“China is the biggest driver of global growth so this [coronavirus] couldn’t have started in a worse place,” said Alec Young, managing director of global markets research at FTSE Russell, to CNBC at the end of January. “Markets hate uncertainty, and the coronavirus is the ultimate uncertainty in that no one knows how badly it will impact the global economy.”

The market had run up almost 15% from the October lows through late January without even one day of a 1% decline. However, fear over the spreading coronavirus caught up with investors, resulting in a 1.8% decline in the S&P 500 and a 600-point drop in the Dow on the last trading day of January. That was enough to push January 2020 into the negative column for both the S&P 500 and the Dow.

Devised by Yale Hirsch in 1972, the January Barometer states that broad index returns in January are likely to reflect the direction of the market for the full year. It has an accuracy rate of 85% for predicting the outcome for the year, going back to 1950, according to the 2020 Stock Trader’s Almanac.

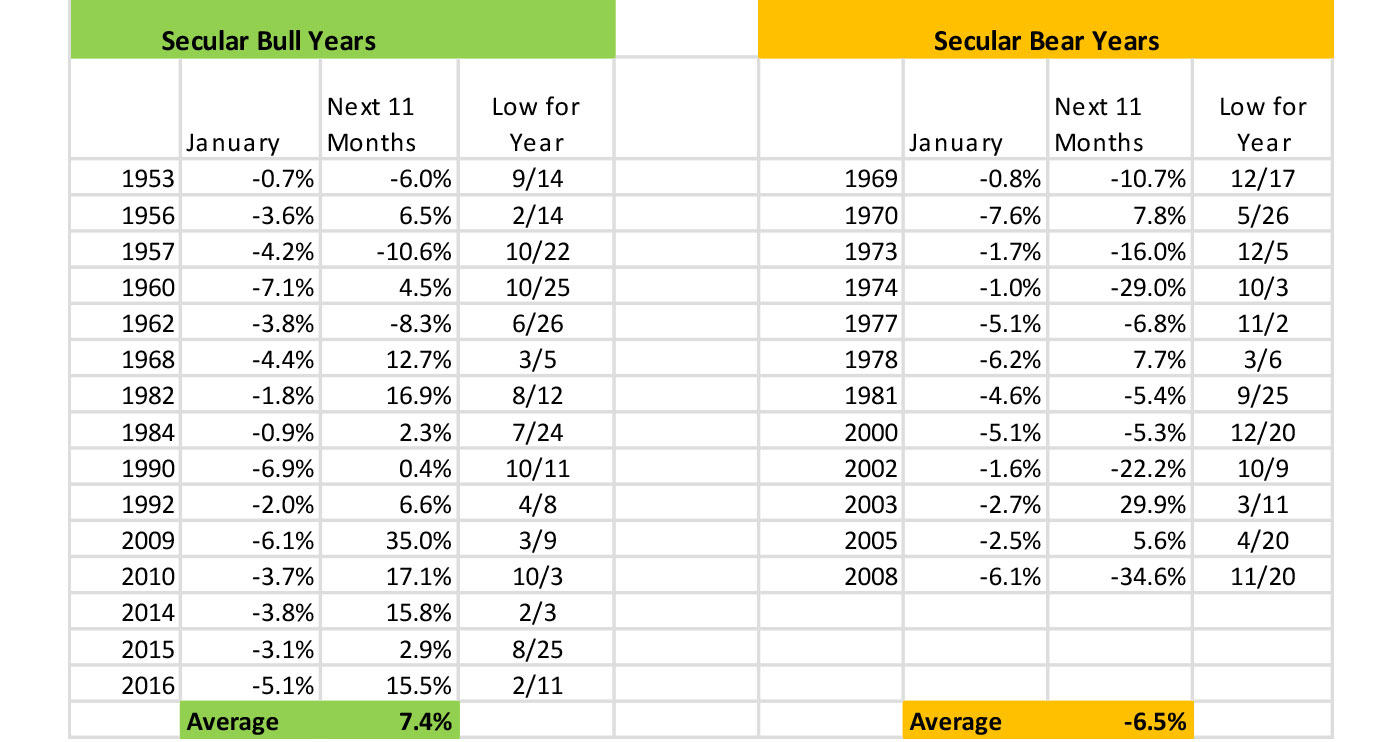

Not necessarily. When you separate out the negative January years between long-term secular bull and secular bear markets, the picture changes dramatically. Eighty percent of the time, down Januarys in secular bull markets have been followed by gains over the following 11 months—many times substantial gains.

AS JANUARY GOES, SO GOES THE YEAR? ONLY IN SECULAR BEAR MARKETS

Source: STIR Research, secular markets as defined by NDR.com.

But the outlook for the balance of 2020 gets even brighter.

Within the secular bull years column, three years had recessions that began during the years 1953, 1957, and 1990. Considering that the market leads recessions, and assuming the U.S. does not go into recession in 2020, then the probability of the next 11 months showing gains rises to 92%, with an average gain of 10.6%. That type of performance would mean a year-end target of 3,570 for the S&P 500. Further, the low for the year occurs 42% of the time in the first quarter (2009 is excluded as the recession began in 2007 and was finished by June 2009).

But to temper optimism, unfortunately, market volatility rises in years with a down January.

In all years, going back 74 years, the S&P 500 fell between 5%–10% in 80 cases. That is an average of 11 drops over a 10-year period. Looking at years when the S&P dropped in January during a secular bull market, that number jumps to almost 16 drops of 5%–10% over a 10-year period, an increase of 45%. Looking at larger declines between 10%–20%, those average about four every 10 years in all years, but in secular bull years with a down January, that increases to seven out of every 10 years, or by 75%.

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com