Options provide an arsenal for investors to both express opinions on markets and limit potential losses, above and beyond “going long” and “going short.” Options are contracts that provide the right to buy or sell 100 shares of a specific stock. Calls provide the right to purchase, and puts are the right to sell a stock at a specific price by a certain date.

For example, a $140 July call on Apple grants a buyer the right to purchase 100 shares of Apple for $140 by July regardless of Apple’s price at that time. A $100 July put provides a buyer the right to sell 100 shares of Apple for $100 by July. Remember, option sellers are obligated to do something while option buyers have a choice:

- Buy options = your choice (typically considered a speculative trade, with an 85% loss probability)

- Sell options = no choice (typically used as a hedge with an 85% win probability)

Let us start with a basic strategy: the covered call.

In options lingo, “covered” means you currently possess the obligation demanded by the options contract. With a covered call, we are selling the right to stock that we currently own. Say you own 100 shares of stock XYZ, purchased for $100 and now trading at $120. Covered call writing could be employed to bring in additional income from your investment. By selling the $120 call option, we agree to sell 100 shares of XYZ at $120 a share, and in doing so receive payment. Any appreciation in the stock’s price beyond $120 would be forfeited to the call buyer. If XYZ trades to $150, our selling price would be limited to $120.

Because options have a finite life, the same trade could be used repeatedly to bring in income. One could sell a higher strike price on stock XYZ, say $130 when the stock was trading at $120, but this would bring in a lower premium—but also a lower chance of being “called out.” As in all things investment-related, one needs to consider risk, reward, and probabilities.

Covered positions, such as this hypothetical example, carry no margin impact on an account. In contrast, if a call was sold on a security that one did not own, this would be deemed a “naked” call. In this instance, there would be a margin impact as we would be responsible for the funds required to purchase the related stock to fulfill the delivery of the stock if called out. The unlimited upside potential for stocks means unlimited risk for naked call positions.

A “collar options strategy” adds another element to the selling of covered calls and can provide significant risk management and downside protection.

All too often, in a strong bull market, inexperienced traders are enticed by the “effortless” income that can be achieved through covered call strategies. Unfortunately, as was seen in the credit crisis, many years’ worth of option income can be wiped out (not to mention absolute portfolio losses), when individual stocks see 50%–80% declines in price.

In a collar options strategy, the proceeds gained through the sale of the call option in our example would be used to purchase a put, guaranteeing a minimum sale price for XYZ. Let’s assume a $120 put is purchased. This transaction, together with the sale of the $120 call, would have the effect of removing all risk from the package (by package we mean all elements of the trade: 100 shares of stock, one call contract, and one put contract).

Should the stock’s price appreciate further, the shares would be called away at $120 a share while a drop in price would trigger a sale for $120 per share at the time of the options contract’s expiration. The collar trade limits the effect of both upside and downside movement, removing most or all risk from that trade (depending on the strike prices used). Purchasing the XYZ put on its own would both cost money and have a limited life. Buying a put is much like buying term insurance. If you die before that term of insurance is up, your family collects, but if you die just one day after the contract has ended, you are out of luck—your family collects nothing.

Let’s look at another example using Apple.

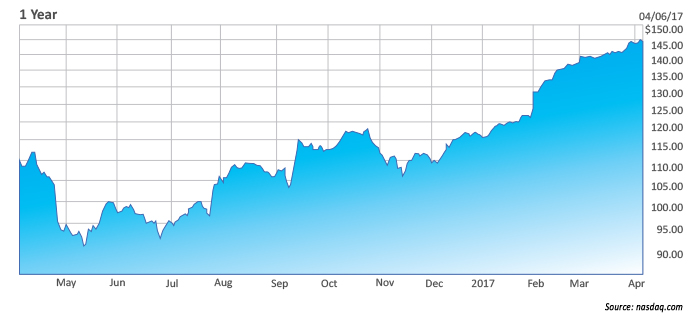

Hypothetically, an investor might have purchased 500 shares of Apple stock (AAPL) in July 2017 at a price of $97. Based on a recent closing price of $143.66 on April 6, 2017, the investor has seen a price gain of 48%! (And a gain of 24% in 2017 alone.)

APPLE (AAPL) STOCK PERFORMANCE (ONE-YEAR)

It would be reasonable to want to lock in some gains on this Apple investment while maintaining some room for further profits. A collar trade offers a smart solution.

The investor could sell a May 5, 2017, AAPL call at the $146 strike price, collecting $2.50 per contract, or, in this example, $1,250. The trader could then buy a May 5 $140 put at a cost of $1.90, protecting his stock below the $140 strike price. This would cost $950. The net gain on the trade would be $300, and the investor has upside potential for further gains up to a price of $146 and no losses below $140 if AAPL happens to decline before May 5.

Collar options strategies can be repeated over and over to derive income from both profitable and unprofitable positions while applying risk management to one’s portfolio.

Several other simple strategies can be used to help manage profitable positions. For instance, a profitable long stock position could be sold in combination with the purchase of long-dated call options near the same selling price, locking in profits on the stock sale while paying for the right to participate in further gains. Of course, should the stock not appreciate, you will lose the money paid for the option.

Another solution is simply purchasing a put, limiting potential downside without giving away future appreciation. Yet another approach could be to sell a covered call on the stock while purchasing a call at a strike price above the sold call price. Here premium is collected from the covered call while the second option allows participation in further stock price appreciation.

Clearly, options provide myriad, well, options, to enhance investing strategies.

Author’s note: Many thanks to my son, Jordan Young, for his assistance in writing this article.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com