The Conference Board reported last week that its Leading Economic Index (LEI) for the U.S. increased 1% in January to 108.1, following a 0.6% increase in December and a 0.4% increase in November.

Its press release stated,

“‘The U.S. LEI accelerated further in January and continues to point to robust economic growth in the first half of 2018. While the recent stock market volatility will not be reflected in the U.S. LEI until next month, consumers’ and business’ outlook on the economy had been improving for several months and should not be greatly impacted,’ said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. ‘The leading indicators reflect an economy with widespread strengths coming from financial conditions, manufacturing, residential construction, and labor markets.’”

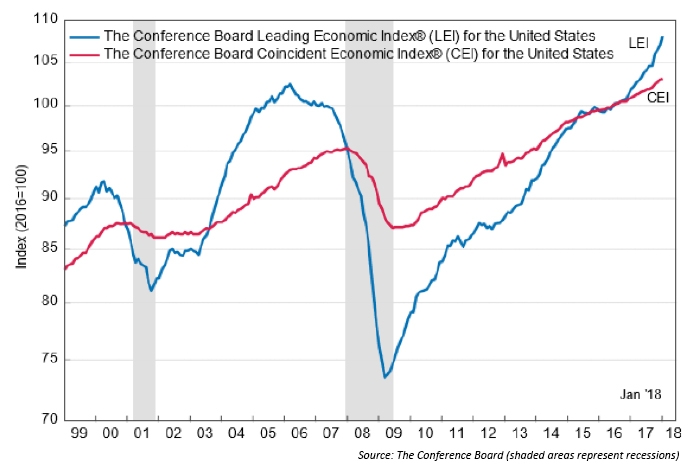

FIGURE 1: LEADING ECONOMIC INDEX AND COINCIDENT ECONOMIC INDEX

(THROUGH JANUARY 2018)

The Conference Board notes that its leading, coincident, and lagging composite indexes are “the key elements in an analytic system designed to signal peaks and troughs in the business cycle.”

Barron’s analysis of the latest report showed that January’s 1% gain was well above the consensus estimate for a 0.6% increase. It stated on the day of the data release,

“Contributing most to the unexpectedly large gain in January were building permits, stock prices and once again ISM’s new orders index, where unusual strength has not yet been translated to similar gains in government data. Steady contributions continue to come from average initial claims, consumer expectations, the interest rate spread and the report’s credit index.”

The Bloomberg Consumer Comfort Index also provided some positive news last week.

According to Bloomberg’s summary of the data through February 18, 2018,

“Americans’ outlook for the U.S. economy improved in February to the second-highest level since March 2002, indicating lower taxes are resonating. … Current views of the economy rose to 61.7, the highest level since February 2001. … The improvement comes as Americans have begun to see the effects of the tax cuts in their paychecks. A robust labor market and wage gains are keeping weekly consumer comfort levels near 17-year highs, indicating the tumble in the stock market earlier this month did little to damp spirits.”

FIGURE 2: ECONOMIC EXPECTATIONS AMONG U.S. CONSUMERS