Are your clients carousel or coaster investors?

It is good for clients to periodically retake the suitability questionnaire. Their appetite for risk may have changed, while their investment portfolio has not.

The allure of amusement parks seems universal. Disney and others have exported the concept worldwide, and the crowds just seem to grow year after year. According to the latest Statistical Abstract (2012), in 2007 there were over 1,300 amusement parks in this country generating over $13 billion in annual revenues.

Because of the success of Disney, Universal, and Six Flags, I’m sure many think of amusement parks as American inventions. Yet the concept goes back to the 1500s and the fairs of Europe. Still, Coney Island in New York City (predated by Vauxhall Gardens in New York) was one of the first fixed venues and was the popularizer of the roller coaster—perhaps the biggest young-adult draw for the last 100 years at the parks.

I think amusement parks are so popular because they have something for everyone, no matter what their age. Whether it’s just a walk around the park’s attractions or a ride on the latest, greatest coaster, there’s something to satisfy everyone.

But not everyone is able to cope with all of the rides. For some, the merry-go-round is all they can stomach, while others line up over and over again (with a VIP speed pass, no doubt) for the Demon Drop!

In investing, most people think they know what will satisfy them; it boils down to an investment with high returns and no risk. Of course, such an investment does not exist.

As investors become more aware of the true opportunities open to them, they learn that risk and return are tied together. Less risk usually means lower return.

Investment advisors usually learn quickly that not all investors are alike. They do not have the same appetite for either returns or risk. One investor may have no problem stomaching declines of 50% or more, while most max out at 20% and a large number are still nauseated by a decline of 10% or less.

As a result, most investment firms offer core, suitability-based strategies. Typically, these strategies come in three to five flavors. Portfolios labeled Conservative, Moderate, and Growth are the usual three, with the five-choice variety adding Balanced and Aggressive to the mix.

Investing risk

in amusement park terms

Conservative = Merry-go-round

Moderate = Ferris wheel

Balanced = Train ride

Growth = Bumper cars

Aggressive = Roller coaster

The advantage of these suitability portfolios, like the variety of rides offered at the parks, is that they seek to match the investor’s (the rider’s) appetite for risk. Each tries to deliver the highest returns for the perceived level of risk being taken.

While this means that the risk of the ride is matched to the rider’s ability to withstand the risk, in the investment world, like at the amusement park, the level of returns will vary—normally, the lower the risk, the lower the return. The rider on the merry-go-round generates fewer screams of joy than the rider on the roller coaster; on the carousel ride the number of heart-stopping plunges is nonexistent, while the coaster fanatic will experience many.

It’s important to remember that investment suitability changes over time. Just as someone may have loved the roller coaster in their teens, the ability to take its twists and turns, climbs, and plunges may have changed when they reach their senior years.

Each investment firm’s suitability questionnaire is the vehicle for determining the client’s level of risk suitability. If a client believes there is a performance problem with their investments, it is usually a good idea to have them retake the questionnaire to see if their true appetite for risk has changed while the investment portfolio has not.

And, of course, the realization that a Moderate portfolio with limited risk will not perform the same as an Aggressive portfolio helps a lot in balancing return expectations with the risks that are truly acceptable by a client. Failure to do this is like putting an aggressive thrill-seeker on a merry-go-round or a conservative rider on a roller coaster—nobody will be happy. The former will be bored and the latter will spend the rest of the day throwing up.

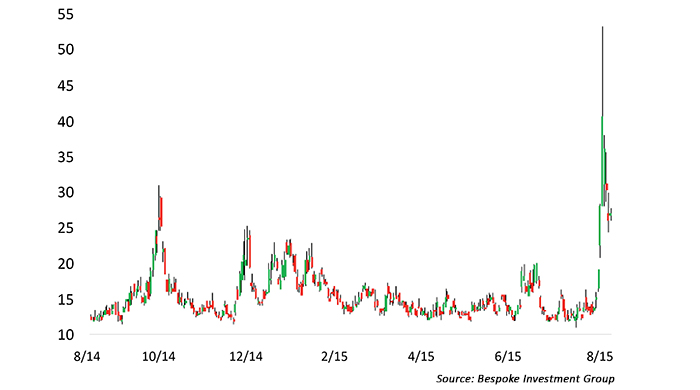

The markets have seen a little bit of every type of “amusement park ride” over the past 12 months. Q4 2014 and the beginning of this year had intermittent bouts of market volatility—not the scariest of rides but enough for investors to make sure their safety belts were securely fastened. In contrast, mid-February through mid-August 2015 had one of the most range-bound markets in recent memory, with the S&P 500 cycling up and down in a tight pattern.

VIX: LAST 12 MONTHS

The remainder of August, however, was reminiscent of that roller-coaster ride you might not want to try again. According to Bespoke Investment Group, last week saw “both the biggest two-day and three-day declines and the biggest two-day move higher of this bull market.” They added, “Markets went from quiet to explosively volatile in no time at all—a rapid doubling of implied volatility, with the VIX reaching new post-crisis highs.”

It is market periods such as this that require periodic evaluations of clients’ appetites for risk. Just like an amusement park and its variety of rides, there are actively managed strategies suitable for everyone. If some clients are more afraid of heights than others, consider ratcheting down their suitability profile until the ground below does not seem so far away.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI was named to the 2015 Financial Times 300 Top Advisers and the 2015 Inc. 5000 List of fastest-growing private U.S. companies. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI was named to the 2015 Financial Times 300 Top Advisers and the 2015 Inc. 5000 List of fastest-growing private U.S. companies. flexibleplan.com