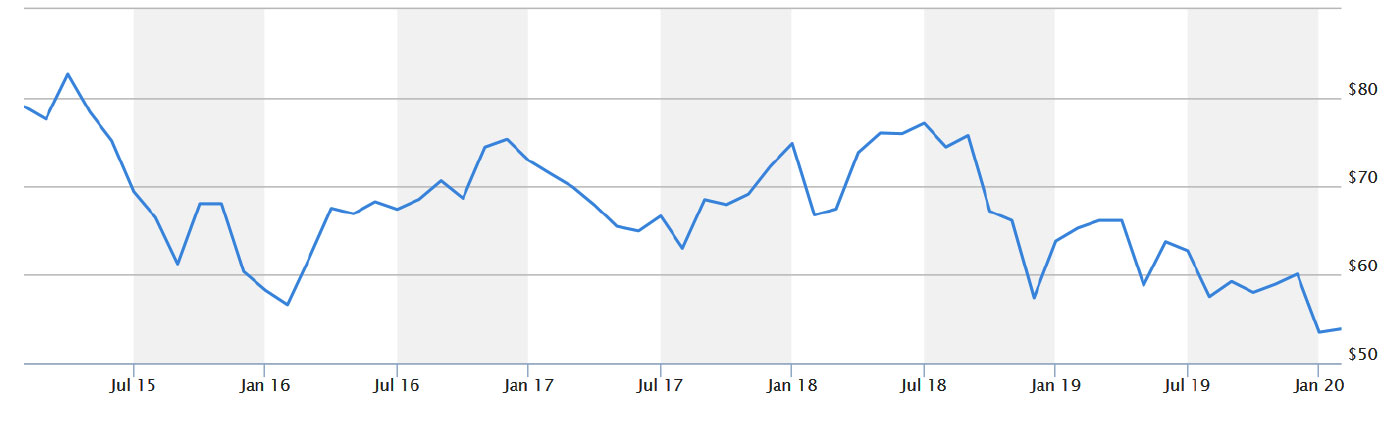

FIGURE 1: WTI CRUDE OIL PRICES—10-YEAR DAILY CHART

Note: Daily closing price for West Texas Intermediate (NYMEX) crude oil. Data as of 2/18/2020.

Source: Macrotrends

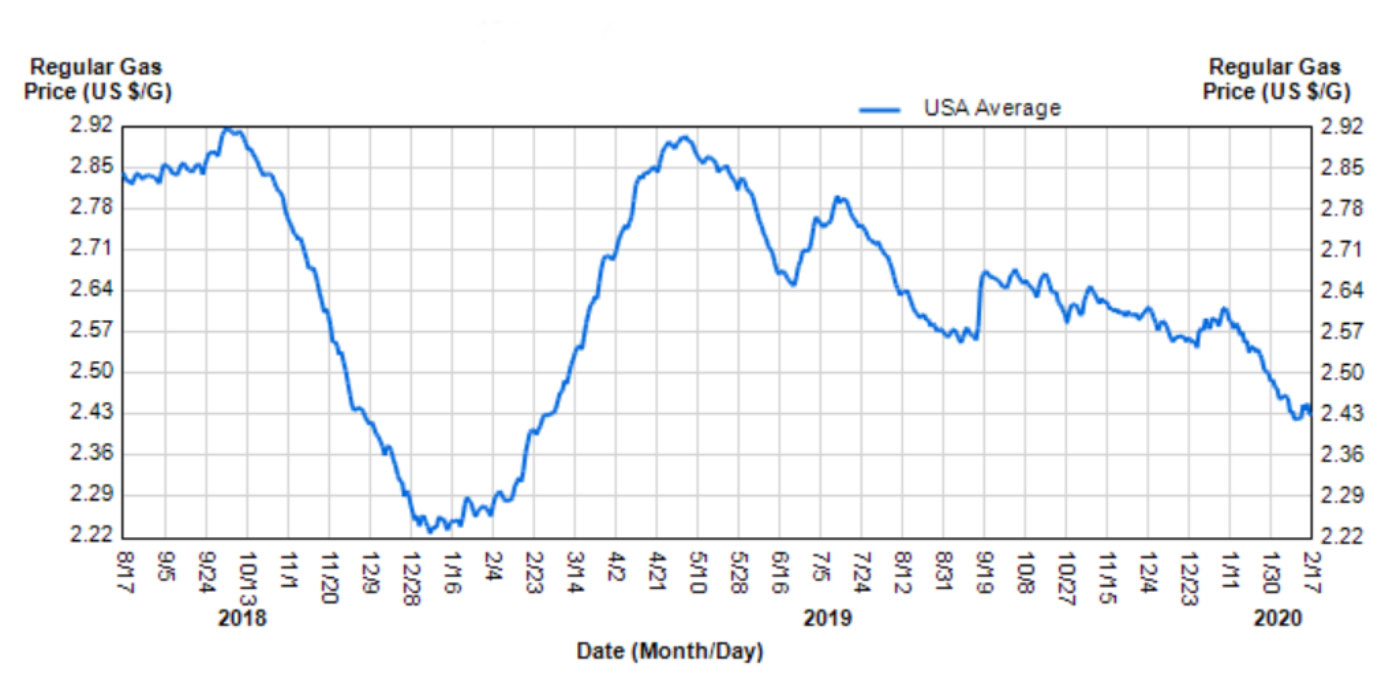

FIGURE 2: 18-MONTH U.S. AVERAGE RETAIL GAS PRICES

Source: GasBuddy.com

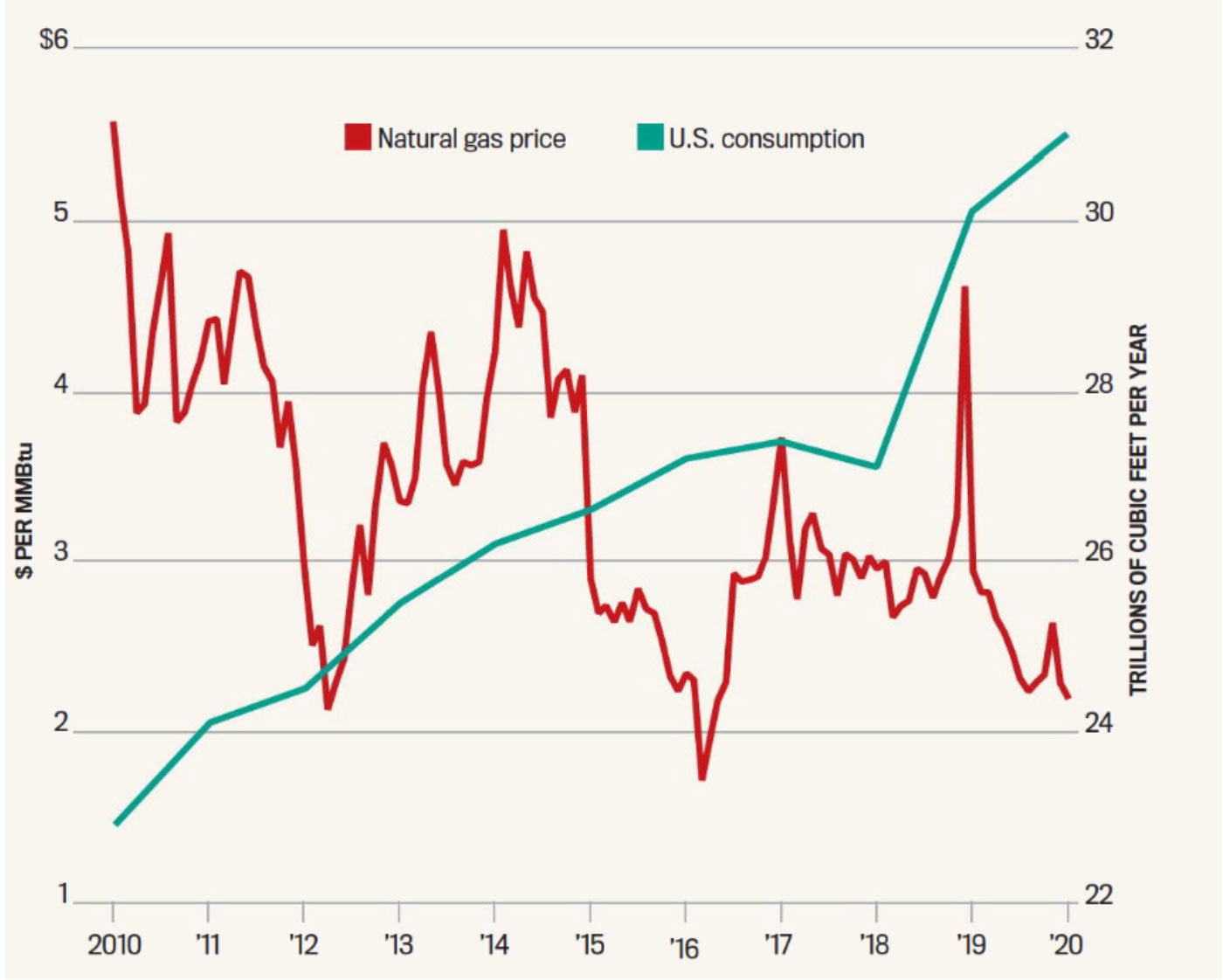

FIGURE 3: NATURAL GAS PRICE VS. U.S. CONSUMPTION TREND

Sources: Barron’s, based on data from U.S. Energy Information Administration (EIA), Bloomberg

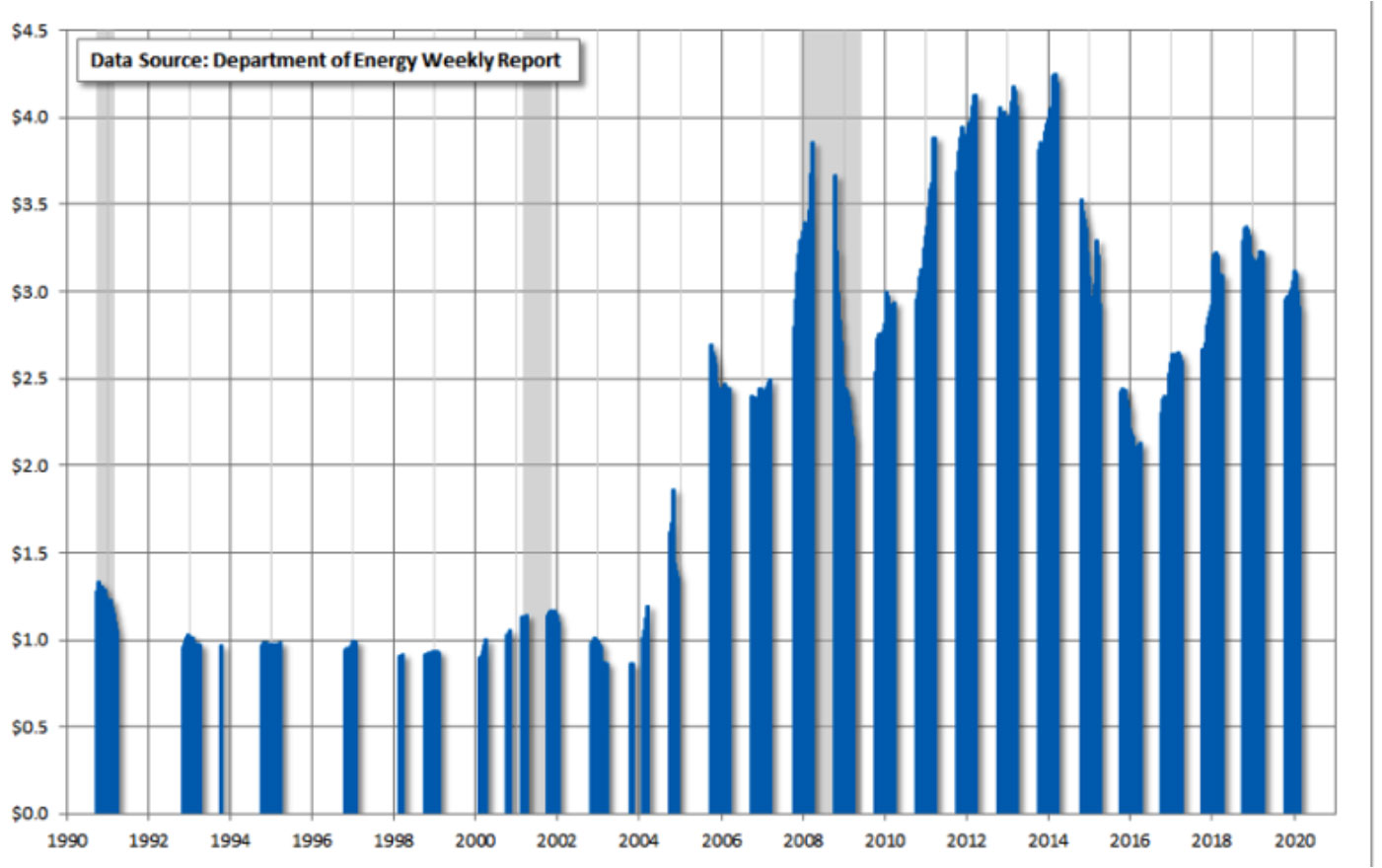

FIGURE 4: WEEKLY U.S. RETAIL HEATING OIL PRICES

Note: Prices as of 2/10/2020.

Source: Advisor Perspectives, U.S. Department of Energy, dshort.com.

MarketWatch notes that crude oil prices declined sharply on Tuesday, Feb. 18, after a week in which they “booked their first weekly gains in six weeks, with WTI notching a 3.4% weekly rise, while Brent, the global benchmark, saw a 5.2% gain over the period, according to Dow Jones Market Data.”

With the mild winter in many parts of the United States, lackluster economic growth around the world, and the threat of further spread of the coronavirus, not only have prices of oil and gas products generally fallen over the past several months, but energy-related stocks and ETFs have also been adversely affected.

However, according to Barron’s on Feb. 9, 2020,

“There are signs of capitulation from investors. The weighting of energy stocks in the S&P 500 index is down to a record low 3.8%, and the entire sector’s value is considerably less than Apple’s (AAPL) $1.4 trillion. The group has trailed the S&P 500 for seven of the past eight years and is on pace for another year of underperformance; it’s down 10% in 2020, against a 3% rise in the S&P.”

That said, they also noted,

“Investors might want to consider getting back in. … For one thing, the group offers some of the best dividend plays. … Investors can get exposure through the Energy Select Sector SPDR exchange-traded fund (XLE), which owns the energy stocks in the S&P 500 index. It trades at $54 after hitting a 52-week low this past week [week of Feb. 3], and yields 4.3%. About 40% of its assets are in Exxon and Chevron.”

FIGURE 5: 5-YEAR TREND FOR ENERGY SELECT SECTOR SPDR FUND (XLE)

Note: Data as of 2/18/2020.

Source: MarketWatch

The theme was reiterated this past weekend in Barron’s “Up and Down Wall Street” column:

“Income-starved investors still want stocks that show them the money via dividends. Energy shares appear to offer both income and rock-bottom valuations. … The big oil majors provide yields ranging from 4.7% to 7.2%.”

While major oil company dividends would appear to be relatively secure, it is very uncertain what the short-term global growth environment will look like. According to Guggenheim Investments, the risk factor of the coronavirus spreading across the globe may have a significant impact on both China’s and the world’s economic growth estimates:

“The already-terrible human impact of coronavirus clearly has the potential to become tragic, but the economic impact will be significant even if its progress can be impeded. Our estimate is that China’s Gross Domestic Product (GDP) growth for the first quarter could be slashed to -6 percent annualized from an already slow 6 percent in the fourth quarter. That could shave about 200 basis points off of global growth relative to its recent trend.”