The reality of the business cycle underlies active investment management

The reality of the business cycle underlies active investment management

Active management attempts to exploit the opportunities created by the business cycle, adjusting market exposure and rotating between asset classes, sectors, and geographic regions during different stages.

If markets were truly random and stock prices were what they were just “because,” many incarnations of active investment management would not exist as viable investment strategies. Active management exists and indeed flourishes to a large extent because cycles permeate nature and human behavior.

Active investment management takes into account current market conditions to seek opportunities for profit and risk management. Active investment management practitioners may ask, “Based on current market conditions, where are the perceived opportunities for profit, income, and/or growth, while factoring in risk?” as well as, “Who are the best-performing managers?” or “Which investment strategies are performing best given this investment climate?”

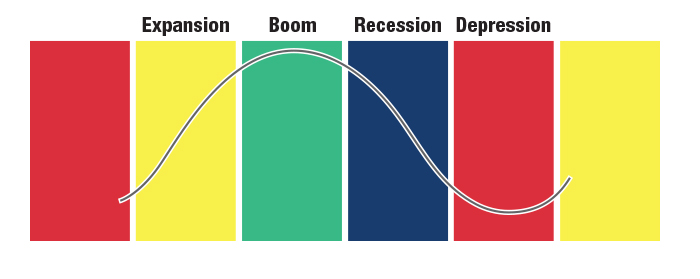

At the center of active management’s viability is the business cycle. First formally described in 1817, the business cycle reflects the economy moving from expansion to boom, recession, and then depression. Before the Great Depression, any severe downturn in economic activity was called a depression. Today, one defining characteristic of a depression is when real GDP declines by more than 10%. As a result, the fourth stage of the business cycle, “depression,” is typically the bottoming of the “recession.”

Despite industrialization, wars, changing technology, and government intervention, the business cycle has persisted for hundreds of years. At some level, this pattern of boom to bust seems to be hardwired into the human psyche, helping to explain the cyclical nature of financial markets, fads, and many other aspects of life.

Since 1800, there have been some 45 recessions in the U.S. As long as human nature plays a role, markets appear to be locked into cyclical patterns that, while not replaying each occurrence in exactly the same pattern, nevertheless “rhyme.” Different asset classes excel and falter at different points in the cycle.

A common goal of active strategies is to determine which asset classes are excelling and to invest in trending assets accordingly. That said, there is no guarantee that any single strategy or combination of strategies will be successful, which is why risk management is paramount for active managers.

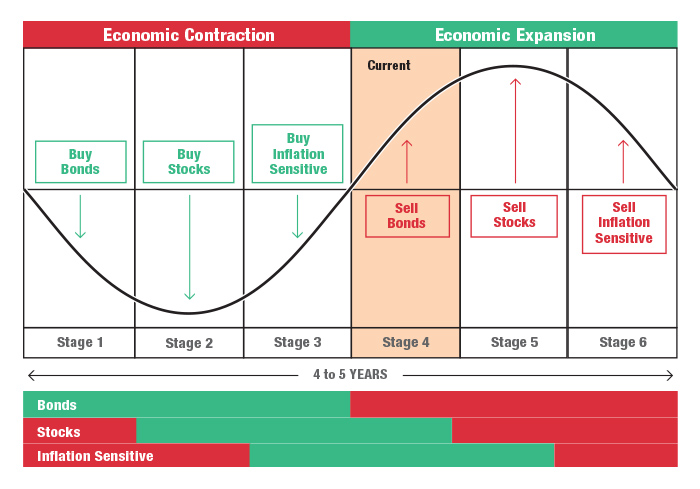

Martin J. Pring, in his 1980 book “Technical Analysis Explained,” set forth the six classic investment stages of the business cycle, establishing optimal phases for stocks, bonds, and inflation-sensitive (commodities) investments. Price action confirms where one is in Pring’s business cycle.

For example, in the last stage of an economic expansion, before the cycle moves into contraction, all three asset classes show negative price action. When the three asset classes are positive, the market is moving into economic expansion.

Based on work by Martin J. Pring

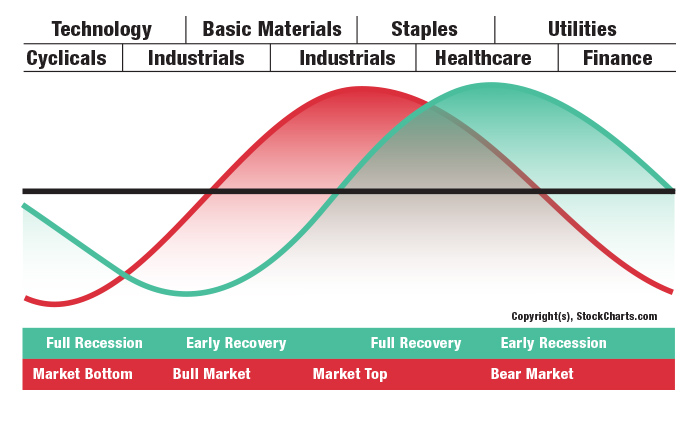

Sam Stovall, long-time chief investment strategist for S&P Global and now CFRA, took Pring’s business cycle and enlarged it further to look at how specific industry sectors fit into the cycle. His work illustrated that the financial performance (and attractiveness as an investment) of different industry sectors is influenced by where the economy is in the business cycle.

The next chart shows which sectors typically outperform at different stages of the business cycle. Stovall’s book “Standard & Poor’s Sector Investing” came out in 1996, and sector rotation strategies have proliferated over the past two decades, aided by the development of sector mutual funds and ETFs.

It has been close to 40 years since “Technical Analysis Explained” was published and over 20 years since the “Guide to Sector Investing” hit the bookstores. Over the years, investment vehicles, trading techniques, and analytical capabilities have changed and evolved, but there is no sign that the long-term cyclical nature of the markets is changing. Asset classes continue to move in and out of favor in response to the overall business cycle, providing the opportunity for successful active management.

While some might believe that government intervention, such as the Federal Reserve’s focus on interest rates and buybacks to spur economic growth, has changed the business cycle, history has shown that government actions have been limited to short-term distortions in the larger business cycle. Rubber-band-like, these distortions have the potential to snap back abruptly to the long-term trend.

Most active investment approaches avoid predictive buy and sell signals based on identifying where the economy is with respect to the business cycle. Instead, indicators are used to provide “confirmation” that an asset class is in an upward or downward trend and the strength of the trend. Rotating between asset classes, sectors, and geographic regions in different stages of the business cycle is based on current market conditions rather than expectations.

Using all of these tools, active management attempts to exploit the opportunities created by the business cycle.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com