There is little doubt that gold is receiving investors’ full attention again.

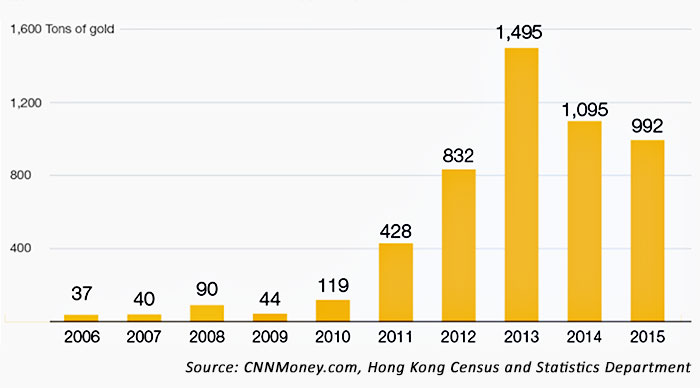

After two years of precipitous declines (2012–13) and then two years of largely negative to sideways price action (2014–15), the precious metal has had an impressive rally of 21.6% in 2016 (through April 29). And gold recently broke through the important $1,300 level, at least on an intraday basis, trading over $1,305 early on Monday, May 2, before paring gains.

PRICE OF GOLD IN U.S. DOLLARS (10-YEAR TREND)

What are some of the reasons being cited for gold’s bullish trend?

Dollar weakness/continued low global interest rates

Bloomberg wrote recently, “Investors have flooded back to precious metals this year as risks to the global economy prompted the Fed to signal it will take a slower approach to further interest-rate increases, weakening the dollar.”

The Wall Street Journal echoed these thoughts, adding, “A weaker buck tends to boost gold prices, as the dollar-denominated metal becomes cheaper to other currency holders.”

However, some currency experts believe the dollar is due for at least a minor reversal, and Tuesday’s (May 3) action helped to reinforce that notion. FXStreet.com reported, “Gold prices surged at the beginning of the day, but the greenback’s comeback seen during the American afternoon sent the commodity into the red, with spot down to a fresh weekly low of $1,282.13 an ounce before settling around 1,286.50.”

Equity market turmoil/global safe-haven trade

Though U.S. markets have recovered all of the early losses of 2016, gold’s rapid ascent coincided with one of the worst starts to a U.S. market year in recent memory. And while the Dow and S&P 500 were firmly in the green for the year at the end of last week, Europe, China, and Japan were still showing significant equity market losses for 2016 (down 6.7%, 17.0%, and 12.4%, respectively). Many analysts expect global volatility to pick up again over the next six months.

Commodity cyclical trends

Frank Holmes, CEO and chief investment officer at U.S. Global Investors, said in a recent interview with GoldSeek.com,

“Down-cycles for gold prices have a range from 1.8 to 5 years, averaging 3.6 years from peak to trough. And so we look at the peak in 2011 and the bottom being December 17, 2015—it’s 4.3 years long. So there are so many nice factors in here that suggest that we’re getting a rising market.”

Gregg Harris, chief technical strategist at MarketTamer.com, wrote in mid-April,

“It is time to add a position in a sector showing strong accumulation that is not likely to go away anytime soon. The price of gold has rocketed off five-year lows set in December. The volume pattern, volume indicators, and anecdotes from the gold market all point to significant accumulation in the precious metal. … Gold does have noticeable cycles, and it is likely gold is starting a new longer-term up-cycle.”

China buying/storing gold?

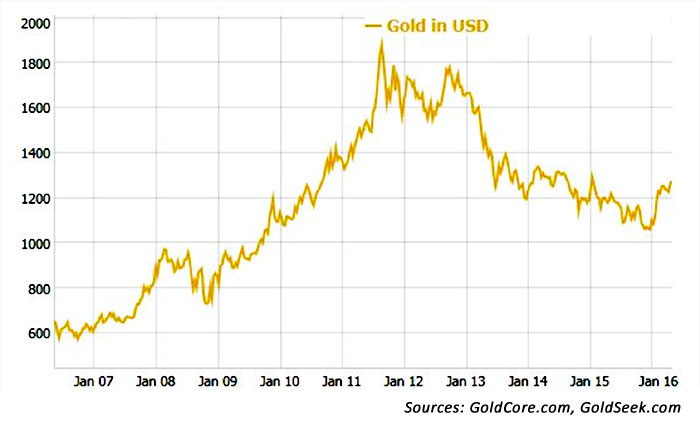

China now consumes about 40% of the gold that comes out of the ground every year, according to a recent interview given by John LaForge, head of Wells Fargo’s commodities team. Says CNNMoney, “The Hong Kong data alone show that China went from importing just over 100 tons of gold in 2010 to just under 1,000 tons last year. In addition to all the imports, China is also the world’s largest gold miner, according to the World Gold Council. So it’s both buying and unearthing a lot of gold each year.”

Mr. Holmes and CNNMoney agree on one key point—the premise that the buildup of China’s gold reserves has much to do with the international currency scene and the International Monetary Fund’s perception of the yuan on the global economic stage. Says CNNMoney, “The People’s Bank of China has been taking extraordinary efforts to try to stabilize the value of the yuan. Buying gold helps increase confidence in the yuan’s worth. It’s also a way for China to diversify its reserves away from U.S. dollars.”

CHINA’S HUGE APPETITE FOR GOLD

China’s gold imports passing through Hong Kong alone