Markets were not wholly surprised on Monday (5/22) when Ford changed its leadership from CEO Mark Fields to Jim Hackett, amid what the Detroit Free Press called “a wide-ranging reshuffling of the company’s top management.”

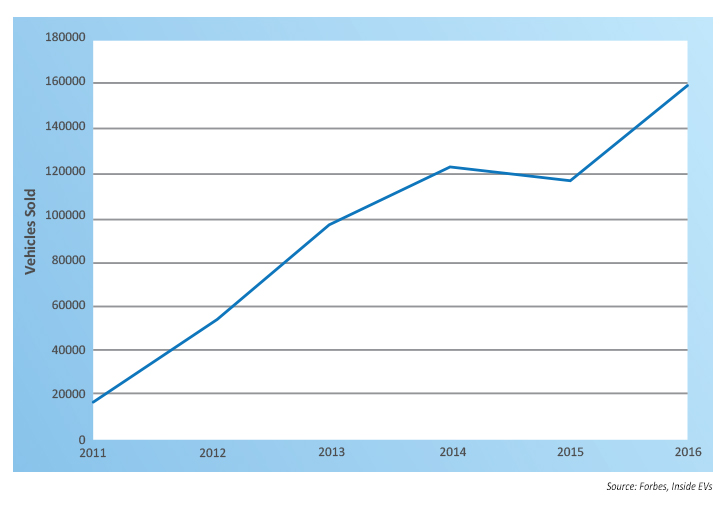

Ford’s (F) share price has languished for the past three years under the guidance of Fields, who replaced the very popular Alan Mulally in 2014. (Mulally was inducted into the Automotive Hall of Fame in 2016, in no small part for helping Ford navigate the 2007–2009 financial crisis.) Notably, Ford’s total vehicle sales were down 5.1% YTD through the end of April 2017, with a higher number of light truck sales only partially overcoming the 22.1% decline in car sales versus the same period in 2016, according to The Wall Street Journal.

FIGURE 1: FORD (F) SHARE PRICE (2012–2017)

Reporting to Executive Chairman Bill Ford, Mr. Hackett will lead Ford’s worldwide operations and 202,000 employees. According to Ford’s press release, “Hackett, 62, has a long track record of innovation and business success as CEO of Steelcase, Interim Athletic Director at the University of Michigan and executive chairman of Ford Smart Mobility LLC since March 2016.”

Bill Ford said, via the press release,

“We’re moving from a position of strength to transform Ford for the future. Jim Hackett is the right CEO to lead Ford during this transformative period for the auto industry and the broader mobility space. He’s a true visionary who brings a unique, human-centered leadership approach to our culture, products and services that will unlock the potential of our people and our business.”

In an interview Monday with Bloomberg, Mr. Ford expanded on that message, speaking about an unprecedented period within the automotive and transportation industry, characterized by rapidly changing technologies, untraditional new competitors, and the need for much faster decision-making on capital allocation and business priorities.

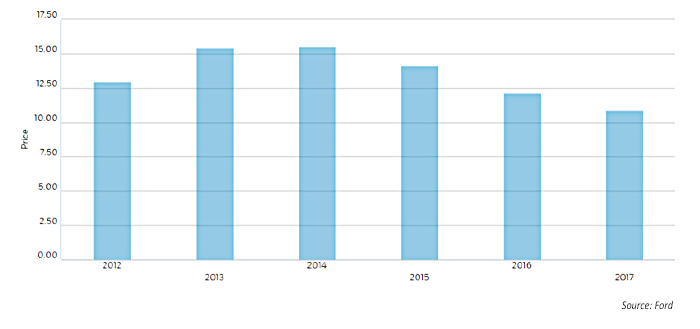

In the interview, he singled out EVs (electric vehicles) and AVs (autonomous vehicles) as two areas representing the intersection of new technologies and new competition. Ford has seen competitors such as Tesla and Chevrolet achieve earlier success in developing long-range electric vehicles. But, under Fields, Ford announced in late 2015 “its largest five-year investment ever in electrified vehicles, with a pledge to spend $4.5 billion and introduce 13 new models by 2020.”

Although electric vehicle sales have been growing at a 32% compound annual growth rate over the past four years, according to Forbes, they still represent only about 1% of annual vehicle sales in the U.S. In January 2017, Tesla had an 18% share of the category, Chevrolet was second at 14%, Toyota 7%, Ford 5%, and Nissan 4%, according to Clean Technica.

FIGURE 2: TOTAL U.S. ELECTRIC VEHICLE SALES GROWTH