Beyond the French election factor, Bloomberg notes that the rally in German bonds (and declining yields) can also be attributed to the “European Central Bank’s stepped-up purchases below its old deposit-rate floor.” Bloomberg also said recently, “Citigroup Inc. is predicting yields that could drop to minus 1 percent and beyond.”

A recent Forbes article, “Will the French election break up the Euro?,” explored some of the momentous political factors at play in France:

“The upcoming French elections have all the makings of the next event to have a profound impact on the financial markets, as a break-up of the Euro, the common currency for the European Union, is on the table. Following Brexit, the U.S. election, and a lesser extent Italy, all eyes are now on France.

“Three candidates are in the lead and all of them have a good chance to make it to the second round (May 7, 2017). Marine Le Pen, the most controversial candidate, has a real shot at being elected president, which could come as a surprise to investors, just like Brexit and the election of U.S. President Trump.

“Market volatility around the French election is expected to rise. Since December, 2016, in anticipation of the upcoming election, the volatility of French bond futures has spiked. … At this moment in history, it is only natural for France to follow in the footsteps of their trading partners. If the U.K. is exiting, and the U.S. is now seen as a threat to European countries (as was recently declared) it should not be a surprise if the French put their own interests first. … If Le Pen wins, the level of uncertainty in EU markets increases dramatically.”

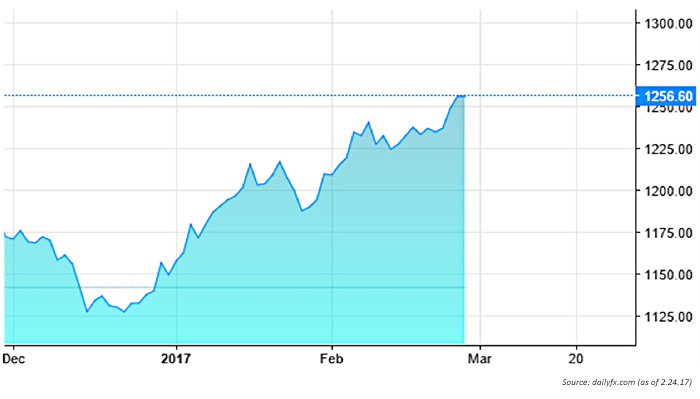

Global markets have seen several recent developments that have to be considered at least in part related to the French elections: 1. German two-year bond yields have moved to their lowest all-time levels as investors move assets to what is considered the most stable European economy, despite the recent poll declines for Angela Merkel’s government (Figure 1). 2. The euro keeps falling in relation to the U.S. dollar (Figure 2). 3. The price of gold has generally acted in positive fashion since the beginning of the year as part of a flight to safety trade (Figure 3).