Markets proved once again last week that they are closely correlated to the perception of Fed interest-rate policy. Board Chair Janet Yellen’s largely dovish testimony before Congress led to the best weekly gain in two months, with the S&P 500 up 1.4%, the Dow up 1%, and the NASDAQ soaring 2.4%. Ms. Yellen, according to a CNBC recap, reiterated that rate hikes would most likely be gradual.

What do analysts have to say broadly about the market outlook for the second half of 2017 and beyond?

- BlackRock, the world’s largest investment firm, continues to talk about “a synchronized global recovery in corporate earnings.” Their July Global Investment Outlook adds, “The global expansion is chugging along; deflation fears and near-term political risks look to have faded; and financial market volatility is subdued. We believe this provides fertile ground for modest gains in risk assets such as equities.”

- Tony Dwyer of Canaccord Genuity, a well-known strategist often interviewed by Bloomberg, has spoken consistently for months on his “base case” for continued higher prices in equity markets: low and stable inflation, a slow normalization of interest rates, tailwinds from global economies, and a continued positive EPS trend over coming quarters.

- Ray Dalio of giant hedge fund Bridgewater Associates, according to MarketWatch, sees “no major economic risks on the horizon for the next year or two.” However, he is far less positive over the long term, expressing worry about “the magnitude of the downturn” that will eventually come.

- Fox Business noted Monday morning (7/17) that the lengthy period without any significant market corrections reflects, in part, institutional traders who are worried that they might miss a big rally based on the Trump “pro-growth” agenda coming to fruition.

- Says Ryan Detrick, senior market strategist at LPL Financial, “This is only the sixth time since 1950 that the S&P 500 has made it at least a year without so much as a 5% correction, and marks the longest streak since 1995. The reality is that earnings are strong, inflation is low, the Fed is accommodative, and valuations aren’t excessive when you factor in the historically low rates―which all suggest the bull market has legs. But all of that doesn’t mean gravity won’t eventually take over. A well-deserved 5% correction could take place at any time, if for no other reason than it has been a year since the last 5% correction.”

- Analysts and strategists interviewed for Barron’s “Mid-Year Roundtable” were slightly less than optimistic, seeing some opportunity, but in a “bumpier road and modest advance, at best, through the end of 2017.” Said Brian Rogers, chairman of T. Rowe Price, “We’ve had a really good year in five months. … The S&P 500 is trading for roughly 18 times future earnings. A P/E multiple of that magnitude has historically suggested limited upside.”

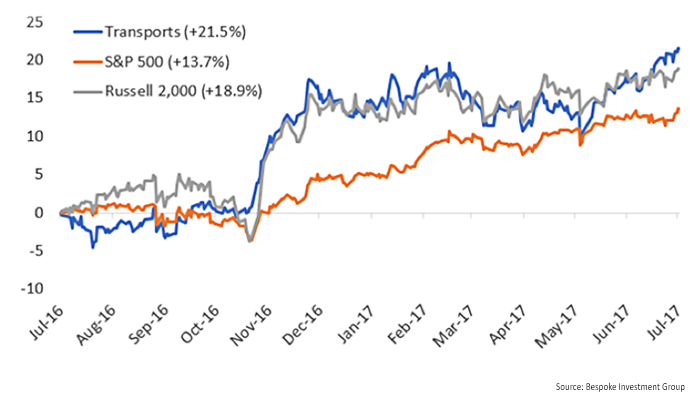

- Bespoke Investment Group, which provides exhaustive research of market trends, has noted that the S&P 500, Dow Transports, and small-cap Russell 2,000 all closed at 52-week highs last Friday. They wrote, “Since the Russell 2,000 came into existence in 1978, all three indices have simultaneously closed at new 52-week highs on just 2.3% of all trading days.”

S&P 500, TRANSPORTS, RUSSELL 2,000: 1-YEAR % CHANGE

Bespoke adds,

“While the average forward returns following the ‘triple play’ of 52-week highs are indeed higher than the average forward returns for all periods, they’re only slightly higher. … Over the next month, the S&P has averaged a gain of 0.64% with positive returns 60% of the time, and over the next three months, the index has averaged a gain of 2.09% with positive returns 64% of the time. … While the new highs across the board are impressive and an indication that the market’s uptrend is solidly intact, based on prior returns after the same thing has happened in the past, it shouldn’t be viewed by itself as a buy signal.”