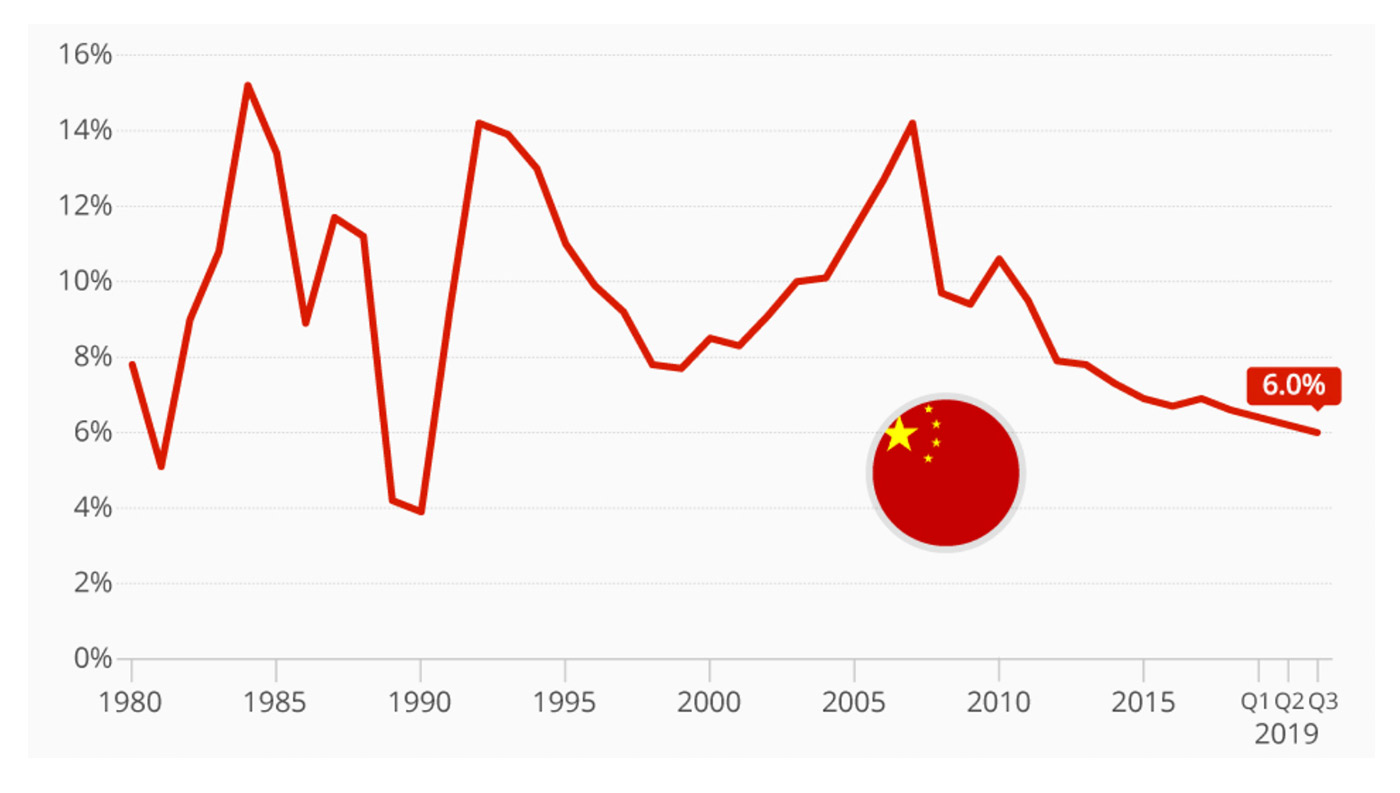

China’s third-quarter economic growth slowed more than expected, recording its weakest pace in almost three decades as the trade war impacted overall productivity.

Research and data provider Statista wrote last week,

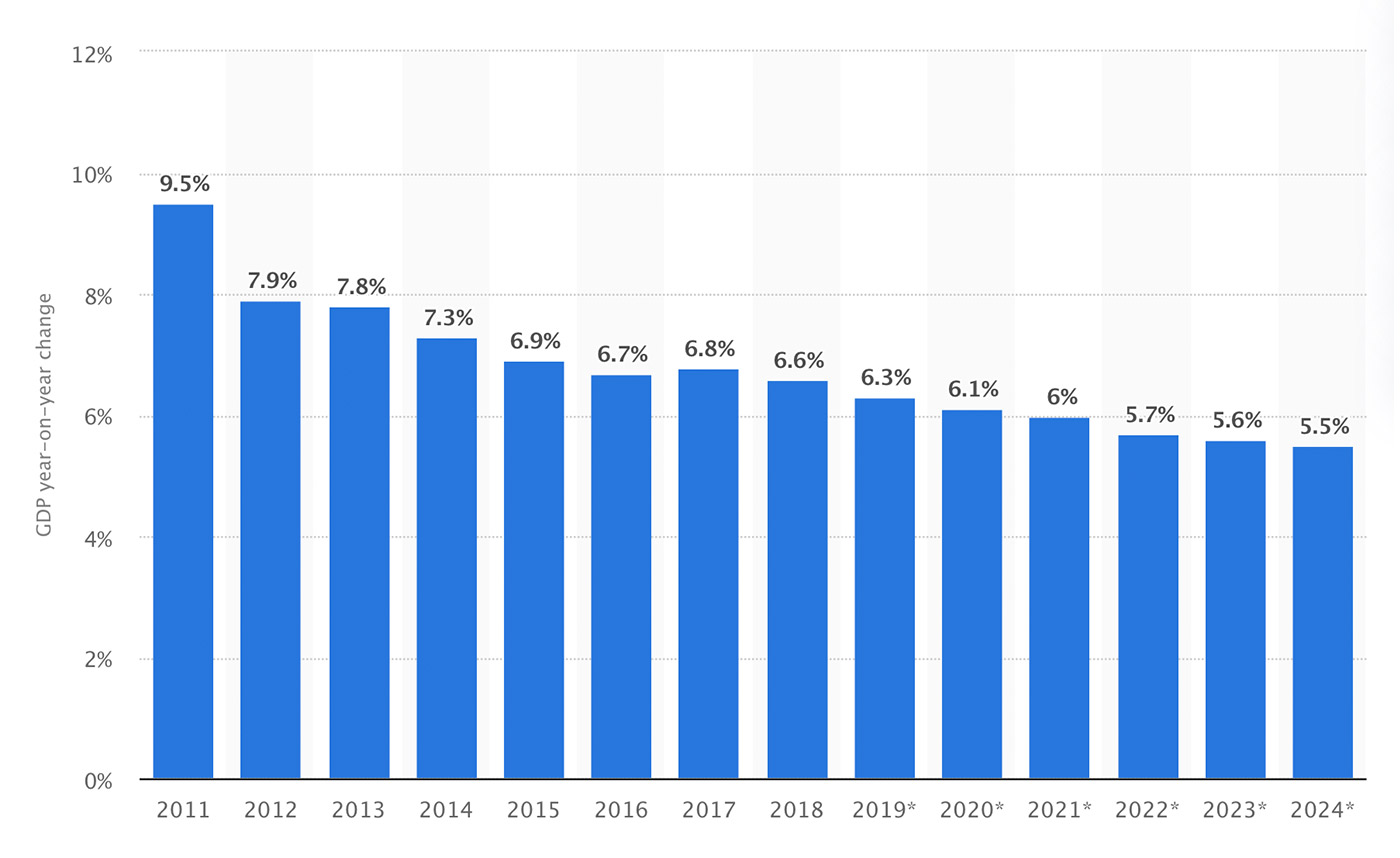

“The National Bureau of Statistics of China has released more data pointing towards weakness in the world’s second largest economy. In the third quarter of 2019, the country’s gross domestic product (GDP) grew by 6.0 percent, a decline on the 6.2 percent recorded in the second quarter. While that sounds great from a U.S. or European perspective, different standards apply to the previously booming Chinese economy, where current growth levels are the lowest for 27 years.

“Lackluster domestic demand paired with the cooling effects of the trade war with the United States on exports contributed to the slowdown, continuing a downward trend that has been going on for several years now (with 2017 a surprise exception). At the start of the year, the Chinese government announced a 1.3 trillion yuan ($193 billion) stimulus package to bolster the economy, one of several measures recently taken to prevent the country’s growth from collapsing altogether. China’s economy is closely watched internationally, as many international corporations consider it a key market in reaching their own growth targets.”

Source: Statista, National Bureau of Statistics of China

Reuters noted that the GDP data was confirmation of a further weakening trend for China:

“A slide in China’s exports accelerated in September while imports contracted for a fifth straight month. The drags on demand, both domestic and global, have hit several key parts of the economy with weakness seen in freight shipments, factory power generation, employment and entertainment spending. In September, factory gate prices fell at their fastest pace in three years. …

“Downbeat Chinese data in recent months has highlighted weaker demand at home and abroad. Still, most analysts say the scope for aggressive stimulus is limited in an economy already saddled with piles of debt following previous easing cycles, which have sent housing prices sharply higher.

“Nie Wen, a Shanghai-based economist at Hwabao Trust, pinned the worse-than-expected GDP growth mainly to weakness in export-related industries, especially the manufacturing sector. ‘Given exports are unlikely to stage a comeback and a possible slowdown in the property sector, the downward pressure on China’s economy is likely to continue, with fourth-quarter economic growth expected to slip to 5.9%. Authorities will loosen policies, but in a more restrained way.’”

Source: Statista, International Monetary Fund (IMF)

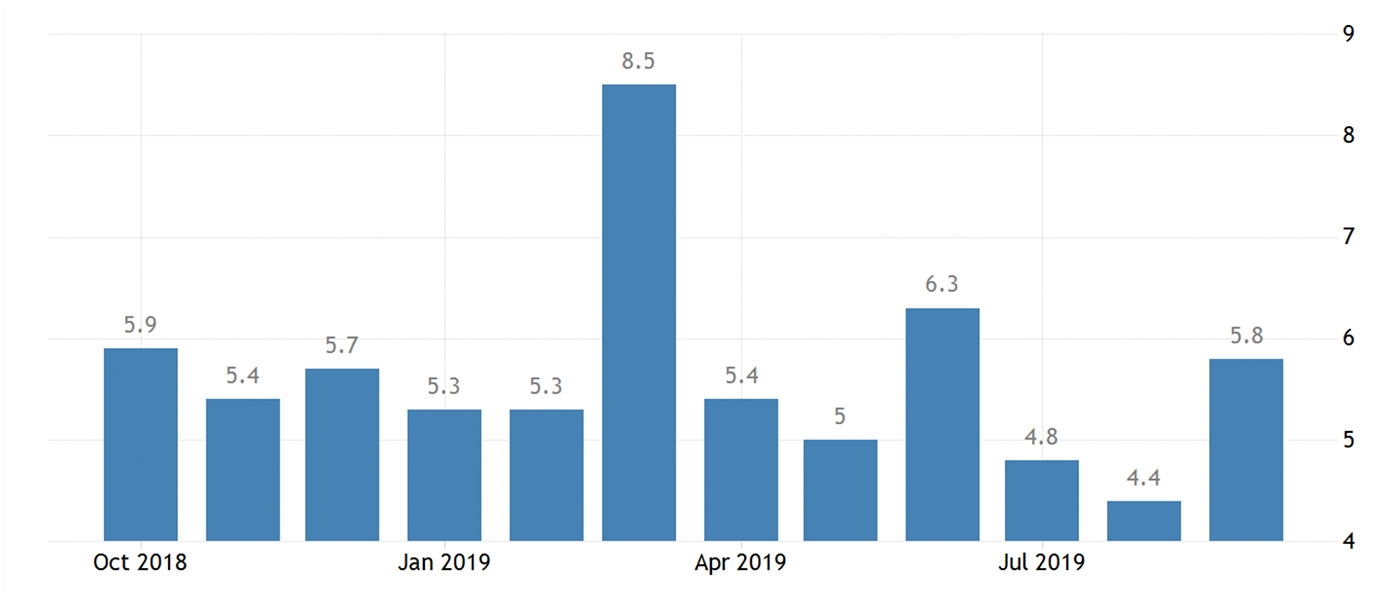

On a brighter note, there were two recent data points for China’s economy that were encouraging, according to Trading Economics:

Source: Trading Economics, National Bureau of Statistics of China