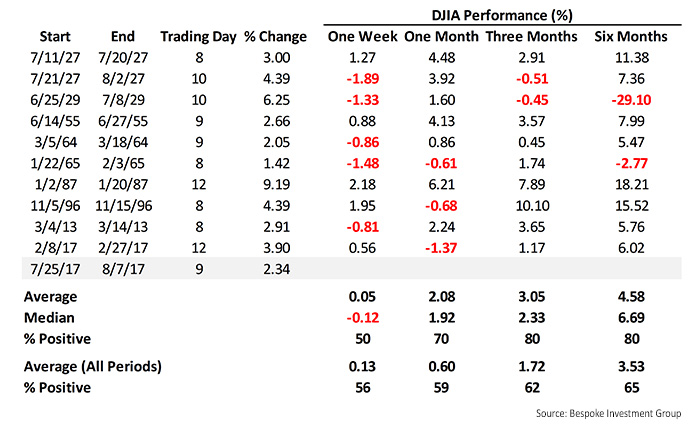

This was the third such streak in the current bull market, and the second this year. According to Bespoke, from Feb. 8, 2017, through Feb. 27, 2017, the DJIA tied a record for the longest streak of record closing highs at 12 trading days.

What have these lengthy winning streaks for the Dow meant for the market’s performance going forward? Bespoke notes:

“While it is easy to assume that the DJIA would experience mean reversion when these streaks finally come to an end, in most instances, it continued to see better than average returns in the near term. While the average one-week return is below the average of all one-week periods (a trend similar to what we have seen this time around), over the following one, three, and six months, the DJIA not only saw better than average returns, but the consistency of positive returns was also greater than normal.”

FIGURE 1: DJIA LONGEST STREAKS OF CONSECUTIVE RECORD CLOSES (1928–2017)

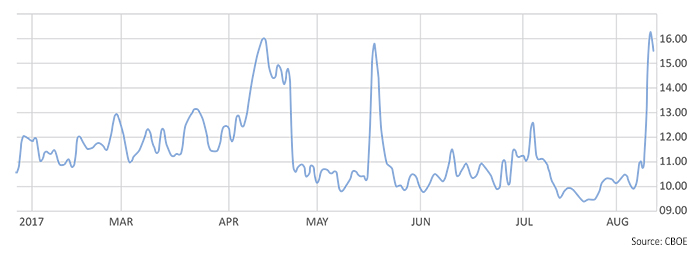

Geopolitical tensions related to the North Korea situation contributed heavily to the Dow’s overall negative performance last week, with the DJIA falling 1.1%. The CBOE Volatility Index (VIX) hit its highest level of the year, peaking at 16.17 on August 10.

FIGURE 2: YEAR-TO-DATE VIX LEVELS

Markets appeared this past Monday (8/14) to feel that somewhat calmer rhetoric was reason to lift the Dow again, at least in the short term. But what factors should drive the market higher over the coming months, assuming North Korea starts to fall off traders’ radar screens?

Barron’s columnist Kopin Tan recently presented five reasons that are most often cited in the bullish case for stocks:

- Stocks reflect corporations’ resurgent health.

- The global economic outlook is brightening.

- There’s a “Goldilocks” U.S. economy (which will keep the Fed from tightening too fast).

- The nature of passive funds and indexing is helping to prop up the market.

- There is no reasonable alternative to stocks in a low-interest-rate, low-return environment.

However, Tan notes that with the Fed’s balance sheet at a “staggering $4.5 trillion,” investors must take note of the possible serious consequences as it starts to divest some of those assets. (Please see this issue’s article by strategist Rob Hanna that tackles that topic, “What will happen when the Fed ends its bond maturities reinvestment?”)

Tan quotes Mike O’Rourke, Jones Trading’s chief market strategist, who warns:

“The Fed has been chasing 20th century 3.5% GDP growth in a 2% U.S. economy. The excess has wound up in asset prices. … The policy mistake investors should fear is not the one that the Fed will create by continuing to tighten. The policy mistake has already been made, and investors should fear how it will be unwound.”