Editor’s note: Tony Dwyer, U.S. portfolio strategist for Canaccord Genuity, and his colleagues author a widely respected monthly overview of market conditions, technical factors, and future market outlook called the “Strategy Picture Book.” The following provides an excerpt from their Aug. 7, 2018, report on the macro market outlook.

Look for a year-end ramp higher driven by earnings per share (EPS)

With volatility back to the lower range, the S&P 500 (SPX) is in close proximity to record highs after a choppy grind higher. There is much discussion about how long the current economic and market cycle can last. We believe the combination of a solid economic backdrop, historically high business and consumer confidence, and EPS growth continues to suggest there is a long way to go. There is no doubt the unpredictable news backdrop of a potential trade war with China and a rise back to 3% in the 10-year U.S. Treasury yield can cause increased volatility, but the fundamental backdrop commands using it as an opportunity to add risk.

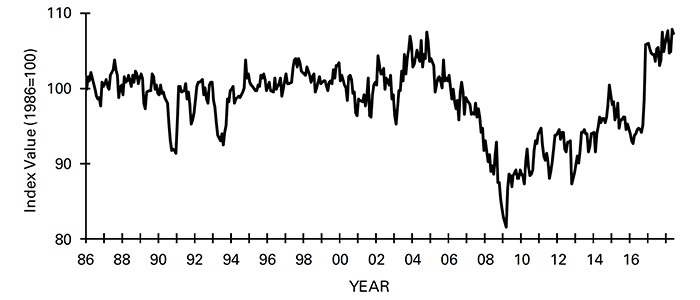

The economy and consumer/business confidence remain very supportive

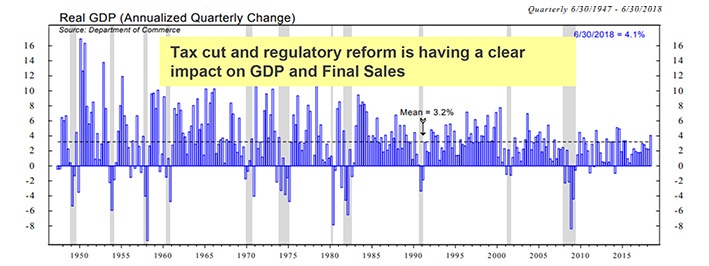

The second-quarter annualized gross domestic product (GDP) and final sales report made clear that both businesses and consumers are in the spending mood following the passage of the Tax Cuts and Jobs Act of 2017. We also believe the more business-friendly regulatory backdrop has helped both small businesses and consumer confidence remain at or near the highest level of the cycle.

FIGURE 1: LONG-TERM U.S. GDP TREND

Sources: Department of Commerce, Canaccord Genuity, ndr.com

FIGURE 2: NFIB SMALL BUSINESS OPTIMISM INDEX

Source: National Federation of Independent Business (NFIB)

Incredible EPS and revenue growth

With the constant news backdrop of global trade uncertainty and political theater, it is so important to remember that over time the market most closely correlates to the direction of EPS—period. According to Thomson Reuters I/B/E/S, second-quarter SPX operating EPS growth now looks to be 24%, with 79% of those companies having reported beating expectations. Confirming the stronger willingness of businesses and consumers to spend, SPX top-line growth should be up 9.4%. The rest of 2018 should be no different, with current consensus expectations for third- and fourth-quarter SPX operating EPS growth of 22.6% and 20.5%, respectively.

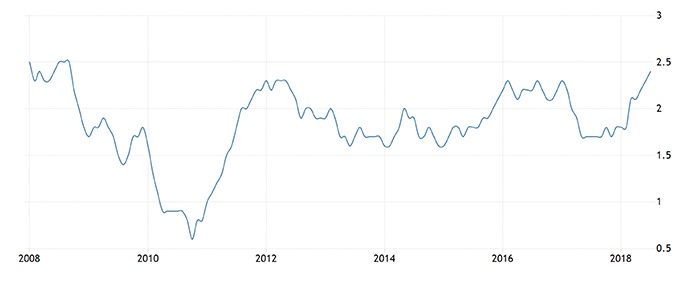

Expect a year-end SPX target of 3,200

Given the current level of growth and confidence highlighted above, our 2018 SPX operating EPS estimate of $160 should prove too low, which means if the SPX ended the year at the current level, it would be trading at only 17.5X. Historically, the SPX trades at an average 19X trailing EPS when core inflation is between 1-3%.

FIGURE 3: U.S. CORE INFLATION RATE

Source: Trading Economics, U.S. Bureau of Labor Statistics

Any pause in the market upside should be considered an opportunity

We expected the first half to show higher volatility, coupled with periods of correction, as investors grappled with a tightening cycle and overly optimistic sentiment. We also anticipated a second-half ramp to our 2018 SPX 3,200 target in our favored sectors, driven by strong EPS growth, reset global expectations, and a demographic tailwind. We favor those areas exposed to a better trend in capital investment, since the best way to combat company-level inflation is through increased productivity. Financials provide the money for spending, Industrials benefit from the improvements, and Information Technology is the brains behind it.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Tony Dwyer is the head of the U.S. Macro Group and chief market strategist at Canaccord Genuity. He also sits on the firm’s U.S. operating committee. Mr. Dwyer joined Canaccord Genuity in 2012 and is known for the practical application of macroeconomic and tactical market indicators. Mr. Dwyer was previously equity strategist and director of research at Collins Stewart and a member of the firm's executive committee. Mr. Dwyer is a frequent guest on many financial news networks. canaccordgenuity.com

Recent Posts: