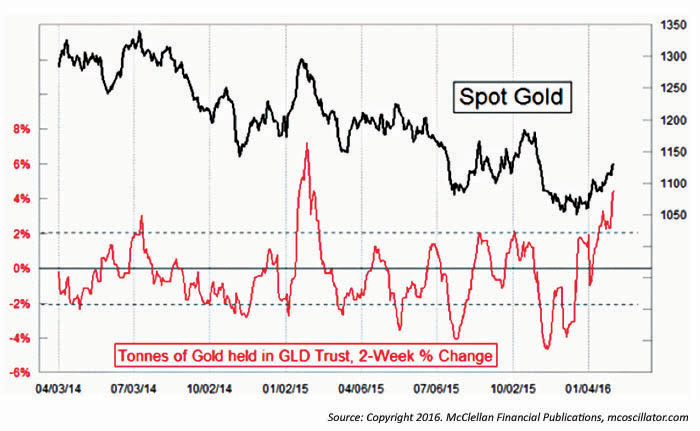

Paying attention to these changes in asset levels can be really useful as a sentiment indication. When investors flee rapidly, that can be a sign of a sentiment washout suitable for a price bottom. And when there is a big surge into GLD, as we have seen over the past two weeks, it is a sign that there is huge bullish interest, a phenomenon that typically happens as gold prices are topping.

Back in December 2015, I wrote about the sentiment washout evident in GLD, which I argued was marking a bottom for gold prices. The total assets held by the GLD Trust had deviated far below the 50-day moving average, a condition suitable for a price bottom in gold. Now we are seeing the opposite condition; investors are surging back into GLD and driving up the level of total assets held by the GLD Trust.

The recent surge is shown in the two-week rate of change (ROC) of assets in GLD, as seen in the chart. The current reading for this ROC indicator is not the highest ever, but it is higher than all of the other recent readings except for the big blowoff in late January 2015. So we are seeing now a sentiment condition consistent with important tops in gold prices.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com